Imagine you’re a small business owner in South Africa, on the verge of securing a lucrative contract that could propel your business to new heights.

However, there’s one significant hurdle: the gap between your current cash flow and the immediate capital required to fulfill the contract.

This scenario is all too common and highlights the vital role that short-term finance can play in bridging the gap between opportunity and reality.

In this article, we’ll explore the realm of short-term finance, providing a comprehensive overview of its various forms and functions.

Our primary focus will be on bridging finance in South Africa—a powerful financial tool that offers rapid funding solutions for individuals and businesses in need.

Importance of the Topic

Understanding short-term finance is essential for both businesses and individuals. It provides a lifeline in times of cash flow shortages, enables the seizing of time-sensitive opportunities, and helps maintain financial stability.

For businesses, short-term finance can mean the difference between thriving and merely surviving. For individuals, it can offer critical support in managing personal finances during transitional periods.

By delving into the specifics of bridging finance in South Africa, we’ll uncover how this particular form of short-term finance can be a game-changer in addressing immediate financial needs and fostering economic growth.

Understanding Short-Term Finance

Definition of Short-Term Finance

Short-term finance refers to any form of funding obtained for a period typically less than one year. This type of finance is used to cover immediate financial needs, whether for businesses or individuals, and is designed to be repaid within a short timeframe.

It provides a quick solution for cash flow issues, helping to maintain operations smoothly without long-term financial commitments.

Types of Short-Term Finance

- Working Capital Loans

- These are loans specifically designed to finance a company’s everyday operations. Working capital loans are used to cover short-term expenses such as payroll, rent, and inventory purchases. They ensure that a business can continue to operate even when cash flow is tight.

- Invoice Financing

- Invoice financing allows businesses to borrow money against the amounts due from customers. Companies receive a percentage of the invoice amount upfront and the remainder (minus a fee) when the invoice is paid. This type of financing helps improve cash flow by unlocking funds tied up in unpaid invoices.

- Merchant Cash Advances

- This type of financing provides businesses with a lump sum of capital in exchange for a percentage of future sales. Merchant cash advances are particularly useful for businesses with high credit card sales, offering quick access to funds based on projected sales revenue.

- Lines of Credit

- A line of credit provides businesses with access to a predetermined amount of money that can be drawn upon as needed. It works similarly to a credit card, allowing for flexible borrowing and repayment. This is ideal for businesses that need to manage irregular cash flow or unforeseen expenses.

- Bridging Loans

- Bridging loans are short-term loans used to “bridge” the gap between a current need for funding and a future financial event, such as the sale of a property or securing long-term financing. They provide immediate access to funds and are typically repaid quickly once the future financial event occurs.

Benefits of Short-Term Finance

- Quick Access to Funds

- One of the primary advantages of short-term finance is the speed at which funds can be obtained. This is crucial in emergencies or when an immediate opportunity arises.

- Flexibility

- Short-term finance options often come with flexible terms, allowing businesses and individuals to tailor the repayment schedule to their specific needs and cash flow patterns.

- Maintains Business Operations

- For businesses, short-term finance ensures continuous operation by covering temporary cash shortages. This can prevent disruptions that might otherwise impact productivity and profitability.

- Supports Growth and Opportunities

- By providing quick funding, short-term finance allows businesses and individuals to seize growth opportunities that require immediate investment, such as purchasing new inventory or equipment.

Common Uses

- Managing Cash Flow Gaps

- Businesses often face periods where expenses exceed incoming revenue. Short-term finance helps cover these gaps, ensuring that operations continue smoothly without interruption.

- Unexpected Expenses

- Emergencies or unforeseen expenses can arise at any time. Short-term finance provides the necessary funds to address these issues promptly, whether it’s for a sudden equipment repair or an urgent bill.

- Seasonal Business Needs

- Many businesses experience seasonal fluctuations in revenue. Short-term finance helps manage these variations by providing the needed capital during off-peak seasons to prepare for the high-demand periods.

- Taking Advantage of Opportunities

- Sometimes, opportunities arise that require immediate capital. Whether it’s a bulk purchase discount, a new marketing campaign, or expanding operations, short-term finance enables quick action to capitalize on these opportunities.

In summary, short-term finance is a versatile and essential tool for both businesses and individuals. It provides the flexibility and quick access to funds necessary to manage immediate financial needs, maintain operations, and seize new opportunities.

Understanding the various types and benefits of short-term finance can help you make informed decisions about your financial strategy.

The Role of Short-Term Finance in Business

Cash Flow Management

Effective cash flow management is crucial for the survival and growth of any business.

Short-term finance plays a pivotal role in this area by providing a financial cushion during periods of cash flow shortfalls. Here’s how:

- Bridging Gaps Between Receivables and Payables

- Businesses often face timing mismatches between when they receive payments from customers and when they need to pay suppliers or employees. Short-term finance solutions like invoice financing allow companies to unlock cash tied up in receivables, ensuring they have the funds needed to meet their obligations on time.

- Smoothing Out Seasonal Variations

- Many businesses experience seasonal fluctuations in revenue. For example, a retailer might see a surge in sales during the holiday season but experience slower periods during other times of the year. Short-term finance can help these businesses maintain steady cash flow throughout the year, allowing them to stock up on inventory in anticipation of peak seasons without straining their resources.

- Maintaining Operational Efficiency

- Consistent cash flow is essential for maintaining operational efficiency. Short-term loans or lines of credit can provide the necessary funds to cover everyday expenses, such as utilities, salaries, and rent, ensuring that business operations run smoothly without interruption.

Meeting Immediate Needs

Businesses often encounter urgent expenses that require immediate attention.

Short-term finance is invaluable in such scenarios, offering quick access to the funds needed to address these immediate needs:

- Unexpected Repairs or Maintenance

- Equipment breakdowns or facility repairs can happen unexpectedly, potentially halting operations and impacting revenue. Short-term finance solutions like working capital loans provide the necessary funds to handle these unexpected expenses promptly, minimizing downtime and maintaining productivity.

- Emergency Stock Purchases

- Sometimes, businesses may need to purchase additional inventory unexpectedly due to a sudden increase in demand or to take advantage of a supplier discount. Short-term finance allows businesses to make these purchases without disrupting their cash flow, ensuring they can meet customer demand and maintain their competitive edge.

- Covering Payroll

- Ensuring employees are paid on time is critical for maintaining morale and productivity. If a business experiences a temporary cash flow shortage, short-term finance can provide the funds needed to cover payroll, preventing any disruptions to operations and keeping employees satisfied.

Seizing Opportunities

In the dynamic business environment, opportunities often arise unexpectedly.

Having access to short-term finance allows businesses to act quickly and capitalize on these opportunities:

- Expansion and Growth

- A business might identify a new market opportunity or consider expanding its operations. Short-term finance can provide the immediate capital needed to invest in new locations, hire additional staff, or purchase new equipment, enabling the business to grow and increase its market presence.

- Bulk Purchase Discounts

- Suppliers often offer discounts for bulk purchases, which can significantly reduce costs and increase profit margins. Short-term finance allows businesses to take advantage of these discounts by providing the necessary funds upfront, leading to long-term savings and improved financial health.

- Strategic Marketing Campaigns

- Launching a new marketing campaign can be a strategic move to attract more customers and increase sales. Short-term finance can fund these initiatives, allowing businesses to boost their visibility and drive revenue growth without having to dip into their existing cash reserves.

In summary, short-term finance is a crucial tool for businesses, aiding in effective cash flow management, meeting immediate financial needs, and enabling the quick capitalization on emerging opportunities.

By providing the necessary liquidity, short-term finance helps businesses maintain stability, respond to unexpected expenses, and pursue growth initiatives, ultimately contributing to their long-term success.

Overview of Bridging Finance

Definition of Bridging Finance

Bridging finance is a type of short-term loan designed to provide immediate funding for individuals or businesses until permanent financing or the next stage of funding becomes available.

Unlike other forms of short-term finance that are typically used for operational expenses, bridging finance is often utilized for more significant, immediate financial needs, such as purchasing property or covering a financial gap during a transaction.

This form of finance acts as a bridge between a current need for capital and a future financial event that will generate the funds needed for repayment.

Types of Bridging Finance

Bridging finance can be broadly categorized into two types: closed bridging loans and open bridging loans.

- Closed Bridging Loans

- Definition: Closed bridging loans are granted when the borrower has a clear exit strategy and a fixed repayment date, such as the confirmed sale of a property.

- Typical Use: These loans are often used by property buyers who have already sold their existing property but are waiting for the sale proceeds to complete the purchase of a new property. The certainty of repayment makes these loans less risky for lenders, often resulting in lower interest rates compared to open bridging loans.

- Open Bridging Loans

- Definition: Open bridging loans do not have a fixed repayment date and are used when the borrower does not have a definite exit strategy in place.

- Typical Use: These loans are suitable for borrowers who need immediate funds but are still in the process of arranging long-term financing or selling an asset. Due to the higher risk involved, open bridging loans usually come with higher interest rates and stricter lending criteria.

How Bridging Finance Works

The mechanics of bridging finance involve several key stages, including application, approval, and repayment processes.

- Application Process

- Initial Inquiry: Borrowers typically start by contacting a bridging finance provider to discuss their needs and financial situation. This initial inquiry helps determine if bridging finance is suitable for their requirements.

- Documentation: To proceed with the application, borrowers need to provide documentation that supports their request, such as proof of income, details of the property or asset involved, and information on the exit strategy (e.g., sale agreement, long-term loan approval).

- Property Valuation: If the loan is for property-related purposes, a professional valuation of the property is usually required to establish its market value.

- Approval Process

- Assessment: The lender will assess the application, taking into account the borrower’s financial situation, credit history, and the viability of the exit strategy. For open bridging loans, lenders may scrutinize the application more thoroughly due to the lack of a fixed repayment date.

- Terms and Conditions: If approved, the lender will present the borrower with the terms and conditions of the loan, including the interest rate, fees, repayment terms, and any other relevant conditions.

- Repayment Process

- Loan Disbursement: Once the borrower accepts the terms and conditions, the funds are disbursed. This process is usually swift, allowing borrowers to access the required funds quickly.

- Interest Payments: Depending on the agreement, interest payments may be made monthly, rolled up to the end of the loan term, or deducted from the loan amount at the time of disbursement.

- Repayment of Principal: The principal amount is typically repaid in one lump sum upon the occurrence of the future financial event that constitutes the exit strategy. For closed bridging loans, this could be the sale of a property; for open bridging loans, it might be securing long-term financing.

Bridging finance is a flexible and efficient solution for addressing immediate funding needs.

Its ability to provide quick access to capital makes it an attractive option for individuals and businesses facing financial gaps.

However, the higher costs and risks associated with bridging loans require careful consideration and planning to ensure successful repayment and financial stability.

Did you know...

- Did you know that bridging finance provides rapid funding, typically within a few days, making it one of the fastest short-term financing options available?

- Did you know that bridging finance is highly flexible in terms of usage, applicable to various financial needs such as property purchases, business expansions, and emergency expenses?

- Did you know that the interest rates for bridging finance are generally higher due to the short-term nature and risk involved, but it offers a quick solution for urgent financial needs?

- Did you know that bridging loans can be either closed, with a fixed repayment date, or open, without a set repayment date, depending on the borrower’s exit strategy?

- Did you know that short-term finance options like working capital loans, invoice financing, and merchant cash advances provide businesses with quick access to funds to manage cash flow and seize opportunities?

- Did you know that bridging finance is often secured against property or assets, posing a risk of asset loss if the loan is not repaid on time?

- Did you know that real-life success stories show how businesses have used bridging finance to complete property transactions, cover unexpected expenses, and expand operations successfully?

- Did you know that alternatives to bridging finance, such as lines of credit and overdrafts, offer immediate access to funds once set up, providing highly flexible financial solutions?

- Did you know that the cost of short-term financing options varies, with personal loans generally having lower interest rates than credit cards, but higher than secured loans?

- Did you know that managing cash flow effectively with short-term finance can help businesses maintain stability and growth even during periods of financial uncertainty?

Bridging Finance in South Africa

Market Overview

The short-term finance market in South Africa is diverse and dynamic, catering to various financial needs of both individuals and businesses.

Within this market, bridging finance has emerged as a critical tool, particularly in the property and real estate sectors.

The demand for quick, flexible funding solutions has driven the growth of bridging finance, making it an essential part of the broader financial landscape.

In South Africa, bridging finance is primarily used to facilitate property transactions, cover temporary cash flow gaps, and enable businesses to seize immediate opportunities.

The real estate sector, in particular, benefits from bridging loans as they provide the necessary funds to complete property purchases or developments while awaiting longer-term financing or the sale of another property.

Regulations and Legal Framework

Bridging finance in South Africa is governed by a robust legal framework designed to protect both lenders and borrowers.

The primary regulatory body overseeing this sector is the National Credit Regulator (NCR), established under the National Credit Act (NCA) of 2005.

The NCA aims to promote a fair and non-discriminatory marketplace for access to consumer credit and to regulate all credit providers, including those offering bridging finance.

Key regulatory aspects include:

- Credit Agreements

- All bridging finance agreements must comply with the provisions of the NCA. This includes clear disclosure of the terms and conditions, interest rates, fees, and repayment schedules. Borrowers must be fully informed about their obligations and rights under the credit agreement.

- Interest Rates and Fees

- The NCA sets limits on the interest rates and fees that can be charged by credit providers. This is to prevent predatory lending practices and to ensure that borrowers are not subjected to exorbitant costs. The Act specifies maximum interest rates based on the type of credit provided and the risk profile of the borrower.

- Consumer Protection

- The NCA includes several consumer protection measures, such as the right to apply for debt review if a borrower is unable to meet their repayment obligations. This process allows for the restructuring of debt to make it more manageable for the borrower.

- Lender Registration

- All bridging finance providers must be registered with the NCR. This registration ensures that lenders adhere to the regulatory standards and allows the NCR to monitor and enforce compliance with the NCA.

Major Players

Several institutions and lenders are prominent in the South African bridging finance market, offering a range of products tailored to meet the diverse needs of borrowers.

Some of the major players include:

- Private Banks

- Major banks such as ABSA, Standard Bank, and First National Bank (FNB) offer bridging finance solutions, particularly for property transactions. These banks leverage their extensive resources and customer base to provide competitive bridging loan products.

- Specialized Bridging Finance Companies

- Companies such as Bridging Finance SA, Sentinel Homes, and MultiNET Home Loans specialize in providing bridging finance. These firms often offer more flexible terms and faster approval processes compared to traditional banks, catering specifically to the urgent needs of their clients.

- Alternative Lenders

- Alternative lenders and financial institutions like Investec and Capitec have entered the bridging finance market, providing innovative solutions tailored to both corporate and individual clients. These lenders often focus on niche markets or specific types of bridging finance, such as development finance for real estate projects.

- Property Development Firms

- Some property development companies offer bridging finance to their clients to facilitate the sale and purchase of properties. These firms understand the real estate market dynamics and provide tailored financial solutions to ensure smooth transactions.

The bridging finance market in South Africa is well-regulated and diverse, with a variety of options available to meet the needs of different borrowers.

By understanding the market landscape, regulations, and key players, individuals and businesses can make informed decisions about their bridging finance needs, ensuring they access the most suitable and beneficial financial solutions.

Benefits of Bridging Finance in South Africa

Quick Access to Funds

One of the most significant advantages of bridging finance is the speed at which funds can be accessed.

Traditional loan processes can be lengthy, often taking weeks or even months to complete due to extensive credit checks, appraisals, and paperwork. In contrast, bridging finance is designed to provide rapid funding, typically within a few days.

This is particularly beneficial in situations where immediate capital is required, such as securing a property purchase or covering unexpected expenses.

The streamlined application and approval process ensures that borrowers can obtain the necessary funds quickly, allowing them to act swiftly and effectively on time-sensitive opportunities.

Need clarity on bridging finance costs?

Use our quick Bridging Finance Calculator to make informed decisions easily.

Flexibility

Bridging loans offer a high degree of flexibility, both in terms of repayment and usage, making them a versatile financial tool for various needs:

- Repayment Terms

- Borrowers can often negotiate repayment terms that suit their financial situation. This includes the option to pay back the loan in full once the expected funds become available, such as the sale of a property or receipt of long-term financing. Additionally, some lenders offer flexible interest payment options, such as rolling up interest payments into the loan amount, paying interest monthly, or deducting it upfront.

- Usage of Funds

- Bridging finance is not restricted to specific uses, providing borrowers with the freedom to allocate funds where they are most needed. While commonly used in real estate transactions, bridging loans can also be employed for various other purposes, such as funding business expansions, covering temporary cash flow gaps, or financing urgent repairs and maintenance.

Supporting Real Estate Transactions

Bridging finance plays a crucial role in the South African real estate market, facilitating smooth and timely property transactions. Here’s how:

- Property Purchases

- In a competitive property market, buyers often need to act quickly to secure their desired properties. Bridging finance allows buyers to access immediate funds to complete the purchase, even if they are still awaiting the sale of another property or the approval of long-term financing. This ensures that buyers do not miss out on prime real estate opportunities due to funding delays.

- Property Development

- Real estate developers frequently use bridging finance to cover the costs of construction or renovation projects. This type of finance provides the necessary capital to start or continue projects while developers arrange for more permanent financing solutions or await the sale of completed units. The ability to access funds quickly helps keep development projects on schedule and minimizes delays.

- Auction Purchases

- Buying properties at auctions often requires immediate payment. Bridging finance is ideal for auction purchases, as it enables buyers to secure the necessary funds quickly to complete the transaction within the required timeframe. This ensures that buyers can take advantage of the often-discounted prices available at auctions without worrying about financing delays.

- Bridging Sale Delays

- Sellers sometimes face delays in the sale of their properties, which can create a cash flow gap if they have already committed to purchasing a new property. Bridging finance provides the interim funds needed to complete the new purchase while waiting for the sale of the existing property to finalize. This avoids potential complications and financial stress associated with simultaneous property transactions.

Bridging finance offers numerous benefits, including quick access to funds, flexible repayment options, and versatile usage. Its significant role in supporting real estate transactions in South Africa highlights its importance as a financial tool for individuals and businesses alike.

Whether used to secure property purchases, fund development projects, or cover temporary cash flow gaps, bridging finance provides the necessary support to navigate complex financial situations effectively.

Get immediate cash payout on your RAF settlement

RAF Bridging Finance – cash advance payout within 24 hours of finalization!

How to Qualify for Bridging Finance in South Africa

Eligibility Criteria

To qualify for bridging finance in South Africa, borrowers need to meet certain basic eligibility requirements.

These criteria ensure that lenders can confidently provide funds, knowing that the borrower has a viable plan for repayment. Here are the primary eligibility requirements:

- Creditworthiness

- Lenders typically assess the borrower’s credit history to evaluate their ability to repay the loan. A good credit score and a history of timely payments increase the likelihood of approval.

- Viable Exit Strategy

- A clear and viable exit strategy is essential. This could be the sale of a property, securing long-term financing, or another predictable source of funds. The exit strategy must be realistic and achievable within the loan term.

- Collateral

- Bridging loans are usually secured against an asset, most commonly real estate. The value of the collateral must be sufficient to cover the loan amount. Lenders will conduct a property valuation to determine its market value.

- Proof of Income

- Demonstrating a stable income helps assure lenders of the borrower’s ability to cover interest payments and other associated costs during the loan term.

- Legal Ownership

- The borrower must have clear legal ownership of the collateral offered for the loan. Any disputes or encumbrances on the property must be resolved before applying.

Application Process

The application process for bridging finance is designed to be quick and efficient, ensuring that borrowers can access funds promptly. Here’s a step-by-step guide to the process:

- Initial Inquiry and Consultation

- Contact a bridging finance provider to discuss your needs and financial situation. This initial consultation helps determine if bridging finance is suitable for your requirements.

- Application Form

- Complete the application form provided by the lender. This form will require details about the purpose of the loan, the exit strategy, and information about the collateral.

- Documentation Submission

- Submit the necessary documentation to support your application. This includes proof of income, property ownership documents, and any other required paperwork.

- Property Valuation

- The lender will arrange for a professional valuation of the collateral property. This valuation helps determine the market value and ensures it is sufficient to cover the loan amount.

- Credit Assessment

- The lender will conduct a credit assessment to evaluate your creditworthiness and ability to repay the loan. This may include a review of your credit history, income, and existing liabilities.

- Loan Offer

- If the application is approved, the lender will present you with a loan offer outlining the terms and conditions, including the loan amount, interest rate, fees, and repayment schedule.

- Acceptance and Agreement

- Review the loan offer carefully. If you agree to the terms, sign the loan agreement to formalize the arrangement.

- Funds Disbursement

- Once the agreement is signed, the lender will disburse the funds to your account, usually within a few days. You can then use the funds as intended.

Required Documentation

When applying for bridging finance, you will need to provide various documents to support your application.

These documents help the lender assess your eligibility and the viability of your exit strategy. Typical documentation requirements include:

- Proof of Identity

- Valid identification documents, such as a passport or national ID card, to verify your identity.

- Proof of Income

- Recent payslips, bank statements, or tax returns to demonstrate a stable income and your ability to service the loan.

- Property Ownership Documents

- Title deeds or other legal documents proving ownership of the collateral property. This confirms that you have the legal right to use the property as security for the loan.

- Property Valuation Report

- An independent property valuation report conducted by a qualified appraiser to establish the market value of the collateral.

- Credit History

- A credit report detailing your credit history and current liabilities. This helps the lender assess your creditworthiness.

- Exit Strategy Documentation

- Supporting documents for your exit strategy, such as a property sale agreement, proof of pending financing approval, or other relevant evidence.

- Application Form

- The completed application form with detailed information about the loan purpose, collateral, and repayment plan.

By understanding the eligibility criteria, application process, and required documentation, you can better prepare for obtaining bridging finance in South Africa.

This preparation ensures a smoother application process and increases the likelihood of securing the necessary funds quickly and efficiently.

Risks and Considerations

Interest Rates and Fees

One of the primary considerations when opting for bridging finance is the cost. Bridging loans typically come with higher interest rates compared to traditional long-term loans.

This is due to the short-term nature of the loan and the expedited approval process, which poses a higher risk to lenders.

Here’s what you need to know:

- Interest Rates

- Bridging loan interest rates can range significantly depending on the lender, the borrower’s creditworthiness, and the specifics of the loan. Rates are generally higher than those for standard mortgages or long-term loans, reflecting the short-term risk assumed by the lender.

- Additional Fees

- In addition to interest rates, borrowers must also be prepared for various fees that can add to the overall cost of the loan. These may include:

- Arrangement Fees: Charged for setting up the loan, usually a percentage of the loan amount.

- Exit Fees: Fees payable upon repayment of the loan, sometimes a fixed amount or a percentage of the loan.

- Valuation Fees: The cost of professionally valuing the collateral property.

- Legal Fees: Charges for the legal work required to process the loan agreement.

- Broker Fees: If a broker facilitated the loan, their fee would also need to be considered.

- In addition to interest rates, borrowers must also be prepared for various fees that can add to the overall cost of the loan. These may include:

Understanding these costs upfront is crucial for borrowers to accurately assess the affordability of bridging finance.

Repayment Challenges

Repaying a bridging loan can present several challenges, particularly given the short-term nature and high interest rates associated with these loans. Here are some potential issues:

- Exit Strategy Failure

- The success of a bridging loan largely depends on the borrower’s exit strategy. If the planned exit strategy, such as the sale of a property or securing long-term financing, falls through or is delayed, the borrower may struggle to repay the loan on time. This can lead to additional fees, increased interest costs, and potential legal action by the lender.

- Cash Flow Strain

- High-interest rates and regular interest payments can put a significant strain on the borrower’s cash flow. If not managed properly, this could impact the borrower’s ability to meet other financial obligations, leading to further financial difficulties.

- Limited Extensions

- While some lenders may offer the possibility of extending the loan term, these extensions often come with additional fees and higher interest rates. Borrowers relying on an extension as a contingency plan should be aware that this may not always be available and can be costly.

- Asset Risk

- Bridging loans are typically secured against property or other valuable assets. Failure to repay the loan can result in the lender seizing the collateral, which could mean losing a crucial asset, such as a home or business property.

Market Risks

Market conditions can significantly impact the success of a bridging loan.

Several risks are associated with market fluctuations and property valuations:

- Property Market Fluctuations

- Property values can be volatile, influenced by economic conditions, interest rates, and market demand. A downturn in the property market can reduce the value of the collateral, potentially resulting in the loan amount exceeding the asset’s value. This scenario increases the lender’s risk and may lead to stricter lending terms or difficulties in securing additional financing.

- Economic Conditions

- Broader economic conditions, such as a recession or economic instability, can affect the borrower’s ability to sell assets or secure long-term financing. These conditions can also impact business performance and income stability, making it harder to meet loan repayment obligations.

- Regulatory Changes

- Changes in regulations or government policies affecting the real estate or finance sectors can impact the feasibility of the borrower’s exit strategy. For example, new property taxes or stricter lending regulations could affect property sales and valuations.

- Interest Rate Changes

- Fluctuations in interest rates can affect both the cost of the bridging loan and the feasibility of securing long-term financing. An increase in interest rates during the loan term can raise the overall cost of the loan, putting additional financial pressure on the borrower.

Understanding these risks and considerations is crucial for anyone considering bridging finance.

Borrowers should conduct thorough due diligence, assess their ability to manage the associated costs and risks, and have contingency plans in place to mitigate potential challenges.

By being aware of the potential pitfalls, borrowers can make more informed decisions and better manage their financial obligations.

Case Studies and Real-Life Examples

Success Stories

Case Study 1: Property Development Success

Background: A Cape Town-based property development company needed quick funding to complete a residential project. They had already invested significant capital but faced unexpected construction delays and cost overruns.

Solution: The company secured a bridging loan, which provided the necessary funds to complete the project on schedule. With the additional capital, they were able to finish the construction, market the property, and attract buyers.

Outcome: The residential units sold quickly, and the proceeds from the sales were used to repay the bridging loan. The development company not only avoided financial distress but also profited significantly from the project.

Lesson Learned: Having a clear exit strategy and securing bridging finance enabled the company to overcome temporary cash flow issues and successfully complete a profitable project.

Case Study 2: Small Business Expansion

Background: A small retail business in Johannesburg identified an opportunity to open a second store in a prime location. However, they needed immediate funding to secure the lease and purchase inventory before the busy holiday season.

Solution: The business owner obtained a bridging loan to cover the initial costs. The loan was approved quickly, allowing them to act fast and capitalize on the opportunity.

Outcome: The new store performed exceptionally well during the holiday season, generating enough revenue to repay the bridging loan and provide a substantial profit. The business expanded its customer base and increased its market presence.

Lesson Learned: Bridging finance can be a powerful tool for small businesses looking to seize time-sensitive opportunities and achieve rapid growth.

Case Study 3: Real Estate Investment

Background: An individual investor in Durban found a lucrative property investment but needed funds to complete the purchase while waiting for the sale of another property.

Solution: The investor secured a closed bridging loan, using the expected proceeds from the property sale as the exit strategy. The quick access to funds allowed them to purchase the new property without delay.

Outcome: The new property appreciated in value, and the investor sold it at a significant profit. They used the proceeds to repay the bridging loan and reinvested the remaining profit into further investments.

Lesson Learned: Bridging finance can enable individual investors to capitalize on market opportunities and enhance their investment portfolio.

Lessons Learned

From these real-life examples, several key lessons emerge that can be applied to various situations:

- Importance of a Clear Exit Strategy

- Having a well-defined exit strategy is crucial for the success of bridging finance. Whether it’s the sale of a property, securing long-term financing, or generating revenue from a new business venture, a clear plan ensures that the loan can be repaid on time, minimizing financial risks.

- Speed and Timing Matter

- Bridging finance is particularly valuable in scenarios where speed and timing are critical. The ability to access funds quickly can mean the difference between seizing a lucrative opportunity and missing out. Businesses and investors must be prepared to act swiftly and decisively.

- Flexibility and Adaptability

- The flexibility offered by bridging loans can accommodate various financial needs and circumstances. Borrowers should leverage this flexibility to tailor the loan terms and usage to their specific situation, ensuring the most effective use of the funds.

- Thorough Due Diligence

- Conducting thorough due diligence is essential before securing a bridging loan. Understanding the terms, costs, and risks involved helps borrowers make informed decisions and avoid potential pitfalls. This includes assessing the reliability of the exit strategy and the financial stability required to meet repayment obligations.

- Professional Guidance

- Seeking professional advice from financial advisors or brokers can provide valuable insights and support throughout the bridging finance process. Expert guidance can help navigate complex financial decisions and ensure that borrowers secure the best possible terms and conditions.

- Risk Management

- Effective risk management is vital when utilizing bridging finance. Borrowers should have contingency plans in place to address potential challenges, such as delays in the exit strategy or market fluctuations. Diversifying income sources and maintaining a buffer of emergency funds can also help mitigate risks.

These success stories and lessons learned highlight the potential of bridging finance to address immediate financial needs, support business growth, and capitalize on investment opportunities.

By applying these insights, borrowers can maximize the benefits of bridging finance while minimizing associated risks.

Alternatives to Bridging Finance

Other Short-Term Financing Options

While bridging finance offers quick and flexible funding, it’s not the only option available for addressing short-term financial needs.

Several alternative short-term financing options can be suitable depending on the specific circumstances and requirements of the borrower:

- Working Capital Loans

- These loans are designed to cover everyday operational expenses such as payroll, rent, and inventory purchases. They are typically unsecured and have shorter repayment terms, making them ideal for managing cash flow gaps.

- Invoice Financing

- Also known as accounts receivable financing, this option allows businesses to borrow money against their outstanding invoices. Companies receive a percentage of the invoice amount upfront, with the remainder (minus a fee) provided once the invoice is paid. This helps improve cash flow by unlocking funds tied up in receivables.

- Merchant Cash Advances

- This type of financing provides businesses with a lump sum of capital in exchange for a percentage of future sales. It’s particularly useful for businesses with high credit card sales, offering quick access to funds based on projected sales revenue.

- Lines of Credit

- A line of credit offers businesses flexible access to funds up to a predetermined limit. Borrowers can draw on the line of credit as needed and pay interest only on the amount borrowed. This is useful for managing irregular cash flow or unforeseen expenses.

- Overdraft Facilities

- Overdrafts allow businesses to withdraw more money than is available in their bank account, up to a specified limit. This provides an immediate buffer for cash flow shortages and can be a convenient and cost-effective short-term solution.

- Personal Loans

- For individuals needing quick access to funds, personal loans from banks or other financial institutions can be an option. These loans can be used for various purposes and typically have fixed interest rates and repayment terms.

- Credit Cards

- Business and personal credit cards offer a revolving line of credit that can be used for short-term financing needs. While convenient, they often come with high-interest rates and should be used carefully to avoid accumulating excessive debt.

Comparative Analysis

Comparing bridging finance with other short-term financing options can help borrowers determine the most suitable solution for their needs.

Here’s a look at how bridging finance stacks up against other methods:

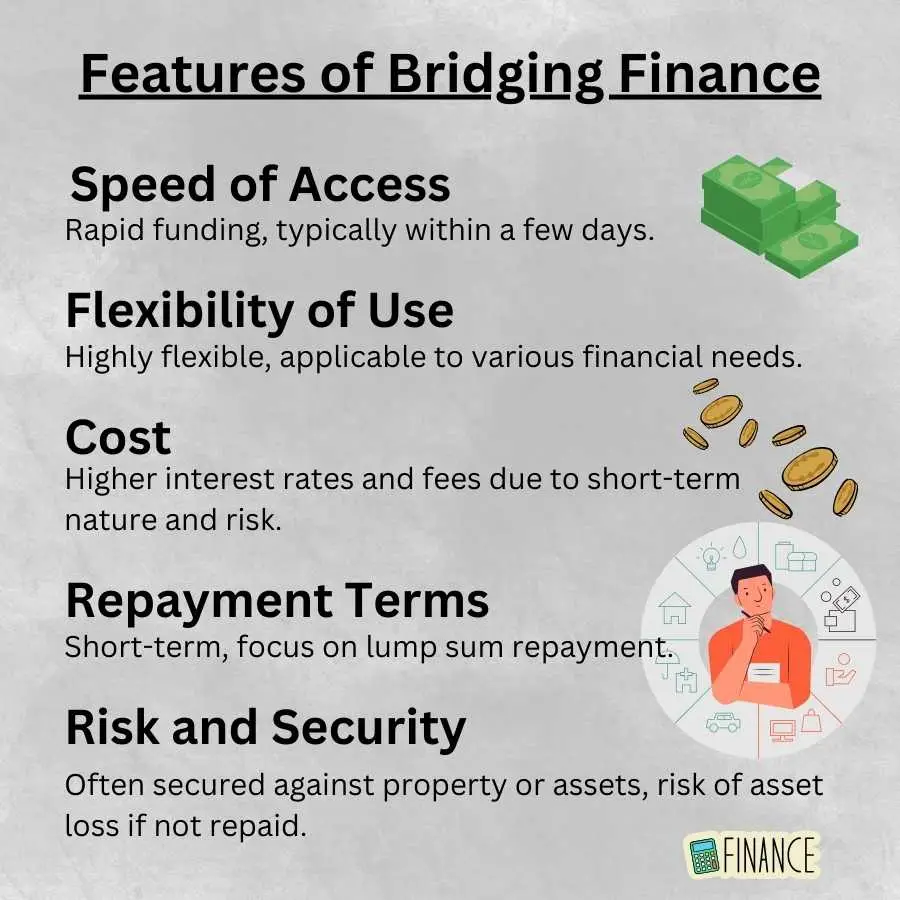

- Speed of Access

- Bridging Finance: Offers rapid funding, typically within a few days.

- Working Capital Loans and Invoice Financing: Generally faster than long-term loans but may take longer than bridging finance.

- Merchant Cash Advances and Credit Cards: Provide quick access to funds, often comparable to bridging finance.

- Lines of Credit and Overdrafts: Offer immediate access once set up, making them very fast.

- Flexibility of Use

- Bridging Finance: Highly flexible in terms of usage, applicable to various financial needs.

- Working Capital Loans: Primarily used for operational expenses.

- Invoice Financing: Limited to unlocking funds from receivables.

- Merchant Cash Advances: Tied to future sales revenue.

- Lines of Credit and Overdrafts: Highly flexible, can be used for multiple purposes.

- Credit Cards and Personal Loans: Flexible for personal or business expenses.

- Cost

- Bridging Finance: Higher interest rates and fees due to the short-term nature and risk.

- Working Capital Loans and Invoice Financing: Generally lower interest rates compared to bridging finance.

- Merchant Cash Advances: Often expensive due to high fees and percentage of sales taken.

- Lines of Credit and Overdrafts: Interest rates can vary, typically lower than bridging finance but with potential fees.

- Credit Cards: High-interest rates, especially for unpaid balances.

- Personal Loans: Interest rates vary, generally lower than credit cards but higher than secured loans.

- Repayment Terms

- Bridging Finance: Short-term with a focus on lump sum repayment.

- Working Capital Loans and Invoice Financing: Short to medium-term, with regular installments.

- Merchant Cash Advances: Repaid through a percentage of daily sales, flexible but can be costly.

- Lines of Credit and Overdrafts: Flexible repayment based on usage and cash flow.

- Credit Cards: Revolving credit with minimum monthly payments, but high interest if not paid in full.

- Personal Loans: Fixed repayment schedule over a set term.

- Risk and Security

- Bridging Finance: Often secured against property or assets, posing a risk of asset loss if not repaid.

- Working Capital Loans and Invoice Financing: May be unsecured or require personal guarantees.

- Merchant Cash Advances: Tied to sales revenue, impacting cash flow but not requiring collateral.

- Lines of Credit and Overdrafts: Can be secured or unsecured, with flexible risk management.

- Credit Cards: Unsecured, but high-interest rates pose a financial risk.

- Personal Loans: Can be secured or unsecured, with varying levels of risk.

By understanding the comparative advantages and disadvantages of bridging finance versus other short-term financing options, borrowers can make informed decisions tailored to their specific financial needs and circumstances.

Each option has its unique benefits and considerations, making it essential to choose the one that aligns best with the borrower’s goals and financial situation.

Introducing Our Interactive Short-Term Financing Comparison Tool

Navigating the world of short-term financing can be complex, with many options available, each with its own advantages and considerations. To make this process easier, we are excited to introduce our interactive Short-Term Financing Comparison Tool. This tool is designed to help you quickly compare different types of short-term financing options, including bridging finance, working capital loans, invoice financing, and more.

How It Works

- Select Your Financing Option: Use the dropdown menu to select the type of short-term financing you are interested in.

- View Key Features: Once you make a selection, the tool will display important details about the chosen financing option, including speed of access, flexibility of use, cost, repayment terms, and risk and security.

- Compare and Decide: By easily comparing these features, you can make an informed decision about which financing option best suits your needs.

Benefits of Using the Tool

- Quick Comparison: Instantly compare various financing options without the need for extensive research.

- Informed Decisions: Access key information that helps you understand the pros and cons of each financing type.

- Time-Saving: Save time by getting all the necessary details in one place, allowing you to focus on your financial planning and decision-making.

Explore the tool below to find the best short-term financing option for your needs and take control of your financial future today!

👇

Bridging Finance

Speed of Access: Rapid funding, typically within a few days.

Flexibility of Use: Highly flexible, applicable to various financial needs.

Cost: Higher interest rates and fees due to short-term nature and risk.

Repayment Terms: Short-term with a focus on lump sum repayment.

Risk and Security: Often secured against property or assets, posing a risk of asset loss if not repaid.

Working Capital Loans

Speed of Access: Generally faster than long-term loans but may take longer than bridging finance.

Flexibility of Use: Primarily used for operational expenses.

Cost: Generally lower interest rates compared to bridging finance.

Repayment Terms: Short to medium-term, with regular installments.

Risk and Security: May be unsecured or require personal guarantees.

Invoice Financing

Speed of Access: Generally faster than long-term loans but may take longer than bridging finance.

Flexibility of Use: Limited to unlocking funds from receivables.

Cost: Generally lower interest rates compared to bridging finance.

Repayment Terms: Short to medium-term, with regular installments.

Risk and Security: May be unsecured or require personal guarantees.

Merchant Cash Advances

Speed of Access: Quick access to funds, often comparable to bridging finance.

Flexibility of Use: Tied to future sales revenue.

Cost: Often expensive due to high fees and percentage of sales taken.

Repayment Terms: Repaid through a percentage of daily sales, flexible but costly.

Risk and Security: Tied to sales revenue, impacting cash flow but doesn't require collateral.

Lines of Credit

Speed of Access: Immediate access once set up, very fast.

Flexibility of Use: Highly flexible, used for multiple purposes.

Cost: Interest rates can vary, typically lower than bridging finance but with potential fees.

Repayment Terms: Flexible repayment based on usage and cash flow.

Risk and Security: Can be secured or unsecured, with flexible risk management.

Overdrafts

Speed of Access: Immediate access once set up, very fast.

Flexibility of Use: Highly flexible, used for multiple purposes.

Cost: Interest rates can vary, typically lower than bridging finance but with potential fees.

Repayment Terms: Flexible repayment based on usage and cash flow.

Risk and Security: Can be secured or unsecured, with flexible risk management.

Credit Cards

Speed of Access: Quick access to funds, often comparable to bridging finance.

Flexibility of Use: Flexible for personal or business expenses.

Cost: High-interest rates, especially for unpaid balances.

Repayment Terms: Revolving credit with minimum monthly payments, high interest if not paid in full.

Risk and Security: Unsecured, high-interest rates pose a financial risk.

Personal Loans

Speed of Access: Generally faster than long-term loans but may take longer than bridging finance.

Flexibility of Use: Flexible for personal or business expenses.

Cost: Interest rates vary, generally lower than credit cards but higher than secured loans.

Repayment Terms: Fixed repayment schedule over a set term.

Risk and Security: Can be secured or unsecured, varying levels of risk.

Conclusion

Summary of Key Points

Throughout this article, we’ve explored the landscape of short-term finance, with a particular focus on bridging finance in South Africa. Here are the key points we’ve covered:

- Understanding Short-Term Finance

- Short-term finance is designed to cover immediate financial needs and is typically repaid within a year. Various types include working capital loans, invoice financing, merchant cash advances, lines of credit, and bridging finance.

- The Role of Short-Term Finance in Business

- Short-term finance helps manage cash flow, meet urgent expenses, and capitalize on immediate opportunities, ensuring businesses can maintain operations and grow.

- Overview of Bridging Finance

- Bridging finance provides quick, short-term funding to bridge financial gaps until a future financial event occurs. It includes closed and open bridging loans, each with distinct characteristics.

- Bridging Finance in South Africa

- The short-term finance market in South Africa is robust, with various regulations governing bridging finance. Key players include private banks, specialized bridging finance companies, alternative lenders, and property development firms.

- Benefits of Bridging Finance in South Africa

- Bridging finance offers rapid access to funds, flexible repayment options, and significant support for real estate transactions.

- How to Qualify for Bridging Finance in South Africa

- Eligibility criteria include creditworthiness, a viable exit strategy, collateral, proof of income, and legal ownership. The application process involves initial inquiry, documentation submission, property valuation, credit assessment, and loan disbursement.

- Risks and Considerations

- Potential risks include high interest rates and fees, repayment challenges, and market risks associated with property valuations and economic conditions.

- Case Studies and Real-Life Examples

- Success stories demonstrate how bridging finance can help businesses and individuals achieve their goals. Key lessons include the importance of a clear exit strategy, speed, flexibility, thorough due diligence, professional guidance, and effective risk management.

- Alternatives to Bridging Finance

- Other short-term financing options include working capital loans, invoice financing, merchant cash advances, lines of credit, overdraft facilities, personal loans, and credit cards. Each option has unique benefits and considerations.

Final Thoughts

Short-term finance, particularly bridging finance, can be a powerful tool for managing immediate financial needs and capitalizing on opportunities. Whether you’re a business looking to maintain cash flow, an individual seeking to bridge a financial gap, or an investor aiming to secure a property deal, understanding the nuances of bridging finance and its alternatives is crucial.

When considering short-term finance, it’s essential to assess your specific needs, the costs involved, and the potential risks.

A clear exit strategy, thorough preparation, and professional advice can help you make informed decisions and ensure the successful use of bridging finance.

If you’re exploring short-term finance options, take the time to understand the various products available and how they can meet your needs.

Consider reaching out to a financial advisor who can provide personalized advice and help you navigate the complexities of short-term finance.

By doing so, you can make informed decisions that support your financial goals and ensure a stable and prosperous future.

Frequently Asked Questions

What is bridging finance?

Bridging finance is a short-term loan that provides immediate funds to cover a financial gap until a future event, such as the sale of a property or securing long-term financing, takes place.

How does bridging finance differ from other short-term loans?

Bridging finance is specifically designed for urgent, high-value needs, often secured against property, and typically has higher interest rates and shorter repayment terms compared to other short-term loans.

Who can benefit from bridging finance?

Individuals or businesses needing quick capital for property purchases, covering cash flow gaps, or funding urgent expenses can benefit from bridging finance.

What are the eligibility criteria for bridging finance in South Africa?

Eligibility criteria include a good credit history, a viable exit strategy, sufficient collateral, proof of income, and clear legal ownership of the collateral property.

What are the risks associated with bridging finance?

Risks include high interest rates and fees, potential challenges in repayment if the exit strategy fails, and market risks affecting property values and economic conditions.

How quickly can I get funds through short term finance?

Funds from short term financing can typically be accessed within a few days, making it one of the fastest short-term financing options available.

Can bridging finance be used for purposes other than property transactions?

Yes, while commonly used for property transactions, bridging finance can also be used for various urgent financial needs, such as business expansions or covering temporary cash flow gaps.

What are the alternatives to bridging finance?

Alternatives include working capital loans, invoice financing, merchant cash advances, lines of credit, overdraft facilities, personal loans, and credit cards.

What documentation is required for a bridging finance application?

Documentation typically includes proof of identity, proof of income, property ownership documents, a property valuation report, a credit history report, and a completed application form.

How can I ensure successful repayment of a bridging loan?

Ensure you have a clear and viable exit strategy, manage cash flow carefully, conduct thorough due diligence, and seek professional guidance to avoid potential repayment challenges.

Glossary

- Bridging Finance: A short-term loan providing immediate funds until a future financial event occurs.

- Exit Strategy: A plan for how a borrower will repay a loan, typically involving the sale of an asset or securing long-term financing.

- Collateral: An asset pledged as security for a loan, which the lender can seize if the borrower fails to repay.

- Creditworthiness: An assessment of a borrower’s ability to repay a loan, based on their credit history and financial status.

- Property Valuation: An estimate of a property’s market value conducted by a professional appraiser.

- Interest Rate: The percentage charged by a lender on the amount borrowed, representing the cost of borrowing.

- Arrangement Fees: Charges for setting up a loan, usually a percentage of the loan amount.

- Invoice Financing: A form of short-term borrowing where a business uses its outstanding invoices as collateral to obtain funds.

- Merchant Cash Advance: A lump sum payment to a business in exchange for a percentage of future sales.

- Line of Credit: A flexible loan that allows a borrower to draw up to a specified limit as needed and pay interest only on the amount borrowed.

- Overdraft Facility: An arrangement allowing a bank account holder to withdraw more money than is available in the account, up to a set limit.

- Due Diligence: A comprehensive appraisal of a business or financial situation, typically conducted before entering into an agreement.

- Regulatory Framework: The system of laws and regulations that govern financial transactions and lending practices.

- Market Fluctuations: Variations in the market value of assets, influenced by economic conditions, supply, and demand.

- Debt Review: A process that allows over-indebted consumers to renegotiate their debt repayments with creditors, making them more manageable.