You have a settlement agreement or court-order from the Road Accident Fund (RAF) and pay-day is finally within sight. What an incredible milestone! It’s now time to start thinking about you and your family’s future.

You might not believe it, but having hundreds of thousands or even millions of Rands landing in your bank account has its dangers.

⛔ Friends and family may become resentful or envious

⛔ Overwhelming number of requests for donations and financial assistance

⛔ Overspending on cars, houses and fancy clothing is a real thing

⛔ Poor investment decisions leading to financial loss

⛔ Increased risk of becoming a target for theft or burglary

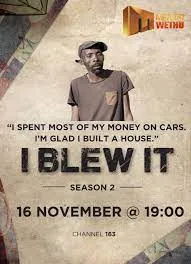

Don’t become another face on ‘I Blew It’

This is a once-in-a-lifetime payout.

If used correctly, the funds can set you up financially for the future.

It’s important to get the right financial advice and save at least a portion of the cash to grow and work for you.

But it can be confusing to understand the various savings and investment options.

Don’t let this stand in the way of doing what is right for the long-term benefit of you and your family.

We specialise in the Road Accident Fund, and helping RAF claimants make the best financial decisions with their payouts.

RAF SAVE takes our knowledge and refers you a trusted financial advisor to assess your specific circumstances and guide you on how to make your money last and grow for the long-term.

Join the smart savers with RAF SAVE – Your trusted partner in everything Road Accident Fund!

👇

1️⃣ Complete the form

2️⃣ A qualified financial advisor will gather your information

3️⃣ A freespecialist investment plan will be provided for your consideration

4️⃣If you’re happy the plan gets actioned and you’re on your way

Get access to top performing investment and savings products in SA

No cost, no obligation proposal.

Cost effective solution

Ethical and fully regulated for your protection

More than just financial advice. We specialize in RAF

The RAF payout is a settlement agreement or court-order compensation received from the Road Accident Fund, typically awarded to victims of road accidents in South Africa.

Receiving a large payout can be overwhelming and can lead to financial missteps like overspending, poor investment choices, and becoming a target for theft. Proper planning ensures long-term financial security.

Dangers include resentment or envy from friends and family, numerous requests for financial help, the temptation to overspend on luxury items, making poor investment decisions, and increased risk of theft or burglary.

RAF SAVE specializes in assisting RAF claimants. We refer you to a trusted financial advisor who assesses your circumstances and guides you on how to make your money last and grow long-term.

You start by completing a form, after which a qualified financial advisor gathers your information, provides a free specialist investment plan, and if you agree, the plan is actioned.

Benefits include access to top performing investment and savings products in South Africa, a cost-effective and ethical solution, no cost or obligation proposal, and specialized advice in RAF matters.

While it’s not mandatory to save the entire payout, it’s wise to save a significant portion to ensure future financial stability and growth.

While it’s possible, professional advice is recommended due to the complexities of financial planning and investment, especially with large sums.