Ever felt lost in the labyrinth of the Road Accident Fund claims?

You’re not alone!

Discover the twists and turns of RAF payouts in our eye-opening guide. Unravel the mysteries, from timelines to legal tips, in a journey that promises clarity in the complex world of RAF claims.

Introduction

In South Africa, the Road Accident Fund (RAF) serves as a critical beacon of hope for thousands of individuals affected by road accidents each year.

Established to offer vital financial support, the RAF assists those injured in road accidents or the families of those tragically killed. This assistance is not just a matter of compensation; it is often a lifeline for covering medical expenses, income loss, and other unforeseen consequences arising from these unfortunate events.

The purpose of this article is to shed light on a question that weighs heavily on the minds of many claimants: “How long will it take for the RAF to pay out my claim?”

Understanding the timeline of RAF payouts is more than a mere administrative concern; it is about planning your road to recovery and financial stability.

This guide aims to provide clarity on the payout process, offering insights into the typical duration, influential factors, and what claimants can realistically expect during their RAF claim journey.

The RAF Claim Journey

Thabo’s Story: A Journey of Persistence and Patience

Imagine Thabo, a 45-year-old father from Johannesburg.

His life took an unexpected turn when he was involved in a road accident while commuting to work. The accident left him with a broken leg and unable to work for several months.

Facing mounting medical bills and the need to support his family, Thabo turned to the Road Accident Fund for assistance. His journey with the RAF, fraught with uncertainty and long waits, is a story shared by many South Africans.

It’s a journey that demands resilience, patience, and a clear understanding of the claim process.

Understanding the RAF Claim Process

The process of filing a claim with the RAF can be intricate and time-consuming. Here’s a simplified overview of the steps involved:

- Recovery and Health First: The immediate priority is to ensure all those involved in the accident receive the necessary medical attention. Thabo’s first step was to focus on his recovery and health.

- Compiling Evidence: Once stable, the next step involves gathering and compiling evidence to support the claim. This includes obtaining a doctor’s report, police reports, witness statements, and other relevant evidence.

- Finding Legal Assistance: Thabo sought out a reputable personal injury law firm to manage his case. This step involved signing a mandate and a fee agreement.

- Completing and Submitting Claim Forms: His attorney helped him complete the RAF claim form (RAF 1) and submitted it along with required supporting documents like ID copies, police case numbers, medical reports, and proof of expenses incurred due to the accident.

- RAF Investigation: Post submission, the RAF had a period of 120 days to investigate Thabo’s claim, which might include site visits, witness interviews, and acquiring additional medical records.

- Issuing a Summons: If the RAF didn’t make a settlement offer within the stipulated time, Thabo’s attorney prepared and issued a Summons against the Fund.

- Medical Examinations and Reports: Expert medical reports were required to support and substantiate Thabo’s claim, often necessitating further medical examinations.

- Securing a Trial Date and Negotiating Settlement: The attorney then worked on securing a trial date and, if possible, negotiated a settlement.

- Receiving Compensation: Finally, after the case was settled, the RAF made the payment. However, this step could take an additional 6 to 12 months after settlement.

Thabo’s story, while unique in its details, echoes the experiences of many who have navigated the RAF claim process. Understanding each step and what it entails can help claimants prepare both mentally and practically for the journey ahead.

Understanding the Timeline

The Typical Timeframe After Filing a Claim

Navigating through the Road Accident Fund (RAF) claim process can often feel like a journey through uncharted territory.

Once a claim is filed, the clock starts ticking, but the pace can feel frustratingly slow for many.

Typically, from the moment a claim is lodged until the final settlement, claimants may find themselves waiting anywhere from three to five years.

This duration encompasses the initial filing, investigation, potential court proceedings, and finally, the settlement phase.

From Case Finalization to Payment

After enduring the lengthy process of getting a claim finalized, one might expect swift compensation. However, another waiting game often begins here.

The RAF promises to make payments within 180 days of settlement or court judgment. While this six-month timeframe might sound reasonable, it’s not always the case in practice.

Administrative backlogs, internal RAF challenges, and various procedural delays can extend this period significantly, leaving claimants in a state of uncertainty.

Real-Life Impact of Delays

Take Nomsa’s story, for example. A school teacher from Cape Town, she found herself severely injured in a taxi accident. Her claim journey with the RAF was a long one, filled with hope and frustration.

After finally reaching a settlement, the additional wait for the payout extended well beyond the promised 180 days. This delay meant struggling to afford ongoing medical treatments and grappling with mounting financial pressures.

Sipho’s experience mirrors this frustration. As an entrepreneur from Durban, a motorbike accident not only impacted his health but also the viability of his business.

After navigating the complicated RAF claim process, he found himself waiting an agonizing extra year for the payout, during which his business faced severe financial strain.

These stories are far from unique and highlight a critical aspect of the RAF claim process – the post-settlement wait can be as challenging as the claim process itself.

For many South Africans, this period is marked by financial hardship, emotional stress, and a desperate need for closure that seems always just out of reach.

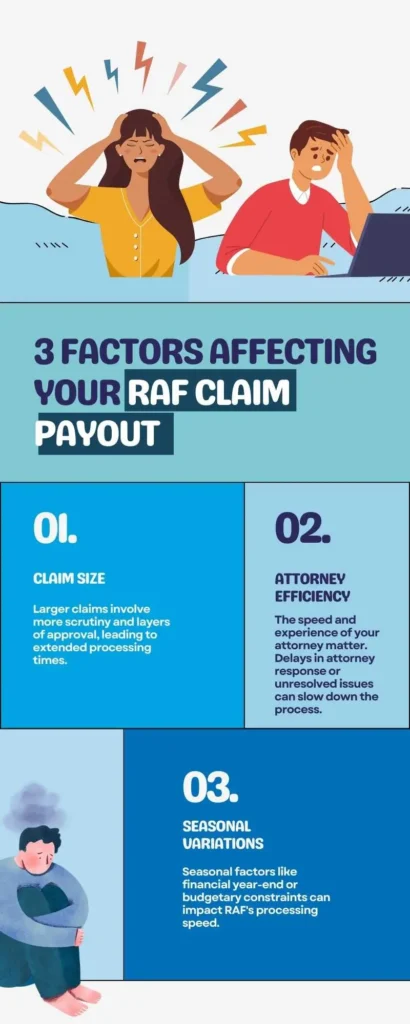

Factors Influencing Payout Time

The duration it takes for the Road Accident Fund (RAF) to process and pay out claims can vary significantly. Several factors play a crucial role in either extending or shortening this timeline.

Understanding these elements can provide claimants with a clearer picture of what to expect and why some claims may take longer than others.

What is the RNYP (Requested Not Yet Paid) List?

Following a settlement or court judgment, an attorney must submit the claim, together with supporting documentation to the Road Accident Fund (RAF).

The RAF will then load the case on their so-called RNYP (Requested Not yet Paid) list within 30 days.

Matters on the RNYP are now officially on the RAF’s radar for payment.

You can think of the RNYP as the official payment list of RAF, where each month new claims are added to the top, and old claims are paid from the bottom.

It should be noted that administrative delays from either the attorney and/or RAF can result in matters not being loaded onto the RNYP list timeously. This can land up delaying your RAF payment unnecessarily.

The Size of the Claim

- Large vs. Small Claims: Larger claims generally take longer to process and pay out compared to smaller ones. This is often due to the increased complexity and scrutiny involved in verifying and assessing larger sums.

- Impact: Larger claims may require additional layers of approval and more extensive investigations, leading to longer waiting periods for claimants.

Attorney-Related Issues

- Efficiency and Experience: The expertise and efficiency of the attorney handling the claim can significantly influence the payout timeline. Experienced attorneys are more likely to navigate the process swiftly and avoid common pitfalls.

- Outstanding Issues: If an attorney’s firm has unresolved issues with the RAF, such as previous overpayments or disputes, this can delay the processing of current claims.

Seasonal Variations

- End of Financial Year: During the RAF’s financial year-end, there may be a rush to settle claims, potentially speeding up some payouts.

- Budget Constraints: Conversely, budgetary constraints at certain times of the year can lead to delays in payout as the RAF manages its cash flow.

Navigating Challenges and Finding Solutions

Psychological and Financial Challenges

The journey through the RAF claim process is not just a legal and administrative one; it’s also an emotional and financial challenge.

Claimants often face significant stress and anxiety during the waiting period, compounded by the uncertainty of when they will receive their compensation.

This can be particularly acute for those unable to work due to their injuries or those who have lost a family breadwinner.

Financially, the prolonged waiting period can exacerbate existing strains. Medical bills, daily living expenses, and the inability to generate income can create a heavy financial burden.

This stress is not just about money. It’s about the emotional toll of feeling stuck and helpless while life seems to be on hold.

Practical Solutions

RAF Bridging Finance

- One practical solution to alleviate financial strain is RAF Bridging Finance. This option allows claimants to access a portion of their expected payout before the RAF processes the final payment. It provides much-needed cash flow to cover immediate expenses, reducing financial pressure.

- Note: It’s important to understand the terms and conditions of such financing to ensure it’s a viable and beneficial option.

Choosing the Right Attorney

- The choice of attorney can significantly impact the duration and success of a claim. Opt for a lawyer who is experienced in RAF claims and has a track record of efficient case handling.

- A competent attorney can navigate the RAF system more effectively, potentially reducing delays and advocating for your interests more robustly.

Proactive Case Management

- Stay actively involved in your case. Regular communication with your attorney can help keep your claim on track.

- Ensure all documentation is complete and submitted promptly. Incomplete or incorrect submissions can lead to unnecessary delays.

Being Informed and Patient

- Understand the RAF process and set realistic expectations. Knowing what to expect can reduce anxiety and help manage the emotional aspects of the waiting period.

- Patience is key. The process is often lengthy, but being informed can help maintain a sense of control and perspective.

Tips for Timely Payment

- Document Thoroughly: Ensure all your documents, medical reports, and evidence are thoroughly and correctly compiled. Any missing or incorrect information can cause delays.

- Follow Up Regularly: Don’t hesitate to follow up with your attorney for updates. Regular check-ins can keep your case active.

- Consider Settlement Offers: If the RAF makes a reasonable settlement offer, consider it seriously. Settlements can often lead to quicker payouts than going to trial.

The Changing Landscape of RAF Payouts

The Road Accident Fund (RAF) in South Africa is an entity in constant evolution, adapting to legal, political, and economic shifts.

Understanding these changes is crucial for claimants to stay informed and prepared.

Recent Policy Changes

In recent years, the RAF has undergone several significant policy revisions. These changes are often in response to broader legal reforms, financial pressures on the fund, or the need to streamline processes for efficiency.

It’s important for claimants to be aware of these changes as they can directly affect how and when payouts are made.

- Cap on Claims: One of the notable changes is the introduction of a cap on claims. This measure was introduced to ensure the sustainability of the fund by limiting the maximum payout amount.

- Direct Claims Process: The RAF has been working towards simplifying the claims process, allowing claimants to file directly without the need for an attorney. This aims to reduce legal costs and expedite the process.

- Electronic Filing and Processing: Embracing digital transformation, the RAF has started shifting towards electronic filing and processing of claims, potentially speeding up the entire process.

Insights from Legal Experts

To add depth to this discussion, insights from seasoned attorneys in the field are invaluable.

They offer a perspective grounded in practical experience and deep understanding of the RAF system.

- Attorney A: “The cap on claims, while controversial, is a necessary step to ensure the RAF can continue to serve all South Africans. It’s about finding a balance between individual needs and the collective good.”

- Attorney B: “The move towards direct claims and electronic processing is promising. However, claimants should still consider legal advice to navigate the complexities of the process and ensure they receive fair compensation.”

- Attorney C: “Claimants need to stay informed about these changes. Policies are evolving, and what applied to a claim last year might not be the same this year. Continuous education is key.”

Future Implications

Looking ahead, the RAF is likely to continue evolving. Potential changes could include further reforms to claim limits, adjustments to the direct claims process, and increased use of technology.

These shifts are aimed at making the fund more sustainable and efficient but may also bring new challenges for claimants.

- Sustainability Measures: With ongoing financial pressures, the RAF might implement more measures to control costs, which could include stricter scrutiny of claims and more rigorous processes.

- Technological Advancements: As technology advances, the RAF could adopt more sophisticated systems for claim processing, potentially reducing human error and speeding up payouts.

- Legal Reforms: Ongoing legal reforms could impact how the RAF operates, possibly changing the landscape for claimants in terms of rights, processes, and compensation.

Case Studies: The Human Impact of Prolonged RAF Litigation

The Road Accident Fund (RAF) claims process can be lengthy and complex, often leading to significant physical, emotional, mental, and financial strain on claimants and their families.

The following three case studies highlight the diverse and profound impacts of these prolonged waiting periods.

Case Study 1: Thabo’s Physical and Emotional Struggle

Background

Thabo, a 35-year-old doctor from Pretoria, and a father of two, was involved in a severe car accident, which left him with multiple fractures and a long road to recovery. He filed a claim with the RAF for compensation to cover his medical expenses and loss of income.

The Waiting Period

- Physical Impact: Thabo’s injuries required extensive and ongoing medical treatment. The delay in receiving compensation from the RAF meant he couldn’t afford some of the necessary procedures, prolonging his physical suffering.

- Emotional Toll: The financial stress and uncertainty of the claim process led to severe anxiety and depression for Thabo, affecting his family life and mental health.

Case Study 2: Nomsa’s Financial Hardship

Background

Nomsa, a single mother, lost her son in a road accident. She turned to the RAF for compensation to cover funeral costs and the loss of financial support her son provided.

The Waiting Period

- Financial Burden: The prolonged process drained Nomsa’s savings, as she struggled to cover everyday expenses while waiting for the RAF payout.

- Mental Health: The stress of financial insecurity, coupled with her grief, led to severe mental health issues, requiring therapy that she could barely afford.

Case Study 3: Sipho’s Family’s Emotional and Mental Anguish

Background

Sipho, a primary breadwinner, was permanently disabled in an accident. His family filed a claim with the RAF for compensation to support his ongoing care and replace lost income.

The Waiting Period

- Family’s Emotional Strain: Sipho’s inability to work and the uncertainty of the RAF claim put immense emotional stress on his family, straining relationships and causing psychological distress.

- Financial Impact: The family had to make significant lifestyle adjustments, including selling assets and incurring debt, to manage their daily expenses and Sipho’s medical needs.

The Case for Road Accident Fund Bridging Finance

Introduction to Bridging Finance in RAF Claims

The Road Accident Fund (RAF) claims process in South Africa can be lengthy, often leaving claimants in a challenging financial position.

Bridging finance emerges as a crucial solution, providing interim financial relief to those awaiting compensation from the RAF.

This section explores how bridging loans can accelerate cash flow and bring closure to claims, along with the qualifying criteria for RAF Bridging Advances.

Accelerating Cash Flow with Bridging Loans

Immediate Financial Relief

- Overview: Bridging finance offers immediate funds to claimants against the expected payout from their RAF claim.

- Benefits: This immediate access to funds can alleviate financial strain, allowing claimants to cover essential expenses like medical bills, living costs, and legal fees.

Bringing Closure to Claims

- Emotional and Psychological Relief: Receiving a portion of the claim amount early can provide emotional and psychological relief to claimants, reducing stress and anxiety associated with financial uncertainty.

- Impact on Recovery: For those recovering from injuries, this financial support can directly impact their health, enabling access to better medical care and rehabilitation services.

Qualifying Criteria for RAF Bridging Advances

Eligibility Requirements

- Valid RAF Claim: The claimant must have a valid claim lodged with the RAF and be represented by an attorney.

- Proof of Expected Payout: Evidence of the likely amount of the RAF payout is required, often provided by the representing attorney.

Assessment Process

- Verification by Lender: Bridging finance providers typically conduct a thorough assessment, verifying the details of the RAF claim and the likelihood of a successful payout.

- Risk Evaluation: Lenders evaluate the risk associated with the claim, including factors like the claim’s complexity and the track record of the representing attorney.

Terms and Conditions

- Repayment: Bridging loans are repaid directly from the RAF payout, with the finance provider claiming their portion first.

- Interest Rates and Fees: Claimants should be aware of the interest rates and any additional fees associated with the bridging advance, ensuring they understand the financial implications.

RAF Bridging Finance plays a vital role in providing interim financial support to claimants, easing the burden during the lengthy claims process.

Understanding the qualifying criteria and being aware of the terms and conditions are crucial for claimants considering this option.

Conclusion: Empowerment and Community Support in Navigating RAF Claims

This comprehensive guide has aimed to demystify the Road Accident Fund (RAF) claim process and to provide South Africans with crucial insights into what they can expect regarding payout timelines and challenges.

We have explored various aspects of the RAF, from understanding the typical claim journey and the factors influencing payout times, to navigating the challenges and finding practical solutions like RAF Bridging Finance.

Key Takeaways

- Understanding the RAF Claim Journey: Knowledge of the steps involved, from filing a claim to receiving compensation, is crucial.

- Factors Influencing Payout Time: The size of the claim, legal complexities, and external variables can significantly affect the duration of the payout process.

- Navigating Challenges: Recognizing the psychological and financial hardships during the waiting period and exploring solutions like RAF Bridging Finance can be vital.

- Staying Informed: Keeping abreast of the changing landscape of RAF policies is essential for both claimants and legal professionals.

We hope this article has provided valuable information and insights that will aid you in your journey with the RAF. It’s important to remember that while the process can be challenging, there are resources and support systems available.

We encourage our readers to share their own stories and experiences with RAF claims in the comments below.

Your insights can provide invaluable support to others in similar situations, fostering a sense of community and shared understanding. Your stories can not only enlighten others but also contribute to a collective voice calling for improvements in the RAF system.

Together, we can empower each other through shared knowledge and experiences, making the RAF claim process more navigable and less daunting. Remember, you are not alone in this journey.

Embark on a continuous journey of discovery within the RAF ecosystem.

Don’t let the complexities overwhelm you. Stay informed and educated by subscribing to our RAF newsletter. Join our community today, and transform confusion into confidence in navigating RAF claims

Frequently Asked Questions

How long does it typically take for the RAF to process a claim?

The processing time can vary, but claims typically take between 2 to 5 years to settle.

What are common reasons for delays in RAF claim payouts?

Delays often occur due to incomplete documentation, legal complexities, or administrative backlog at the RAF.

Can I get financial assistance while waiting for my RAF claim to settle?

Yes, claimants can consider RAF Bridging Finance for financial support during the waiting period.

What should I do if my RAF claim is taking longer than expected?

Ensure all your documentation is complete and regularly follow up with your attorney for updates.

How can I improve the chances of a timely payout for my RAF claim?

Choose a reputable attorney, submit thorough documentation, and stay proactive in managing your case.

Are there any recent changes in RAF policies that could affect my claim?

Recent policy changes may affect claim processing times and payout amounts; it’s best to consult with your attorney for the latest updates.

What is RAF Bridging Finance and how does it work?

RAF Bridging Finance provides short-term financial relief to claimants awaiting RAF payout, typically repaid once the claim is settled.

Can seasonal variations impact the timeline of my RAF claim?

Yes, high claim volumes during certain times of the year can lead to increased processing times.

What kind of challenges do claimants face during the RAF claim process?

Claimants often face financial strain, emotional stress, and uncertainty during the lengthy claim process.

How can sharing my RAF claim experience help others?

Sharing your story can offer valuable insights and support to others navigating similar challenges with RAF claims.

Glossary

- Claimant: A person who files a claim for compensation, typically after being involved in a road accident.

- Payout: The money awarded to the claimant by the RAF after a successful claim.

- Bridging Finance: A short-term loan provided to a claimant awaiting a payout from a long-term claim, like an RAF claim.

- Litigation: The legal process of resolving a dispute in court.

- Attorney: A legal professional representing the claimant or defendant in legal proceedings.

- Compensation: Financial payment received by a claimant for losses or injuries suffered.

- Case Management: The administration and organization of a legal case by an attorney or legal team.

- Policy Update: Changes or amendments made to the rules or guidelines of the RAF.

- Emotional Impact: The psychological effect experienced by claimants due to the accident or the claims process.

- Financial Strain: Economic difficulty faced by claimants while waiting for their RAF claim to be processed.

- Legal Strategy: The plan or approach adopted by an attorney to win a case or secure the best outcome.

- Claim Processing: The procedure followed by the RAF in evaluating and deciding on a claim.

- Payout Factors: Various elements that can influence the amount and timing of a RAF payout.

- Seasonal Variations: Changes in claim processing times due to different times of the year, often influenced by workload or holidays.

- Claim Closure: The final resolution or settlement of a claim, resulting in the end of legal proceedings.

10 Responses

Good day

I refer to the above matter.

I did went to court last year on the 3rd of May 2023.

I did receive bridging loans. But not all of the money that was given to me for loss of Income.

My attorney is not very helpful. All that he says is that there is still a long road ahead.

Can you perhaps assist me in finalising my claim after all this years?

Look forward to hear from you.

Kind regards

Sanieta Kroukamp

0823447087

Sent from Proton Mail mobile

I was involved in a car accident went to the nearest clinic to get help they helped me Im waiting for My Raf payout

Hi Jabulile, I’m not entirely sure of your question? Are you saying you were assisted with regards to your RAF claim at the clininc?

Good day

After receiving the general earning as smaller as ut was, how much it the future earning it takes?

It was 05-042024 and the next how much time it takes?

Hi Nkosinathi , thank you for reaching out.

What I’m understanding is that you received an interim payment for general damages but are still waiting for a settlement on loss of earnings?

The timing difference can vary widely from case to case, as your attorneys need to follow the claims process.

Your best bet is to speak directly to them and get a status update and expected timelines.

All the best!

I went to sign for first offer last week can i ask if how long does the second offer can take to pay thank u

Hi Mduduzi,

Firstly, Congrats on reaching this milestone!

With regards to second claim, it depends what this is for.

If you are referring to the costs order then this can be relatively quick – say 3-6 months.

If you have an interim order only (say for general damages) and are now waiting for the balance (say, loss of earnings) then this could still take a while to run through the court / RAF process.

Best of luck!

Good day

I was involve in an accident in 2019 flied a claim with my attorney in 2020 december today they have called me saying I have a trial date for 2027 January is this possible or its just being delayed?

That seems long, but not impossible. Perhaps try asking your attorney for proof of court dates?

Hi it’s vusi my lawyer made aclaim at raf about my late father who passed away in a car accident but what shocked me is that there’s nothing we can receive cz my father was a pensioner,so which means if you are a pensioner and become involved in accident you are not counted but to the levy you are.secondly what about the funeral expenses how long does it takes and what to do cz my lawyer is nowhere to be found