Navigating the financial world in South Africa can be challenging.

That’s where bridging finance comes in – a quick and flexible solution for when you need money fast. It’s like a temporary bridge for your finances, helping you cover costs until your regular funds arrive.

In this article we explore this vital financial tool.

This guide covers everything about bridging finance. You’ll learn what it is, how it works, and why it’s different from other loans.

We’ve also included real-life case studies, showing how these loans help in actual situations.

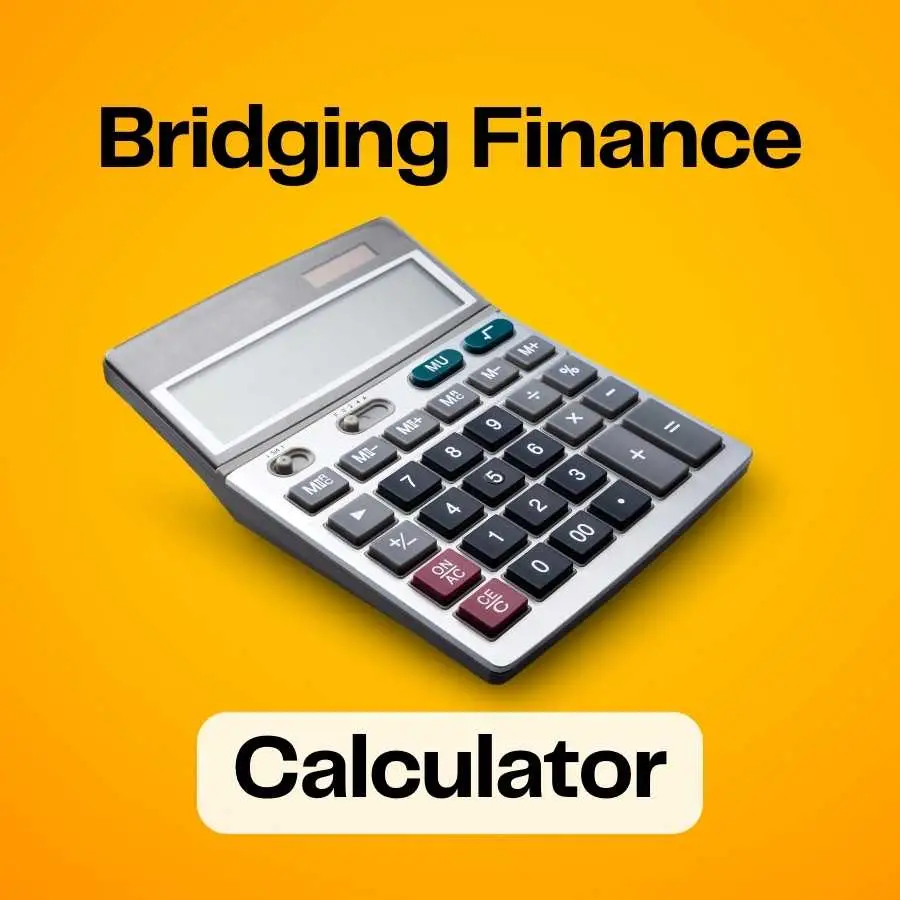

Plus, you’ll find our Bridging Finance Calculator to help you calculate the real cost of borrowing, for your specific situation.

Join us as we simplify the world of bridging finance. Whether you’re a business owner, a property seller, or someone facing financial gaps, this guide is your key to understanding how bridging finance can work for you.

What is Meant by Bridging Finance

What is the purpose of a bridge loan

There is one important difference which separates bridging finance from other forms of borrowing.

Bridge loans are short.

Unlike other financing solutions on the market, bridge loans are flexible and fast. They usually last for a few weeks to a year. This is much shorter than regular loans, which can last for several years!

Individuals and companies may have different reasons for considering a bridging loan such as:

-

- Cover short-term working capital requirements

-

- Pay for salaries at the end of the month

-

- Property transaction related expenses

-

- Cash for school fees, rent, medical bills and other once-offs due at the end of the month

-

- Smooth earnings which awaiting a commission payment

-

- Repay other debt while awaiting the proceeds from a pension fund

You may have heard about bridge funding in the context of selling a property, awaiting a Road Accident Fund court order, or accessing an imminent pension payout.

However, the common thread between all of these is the need for quick and easy access to funds.

What does a bridging loan do

Bridging funding provides an easy way to accelerate a future cash flow event and access immediate funds. In short, the purpose of gap financing is to provide quick, temporary financial help when you’re stuck between needing to pay for something now, and getting your future funds later.

They help when you’re in a situation where you need money quickly and plan to pay it back soon. They’re a useful tool for managing timing mismatches in finances

Temporary cash flow solutions are mainly used when you need quick access to funds. Usually, it’s to cover an immediate expense while waiting for a more permanent financial solution. Think of it as a temporary bridge in your finances.

This is the reason for the name – bridging finance.

Temporary financial support in South Africa

Bridging loans are especially important in South Africa due to several unique market trends and economic conditions. In South Africa’s dynamic economy, people often face situations where they need quick access to funds. This is where bridging loans become crucial.

The economic landscape in South Africa can be unpredictable, with fluctuating interest rates and economic policies.

In such an environment, the flexibility and speed of bridging loans offer a valuable financial tool for individuals and businesses alike.

According to Globe Newswire the alternative lending market in South Africa is projected to reach US$638.4 million by 2027. This equates to a Compound Annual Growth Rate (CAGR) of 23.1% during 2023-2027. These figures underscore the rapidly expanding role of alternative lending, including bridging finance, in South Africa’s financial landscape.

Lastly, the regulatory framework in South Africa has been supportive of alternative lending solutions, including bridging finance. This support has led to a growth in the availability and accessibility of these loans, making them a significant part of the financial landscape.

Quick financing options are significant in South Africa due to the active property market, the needs of growing businesses, economic volatility, and supportive regulatory policies. These loans offer a vital financial lifeline in various situations, making them a key component of South Africa’s financial toolkit.

Types of bridging loans

In South Africa, bridging loans come in different types to cater to various needs.

Whether it’s for buying property, managing business expenses, or waiting for funds to be released. There’s a solution to bridge the gap for each situation.

Road Accident Fund (RAF) Bridging

RAF Claimants

Road accident victims claiming from the South African Road Accident Fund (RAF) must wait months to have their settlements paid.

However, medical bills and other expenses don’t stop just because the RAF delays.

Unfortunately there is not much that can be done until the court order gets paid into your attorney’s bank account.

RAF loans provide a rapid funding solution during this waiting gap.

A Road Accident Fund Cash Advance allows plaintiffs to access a portion of their outstanding payment. Repayment is conveniently linked to court-order payment date.

Attorney Contingency Fee Advance

Attorney Contingency Fee Advance is a financial solution for law firms handling personal injury and third-party negligence claims.

It provides upfront cash against the contingency fees attorneys expect to receive once their cases are settled.

This is often crucial because such legal matters take a long time to resolve. Stretching the firm’s cash flow can put considerable strain on the firm’s directors.

The advance allows attorneys to fund ongoing expenses like medico-legal disbursements and advocate fees. This enables them to take on new cases and grow their practice.

The public interest is served by expanding the access to justice.

Property Bridging

Property Seller Bridging

This is a financial solution for those who’ve sold a property but haven’t yet received the sale proceeds.

Cash can be tight during this waiting period.

Immediate expenses, like deposits, moving costs or personal expenses, have a way of showing up unannounced.

There are also the hidden costs of selling a house or apartment. These include rates and taxes, transfer costs and duties, and unplanned levies arrears.

If these need to be paid before the property sale is officially registered and completed you may not have access to the money required.

Real estate bridge loans close this gap. They allow you to unlock trapped cash between the sale agreement and the actual receipt of funds.

Estate Agent Commission Bridging

The earnings of an estate agent can be very volatile.

The ebb and flow of the property cycle can swing commissions payments.

Short term credit provides real estate agents with an advance on their pending commission from a property sale.

This service allows agents to access a significant portion of their commission quickly. No having to wait for the final sale transaction to be complete.

This helps agents manage cash flow and focus on new sales.

Pension Funds

Pension bridging in South Africa is a financial offering for people who are waiting for their pension or provident fund payouts.

When you retire or leave a job, it can take some time before you start receiving your pension.

Pension bridging loans offer you a portion of your expected pension funds in advance. This means you can get part of your pension money immediately, instead of waiting for the full process of the payout.

It’s useful for covering immediate expenses like living costs or paying off debts.

The loan amount is then deducted from your total pension payout once it’s processed and paid out.

This helps ease the financial strain during the waiting period between leaving a job and receiving your pension benefits.

Invoice Discounting

Invoice discounting, also known as factoring, is a way for businesses to get money quickly. This is instead of waiting for their customers to pay their invoices.

Here’s how it works.

A business sells its unpaid invoices to a finance company at a discount.

The finance company then gives the business most of the invoice value upfront, usually around 80-90%.

This provides the business with immediate cash flow.

The business still collects the payments from their customers as usual.

Once the customer pays the invoice, the lender gets repaid with fees and interest.

This solution is helpful for businesses needing cash quickly and not wanting to wait for customers to pay. It’s a common tool used to manage cash flow, especially for companies with long payment terms on their invoices.

Purchase Order Finance

Purchase Order (PO) Funding helps businesses fulfill large orders when they don’t have enough cash on hand.

Suppose a business receives a big order from a customer. But it doesn’t have enough money to buy the supplies or pay for the production costs.

In this situation, a purchase order funding company can pay the suppliers directly.

This ensures the business can produce and deliver the order on time.

Once the order is completed and delivered, the customer pays the invoice. The business then pays back the funding company, along with a fee for their services.

This type of funding is especially useful for growing businesses. It can help them to take on more orders than their wallets allow.

Business Bridging Loans

Business bridging loans are short-term loans designed to help businesses manage cash flow gaps.

These loans are useful when a business needs money immediately, and expects to receive funds soon.

For example, a business might use a bridging loan to pay for supplies or staff salaries while waiting for a client to pay a large invoice.

The loan provides the necessary funds to keep the business running smoothly during this waiting period.

Once the business receives the expected funds, it pays back the bridging loan. This is usually within a few months.

Bridging loans are a quick and flexible way for businesses to access cash for urgent needs. They help companies to continue operating without financial interruptions.

How does bridge financing work?

How does a bridging loan work in South Africa?

Bridging finance is a way to access funds you’re expecting but haven’t received yet. Here’s how the process generally works, explained in simple steps:

Step 1: Identifying Funds

First, you figure out the funds you’re waiting for but need sooner. This could be the sale proceeds from a property, a business invoice, or your pension.

Step 2: Applying for Bridging Finance

Next, you apply for a bridging loan. This usually involves filling out a form and providing details about the funds you’re waiting for and why you need the money now. Supporting documents may also be required.

Step 3: Due Diligence by the Lender

The finance company will then check your details. They’ll look into your situation and the funds you’re expecting to make sure everything is in order. This step is about assessing the risk and confirming that you will indeed receive the funds you’re anticipating.

Step 4: Receiving the Funds

If approved, the finance company will give you a part of the funds you’re waiting for. This won’t be the full amount but a significant percentage. You’ll be charged interest on this amount. Think of it as a fee for accessing your funds early.

Step 5: Repayment

When you finally receive the funds you were waiting for, you pay back the bridging loan. This payment includes the original amount you borrowed plus the interest charged.

Additional Consideration

In some cases, the lender might ask to be added to any contracts related to the funds as a beneficiary. This means they have a legal claim to the funds, ensuring they get repaid.

This process offers a flexible financial solution when you’re in a tight spot, needing funds before they’re due to arrive. It’s a temporary bridge to help you manage until your actual funds come through.

Infographic: Download our step-by-step visualization of the bridging finance process.

Borrowing Amounts and Deposits

In bridging finance, borrowing 100% of the funds you’re waiting for is usually not possible.

Lenders often require some form of security.

This is achieved by advancing less than the full amount.

Here’s how it works:

Can You Borrow 100% in Bridging Finance?

Typically, no.

Bridging finance is designed to provide part of the funds you’re expecting, not the entire amount.

This partial advance acts as a safety net for the lender. The exact percentage you can borrow varies, but it’s usually between 40% to 80% of the total funds due.

What Determines the Amount You Can Borrow?

Several factors influence how much of the expected funds a lender will advance:

Term of the Loan:

The length of time until you repay the loan affects the amount.

Generally, a longer term means a smaller percentage of the total funds will be advanced.

Perceived Risk:

Lenders assess the risk involved in your specific situation.

Higher risk often leads to a lower Loan to Value (LTV) ratio, meaning you get a smaller portion of your expected funds.

Funder Appetite and Market Competition:

The lender’s willingness to take on risk and the level of competition in the market also play a role.

More competition among lenders can sometimes lead to better terms for borrowers.

Do You Need a Deposit for Bridging Finance?

Unlike traditional loans, bridging finance doesn’t typically require a deposit in the conventional sense. However, the fact that you don’t receive the full 100% of the funds serves a similar purpose.

This gap between the loan amount and the total funds due acts as a form of security for the lender.

Summary

Bridging finance is a flexible solution when you need access to funds you’re expecting but haven’t received yet.

However, it’s important to understand that you won’t get the full amount upfront.

The exact percentage you can borrow depends on factors like the loan term, the risk involved, and the lending market. This ensures a balance between providing you with immediate financial support and maintaining security for the lender.

Speak to the potential financier to understand the amount your likely to receive. However, you will most likely need to go through the application process to get certainty.

How much does bridging finance cost in South Africa?

In exploring the costs of bridging finance in South Africa, it’s crucial to understand how these costs are influenced by various factors. A primary determinant is risk, with higher risk often leading to higher costs. However, when it comes to short-term financing like bridging loans, the impact of interest rates on the total borrowing cost plays out differently compared to long-term loans.

Interest Rates in Short-Term vs. Long-Term Borrowing

While interest rates are a significant factor in determining the cost of any loan, their impact in short-term borrowing scenarios like bridging finance is less pronounced compared to long-term loans such as home mortgages. This difference is due to the shorter duration over which interest is accrued in short-term loans.

To illustrate this point, consider a comparison of the total cost of borrowing for a R1 million loan under two different interest rate scenarios – 10% per annum and 15% per annum – for both a 20-year home loan and a 2-month bridge loan:

| Product | 10% Rate Scenario (R) | 15% Rate Scenario (R) | Difference (R) |

| 20-Year Home Loan | R2,000,000 | R3,000,000 | R1,000,000 |

| 2-Month Bridge Loan | R16,667 | R25,000 | R8,333 |

In the 20-Year Home Loan scenario, increasing the interest rate from 10% to 15% raises the total cost of borrowing by R1,000,000. In contrast, for the 2-Month Bridge Loan, the same interest rate increase results in a much smaller difference of R8,333.

Need clarity on bridging finance costs?

Use our quick Bridging Finance Calculator to make informed decisions easily.

Other Factors in Short-Term Financing

In bridging finance, there are other considerations that can be more crucial than the interest rate:

Amount Accessible

The percentage of the total expected funds you can access is vital. A higher advance may serve you better, even if it comes at a slightly higher rate.

Speed of Execution

The ability to quickly access funds can be crucial, especially in time-sensitive situations.

Customer Service

The quality and efficiency of the lender’s service, including responsiveness and support, are significant factors.

Repayment Flexibility

Terms regarding repayment and any associated penalties or flexibility options can impact the overall cost and convenience.

Loan Terms

Specific terms and conditions of the loan. Additional fees or charges or any hidden clauses should be checked.

Concluding Insights

While the interest rate is an important factor in bridging finance, its impact on the total cost is less significant due to the shorter term of the loan.

Other aspects, such as the amount accessible, speed of execution, customer service, and flexibility of repayment, often play a more pivotal role. The overall suitability and cost-effectiveness of short-term financing products should be considered.

Bridging Finance case studies

Explore the transformative impact of bridging finance through these three real-life case studies. Each showcases how timely financing solutions helped individuals and businesses to navigate challenging situations and seize opportunities.

Timely Financial Relief: How RAF Bridging Helped Emmy’s Recovery Journey

[*Note: The names below are fictitious. Individuals involved have asked that their real names not be shared]

Four years ago, Sarah’s life changed forever when her daughter, Emmy, was seriously injured in a car accident. After a lengthy legal battle, they were relieved when Emmy was awarded a R4.2 million court order against the Road Accident Fund (RAF). However, their relief was short-lived when they learned it would take about 180 days for the payment to be processed.

“Every day was a struggle,” Sarah recalls. “Emmy needed ongoing medical care, and the delay in funds was agonizing. We felt helpless.”

That’s when they discovered the option of a RAF Cash bridging advance. It offered a ray of hope – access to a portion of the court-ordered funds before the RAF’s payment. With the funds, they wouldn’t have to wait six months to start Emmy’s much-needed treatments.

The family’s attorney, Mr. Jacobs, played a crucial role in this process. He reassured them, saying, “This bridge is tailored for situations like yours. You won’t need to make monthly payments. It’s settled once the RAF pays out.”

Sarah applied and the next day the funds were in the bank. “It was like a weight lifted off our shoulders,” she says. “We could finally afford the care Emmy desperately needed.”

The bridging loan was a financial lifeline. It allowed them to start Emmy’s treatments immediately, significantly improving her quality of life. “Seeing Emmy smile again, without the constant pain, was priceless,” Sarah shares.

When the RAF funds finally arrived, the bridging loan was repaid in full. “The process was smooth,” notes Sarah. “Our attorney handled everything, and there were no surprises.”

This case study highlights the critical role bridging finance can play in providing immediate relief in challenging times. For Sarah and Emmy, it wasn’t just about the money. It was about accessing timely care and easing the pain of a child suffering from the aftermath of an accident.

“Without the RAF Cash speedy discount, I can’t imagine how we would have managed,” Sarah reflects. “They gave us more than just financial support. They gave us hope. They gave us time. Time that was crucial for Emmi’s recovery.”

New Beginnings Delayed: A Property Seller’s Bridge to Cape Town

Michael and his son, Joshua, were excited about their move from Pretoria to Cape Town for new job opportunities and a change in lifestyle. They put their house on the market and quickly found a buyer. That was late September.

But the excitement soon turned to stress as the buyer faced delays in securing funding. This delayed the process by 45 days.

“It was December, and we were stuck,” Michael explains. “We needed the sale proceeds to cover our move and the deposit for our new place in Cape Town.”

The delays meant they couldn’t access the funds from their house sale, putting their plans on hold.

Michael needed a solution. That’s when he learned about sellers bridging loans.

“I was skeptical at first,” Michael admits. “But the bridging finance seemed like our only way out.”

He applied for the loan and received an advance on a portion of the property’s equity. This cash infusion was a game-changer. “It was a huge relief,” Michael recalls. “We could finally cover our moving expenses and the rental deposit.”

With the bridging loan, Michael and Joshua could proceed with their relocation plans. “It just all came together,” says Joshua.

The property eventually settled in the new year, and the bridging loan was repaid without any hassle. “I was impressed by how smooth the repayment process was,” Michael notes.

Reflecting on their journey, Michael shares, “The bridging finance was our lifeline. It allowed us to move forward with our lives at a time when everything seemed to stand still.”

Quick Fix in a Crunch: Lindiwe’s Bridging Loan Saves Her Printing Business

Lindiwe owned a small but bustling printing shop in her local community. She catered to various businesses with design, printing, and courier solutions. April, with its many public holidays in South Africa, usually meant slower business and tighter cash flow.

This particular April, Lindiwe faced an unexpected setback. Her main printer broke down.

“The timing couldn’t have been worse,” Lindiwe recalls. “Repairing it was going to cost R150,000, and I just didn’t have that kind of cash on hand.”

With a broken printer, Lindiwe’s business was at a standstill. The usual process of applying for a bank loan felt daunting and time-consuming. She wasn’t actually confident about her chances of getting approved.

“I felt stuck,” she says. “I needed a quick solution to get my business running again.”

That’s when Lindiwe learned about small-business bridging loans. This type of loan offered a swift and straightforward way to access the funds she needed.

“I was amazed at how fast the process was,” Lindiwe shares. “Within a short time, I had the money to repair the printer.”

The bridging loan was a crucial lifeline. It allowed Lindiwe to pay for the repairs and get her business operational quickly. “It was like watching my business come back to life,” she expresses.

With the printer fixed, Lindiwe’s shop was back in full swing. The profits from May, June and July trading were sufficient for her to refinance the loan comfortably.

Reflecting on the experience, Lindiwe feels grateful for the bridging loan option. “It was a straightforward solution at a time when I needed it most. Without it, I might have lost many valuable clients,” she says.

Lindiwe’s story is a testament to the role a SME merchant cash advance can play in overcoming sudden financial hurdles.

For her, the bridging loan wasn’t just about the interest rate. It was about keeping her business alive during a critical period.

Bridging Finance Calculator

Discover the most suitable bridging finance options for your needs with our interactive Bridging Finance Calculator. This easy-to-use tool helps you estimate the costs and benefits of different bridging loan scenarios.

Whether you’re considering loan amounts, interest rates, or repayment terms, our calculator provides clear, personalized insights. Make an informed decision by exploring various possibilities and understanding the financial implications.

Try the Bridging Finance Calculator and take the first step towards a smart borrowing choice. Your financial clarity is just a few clicks away!

Need clarity on bridging finance costs?

Use our quick Bridging Finance Calculator to make informed decisions easily.

Is a bridging loan a good idea? (Pros and Cons)

Deciding if a bridging loan is a good idea involves understanding its advantages and disadvantages. These loans can be an effective solution for specific financial situations. But they also carry risks and costs that need careful consideration.

Advantages of Bridging Loans

-

- Quick Access to Funds: Bridging loans are known for their quick processing. This makes them ideal urgent financial needs. This speed is a significant advantage over traditional loans, which often have longer processing times.

-

- Tailored Repayment Terms: These loans may offer flexible repayment options. This can be adjusted according to individual circumstances and to match specific cash flows. Often early repayment is allowed without penalty.

-

- Flexible Lending Criteria: Many alternative lenders will have niche expertise. This allows them to better understand your specific requirements. This allows them to accommodate flexible criteria than traditional loans. They can also often allow for borrowing more significant sums.

-

- Accessibility with Less-than-Perfect Credit: Bridging finance is often available even to those without a clean credit profile.This makes it more accessible than traditional loans which typically require a strong credit history.

-

- Lower Total Cost of Borrowing: Due to their short duration, the total cost of borrowing can be less with bridging loans. There’s less time for compound interest to accrue. The overall financial burden is potentially lower despite higher interest rates.

Disadvantages of Bridging Finance

-

- Higher Interest Rates: The most notable disadvantage is their higher interest rates compared to standard loans. However, you need to weigh up cost versus access.

-

- Short Repayment Period: These loans require quick repayment, which can be a source of stress and financial strain. Quick turning loans are not appropriate in all circumstances.

-

- Requirement of a Clear Exit Strategy: Lenders of bridging finance typically require a well-defined repayment strategy. This means you must have a solid plan for how and when you’ll repay the loan. This may be linked to a specific event like the sale of a property or receipt of a known sum of money.

When considering a bridging loan, it’s important to evaluate these pros and cons in relation to your specific financial situation.

For instance, if you need quick funds for a short period and have a clear repayment strategy a bridging loan can be a viable option. For example the sale of a property or incoming business revenue.

However, if you’re uncertain about your ability to repay within the short term it might be prudent to explore other financing options.

In summary, bridging loans are a valuable financial tool when used under the right circumstances. They offer quick access to funds and flexibility, but their costs and risks should be carefully weighed. It’s advisable to consult with a financial advisor to understand how a bridging loan fits into your overall financial plan. Always ensure that you make an informed borrowing decision.

Bridging Finance vs other Borrowing Products

Bridging loans are obviously not the only form of capital available.

It is important to understand the differences between bridging loans and other borrowing structures like unsecured and secured loans. By considering your options you will be better placed to find the solution which works best for you.

Each has unique features, benefits, and drawbacks, suitable for different financial needs and situations. We will now explore the key differences.

Bridging Loans vs. Unsecured Loans (e.g. Credit Cards & Overdrafts)

Security Requirement

-

- Bridging Loans: Often require collateral, usually property or a financial asset.

-

- Unsecured Loans: No collateral required.

Purpose and Use

-

- Bridging Loans: Specifically designed to ‘bridge’ a short-term financial gap until a known future income (like a property sale) materializes.

-

- Unsecured Loans: More flexible in purpose, often used for a variety of personal or business expenses.

Loan Amounts

-

- Bridging Loans: Can offer larger amounts based on the value of collateral.

-

- Unsecured Loans: Typically smaller amounts based on creditworthiness.

Interest Rates and Fees

-

- Bridging Loans: Generally higher interest rates due to short-term nature and risk.

-

- Unsecured Loans: Interest rates can vary, often lower than bridging loans but can be high for products like credit cards.

Repayment Terms

-

- Bridging Loans: Short-term, often requiring lump-sum repayment.

-

- Unsecured Loans: More flexible, with options for monthly repayments over a longer period.

Approval Speed

-

- Bridging Loans: Often faster approval due to the secured nature.

-

- Unsecured Loans: Can vary, sometimes quick but can be slower due to credit checks.

Bridging Loans vs. Secured Loans (e.g. Mortgages & Vehicle Finance)

Collateral

Both: Require collateral, but bridging loans are typically more flexible regarding the type of collateral.

Loan Term

Bridging Loans: Designed for short-term use, usually up to a year.

Secured Loans: Long-term commitments, like mortgages, can last up to 30 years.

Interest Rates

Bridging Loans: Higher rates due to the short-term and higher risk.

Secured Loans: Generally lower interest rates, spread over the loan term.

Purpose

Bridging Loans: Specific, short-term financial needs, often related to property or business transactions.

Secured Loans: Long-term financial commitments like home purchases or vehicle financing.

Repayment Structure

Bridging Loans: Usually require a lump-sum repayment.

Secured Loans: Typically structured with monthly repayments.

Approval and Processing Time

Bridging Loans: Can be quicker due to the urgency of the funding need.

Secured Loans: Often involve a more extended approval and underwriting process.

Summary

When choosing the right borrowing structure, consider all the terms and conditions. Factors like the purpose of the loan, the available collateral, and the preferred repayment period are all important.

| Bridging Loans | Quick access to funds but come with higher interest rates and require a clear exit strategy for repayment |

| Unsecured Loans | More flexible and don’t require collateral, but they often have lower borrowing limits and can carry high-interest rates |

| Secured Loans | Are designed for longer-term borrowing, have lower interest rates, and are secured against a specific asset like a house or ca |

Each type of loan serves different financial needs. Understanding these differences will help you make an informed decision.

Who offers Bridging Loans in South Africa 🇿🇦

In South Africa, a variety of financial institutions offer bridging loans. Each caters to different needs, from personal finance to business requirements.

Here’s an overview of the types of entities that typically provide bridging finance in SA:

-

- Banks: Many major banks in South Africa have bridging loan products. These are often tailored to specific needs like business cash flow solutions.

-

- Specialized Bridging Finance Companies: There are firms that specialize exclusively in bridging finance. These companies often provide more flexible terms and quicker processing times than traditional banks.

-

- Private Lenders: Private financial institutions and individual lenders also offer bridging loans. They can be a good option for those who need personalized service and more bespoke financial solutions.

-

- Property Development Financiers: For those in the property development sector, there are lenders who specialize in providing finance for property-related projects. This includes bridging loans for development purposes.

-

- Commercial Finance Brokers: They can provide advice and access to a range of finance products, especially for business-related needs.

When it comes to financing it’s essential to consider factors like the lender’s credibility, the contract terms and conditions, interest rates, and any associated fees.

Each lender type has its advantages and suitability depending on the borrower’s specific requirements and financial situation.

It’s always advisable to conduct thorough research or consult with a financial advisor to find the most appropriate lender for your bridging finance needs.

RAF CASH

RAF Cash is the leading RAF bridging firm in South Africa. With extensive experience across the Road Accident Fund. We use this to assist accident victims unlock value in their client by discounting their court order or settlement award.

Delays in receiving payouts is a real thing.

Our service can be a crucial aid for individuals awaiting the funds necessary for their recovery or compensation for their losses.

Get immediate cash payout on your RAF settlement

RAF Bridging Finance – cash advance payout within 24 hours of finalization!

Here’s how RAF Cash can help:

-

- Immediate Financial Relief: RAF Cash provides an advance on the compensation amount. This means you can access a portion of your RAF settlement before the fund actually pays out. RAF Cash equals immediate financial support.

-

- No Long Waiting Periods: Typically, receiving compensation from the RAF can take a long time. RAF Cash eliminates this waiting period. Ensure you get the money when you need it most.

-

- Flexible and Accessible: The service is designed to be straightforward. Our application process is simple. We make it easy for those who may not have a comprehensive financial background.

-

- Supports Various Needs: Whether it’s for medical expenses, loss of income, or other accident-related costs. RAF Cash helps cover these financial burdens while you wait for the actual RAF payout.

RAF Cash is a valuable tool for individuals facing the aftermath of road accidents.

CONCLUSION

This concludes the comprehensive guide to bridging finance in South Africa.

We acknowledge the complex financial challenges faced in times of unforeseen circumstances.

Bridging finance emerges as a beacon of hope. Providing the necessary funds when traditional avenues may fall short.

Do you or someone you know is navigating the aftermath of an accident and waiting on settlement funds? Consider exploring bridging finance as a viable option.

RAF Cash specifically caters to those awaiting compensation from road accidents, offering a financial bridge to aid in your recovery journey.

Take the first step towards financial relief and visit RAF Cash. Discover how bridging finance can alleviate the burden during this critical time. Don’t let financial constraints hinder your path to recovery. Reach out to RAF Cash, where support is ready and waiting.

Frequently Asked Questions

What Is Bridging Finance?

Bridging finance is a short-term loan used to cover immediate expenses while waiting for future funds.

How Long Do Bridging Loans Last?

They typically last a few weeks to a year, much shorter than regular loans.

Can Individuals Use Bridging Finance?

Can Individuals Use Bridging Finance?

Yes, individuals can use bridging finance for personal expenses like school fees or medical bills.

Are Bridging Loans Only for Property Transactions?

No, they can also cover business expenses, salaries, and other urgent financial needs.

How Fast Can I Get a Bridging Loan?

Bridging loans are known for quick processing, often providing funds within a short timeframe.

What Is a Bridging Finance Calculator?

It’s a tool that helps you estimate the costs and benefits of a bridging loan for your situation.

Do Bridging Loans Have High Interest Rates?

Yes, they typically have higher interest rates due to their short-term nature.

Can I Get a Bridging Loan with Bad Credit?

Yes, bridging finance is often available even with less-than-perfect credit.

What Are Some Common Types of Bridging Loans?

Common types include RAF bridging, property bridging, and business bridging loans.

Is Repaying a Bridging Loan Flexible?

Repayment terms can be flexible, often aligned with the receipt of your anticipated funds.

2 Responses

Is it possible to get bridging finance for art work which is to be auctioned in May 2024?

I await a Vat refund of R228 000. I will be paid in the next two weeks. I need short term loan . Can you assist. my cell phone number is 0611476492