Understanding the Importance of RAF Actuarial Reports

When you’re dealing with the aftermath of a road accident in South Africa, especially as a claimant of the Road Accident Fund (RAF), the legal and financial complexities can feel overwhelming. One of the critical elements that could significantly impact the outcome of your claim is the RAF Actuarial Report. But what exactly is this report, and why is it so vital to your case?

Imagine trying to solve a complex puzzle without knowing how the pieces fit together. This is what it’s like to navigate a RAF claim without understanding the role of RAF Actuaries. These professionals provide the essential analysis and projections that can make the difference between a fair settlement and a disappointing one.

The Role of RAF Actuaries in Your Claim

At the heart of every substantial RAF claim is an actuarial report. RAF Actuaries are specialized professionals who use their expertise in mathematics, statistics, and financial theory to assess the potential future financial losses you may face due to the accident. They analyze factors like your lost earnings, medical costs, and the overall impact of the accident on your life. Their work results in an Actuarial Medico-legal Report, which forms a critical piece of evidence in your claim.

Imagine a financial GPS that maps out the journey of your life after an accident. The actuarial report is this GPS, guiding the legal process toward a destination that accurately reflects the financial compensation you deserve.

What Makes RAF Actuarial Reports Essential?

Why is this report so crucial? In simple terms, it quantifies your losses. But it goes beyond that—it anticipates the future. RAF Actuaries take into account not just your current situation but also your potential future needs. For example, if the accident affects your ability to work, the report will estimate your loss of future earnings. If you require ongoing medical care, it will project those costs over your expected lifespan.

This forward-looking approach is what sets the actuarial report apart. It’s not just about what you’ve lost—it’s about ensuring that you’re equipped for the future, no matter what challenges may arise.

How Actuarial Reports Influence RAF Settlements

The RAF Actuarial Report plays a pivotal role in the settlement process. It’s not just a document; it’s the backbone of your claim. Lawyers, judges, and RAF officials rely on these reports to make informed decisions about the compensation you should receive.

Think of the report as a blueprint for justice. Without it, there’s a risk that the full extent of your losses may not be recognized, leading to a settlement that falls short of what you need to rebuild your life.

The Components of an RAF Actuarial Report

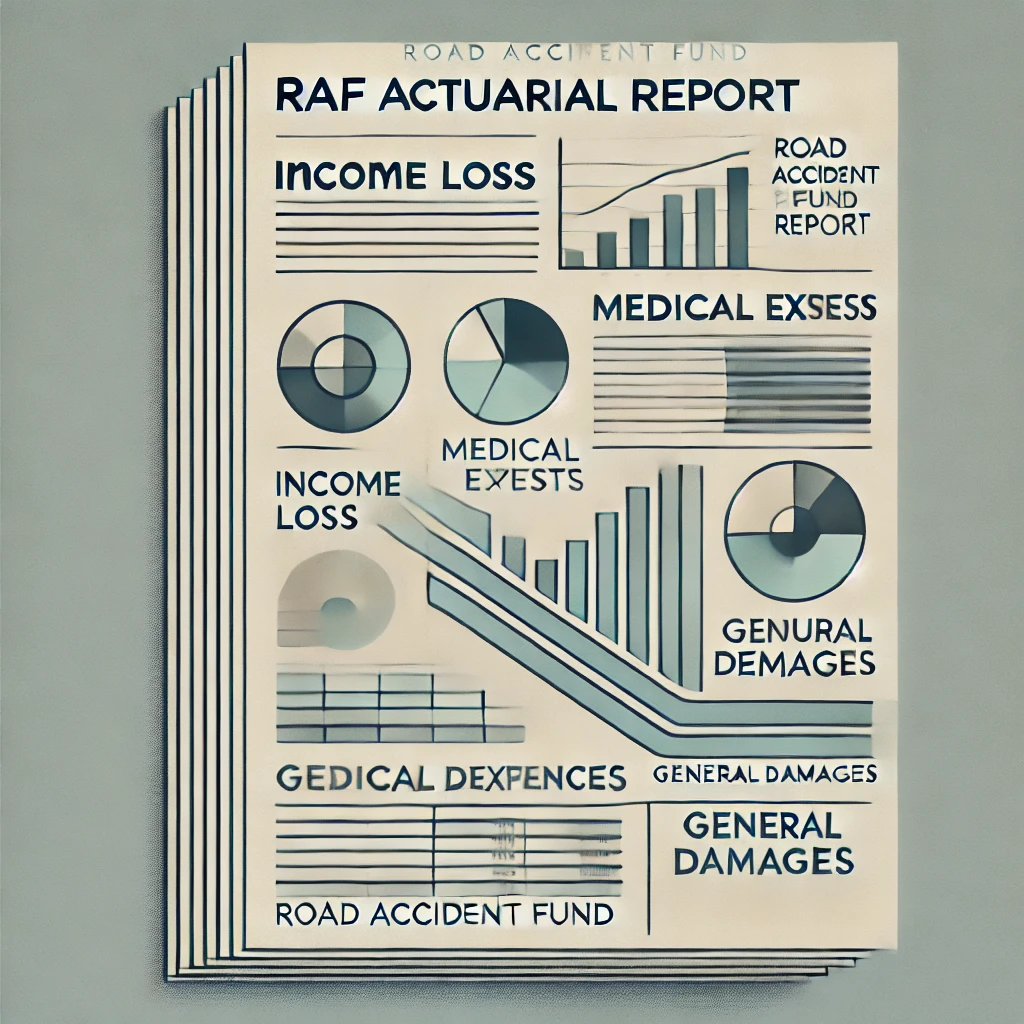

An Actuarial Medico-legal Report is a detailed document that covers various aspects of your financial situation post-accident. Let’s break down the key components:

1. Income Loss Analysis

This section assesses the income you have lost due to the accident. It considers both past and future earnings, taking into account your age, profession, and potential career trajectory.

2. Medical Expenses Projection

Here, the report estimates the costs of your medical treatment, rehabilitation, and any necessary ongoing care. This projection is critical in ensuring that you’re not left struggling with medical bills years down the line.

3. General Damages Assessment

This part of the report addresses non-monetary losses, such as pain and suffering. While these damages are more subjective, the actuarial report provides a structured approach to valuing them.

4. Contingency Deductions

Actuaries also factor in potential uncertainties—known as contingency deductions. These could include factors like changes in your health or employment prospects, ensuring that the final figure is both realistic and fair.

5. Life Expectancy Calculations

Your life expectancy is another crucial element in the report. It influences the amount of compensation you’ll need to cover future losses, particularly for ongoing care and support.

Why You Need a Skilled RAF Actuary

Choosing the right RAF Actuary is crucial. These professionals need to be not only skilled in their field but also experienced in RAF claims specifically. A well-prepared actuarial report can be the difference between a claim that’s dismissed and one that’s successful.

Expertise Matters

The expertise of a RAF Actuary lies in their ability to see beyond the numbers. They understand the legal nuances of RAF claims and how to present the data in a way that supports your case. Their reports are meticulously prepared, leaving no stone unturned in assessing your financial needs.

The RAF Actuarial Report as a Legal Tool

In court, the actuarial report serves as a powerful tool. It provides a clear, evidence-based argument for the compensation you’re seeking. Without it, you’re relying on subjective opinions, which can be easily challenged. With a well-crafted report, however, your case is grounded in hard data that’s difficult to dispute.

Common Challenges with RAF Actuarial Reports

While the importance of the RAF Actuarial Report is clear, the process of obtaining one is not always straightforward. There are common challenges that claimants often face.

1. Complexity of Calculations

The calculations involved in these reports are highly complex. This can lead to misunderstandings or disputes if the report is not thoroughly explained or if the actuary is not well-versed in RAF claims.

2. Disagreements over Projections

Disagreements can arise over the projections made in the report. For instance, the RAF might challenge the assumptions used by the actuary, leading to lower compensation offers.

3. Delays in Report Preparation

Preparing an actuarial report takes time, and delays can prolong the settlement process. This can be frustrating, especially when you’re in urgent need of compensation.

4. High Costs

Actuarial reports can be expensive to prepare, adding financial strain to an already stressful situation. However, this cost is often justified by the significant impact the report can have on your claim’s outcome.

Navigating These Challenges

Understanding these challenges is the first step to overcoming them. Here are some strategies to help you navigate the process:

1. Work with Experienced RAF Actuaries

Choose an actuary who specializes in RAF claims and has a proven track record. Their experience will help ensure that your report is both accurate and persuasive.

2. Ensure Clear Communication

Make sure that the actuary explains their findings in plain language that you can understand. This will help you feel confident in the report and better prepared to address any challenges.

3. Be Patient but Proactive

While the process can be slow, staying proactive can help move things along. Regularly check in with your legal team and the actuary to ensure that everything is on track.

4. Consider the Long-Term Impact

While the cost of the report might be high, consider the long-term impact of not having it. A well-prepared report can significantly increase your compensation, making it a worthwhile investment.

Final Thoughts: Empowering Your RAF Claim

In the complex world of RAF claims, the RAF Actuarial Report is an indispensable tool. It’s more than just a collection of numbers; it’s a detailed map that guides you toward fair compensation. By understanding the importance of this report and working with experienced RAF Actuaries, you can ensure that your claim is as strong as possible.

Remember, your future may depend on the accuracy and thoroughness of this report. Don’t leave it to chance—invest in a well-prepared Actuarial Medico-legal Report to secure the compensation you deserve.

Empower yourself with knowledge, choose the right professionals, and take control of your RAF claim. The road ahead may be challenging, but with the right tools, you can navigate it successfully.