Tragedy strikes unpredictably on South Africa’s roads, leaving a wake of uncertainty and loss. The Road Accident Fund (RAF) stands as a crucial ally in these times of need. This deep dive into RAF’s ‘Loss of Support’ claims uncovers the vital lifeline it offers families, blending raw statistics with human stories. Unearth the truths behind these claims and how they sustain futures shaken by road calamities.

Introduction

In the wake of a tragedy on the roads of South Africa, the Road Accident Fund (RAF) emerges as a beacon of hope for those left in the shadow of loss.

The RAF was established with the intent to provide indemnity to individuals who have been detrimentally impacted by motor vehicle accidents.

But the RAF is not just a fund. it’s a lifeline for thousands each year who face the daunting road of recovery, both physically and financially.

The Road Accident Fund offers a range of benefits. Among those processed by the RAF, Loss of Support (LOS) claims stand out as a critical component.

But these claims are not just about numbers. They represent the sustenance of families who have lost their breadwinners, the provision for education, and the protection of futures now perched on the brink of uncertainty. Their financial futures being irrevocably altered.

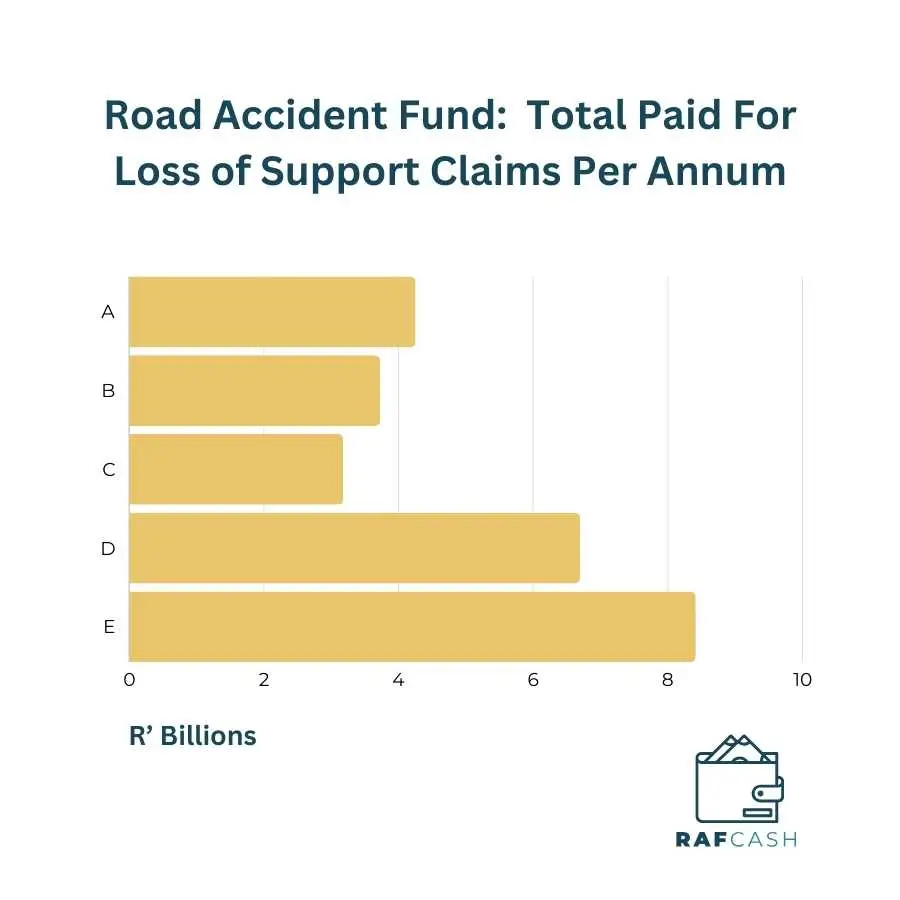

A closer look at the RAF’s annual reports reveals the fiscal magnitude of these claims. With payouts ranging between R2.5 billion to R3.0 billion per annum, the RAF adjudicates approximately 4,500 to 6,500 individual Loss of Support claims each year.

Yet, despite these substantial figures, LOS claims account for a mere 5% of the RAF’s total claims budget—a testament to the vast scope of the fund’s responsibilities.

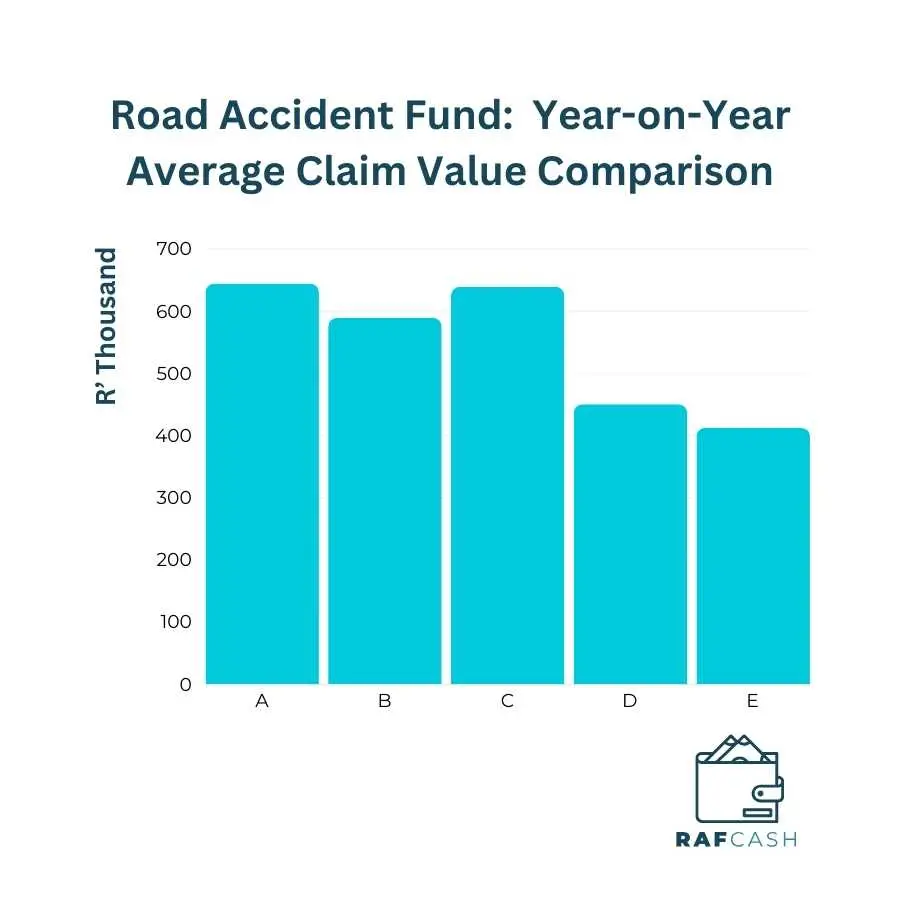

The average Loss of Support claim hovers around R450,000 to R650,000. This sum signifies the gravity of each loss. It is also an effort to quantify the unquantifiable – the value of a human life and the cost of its absence.

This article will navigate the intricacies of Loss of Support claims with the RAF. We will shed light on this crucial aspect of the Road Accident Fund.

Guiding those affected towards the required support and restoring hope and dignity to South Africa’s road accident victims.

Understanding Loss of Support Claims

At its core, a Loss of Support claim is a formal request for financial compensation made to the Road Accident Fund (RAF) by the dependents of an individual who has died in a motor vehicle accident.

These claims arise from the legal premise that had the deceased not been taken prematurely, they would have continued to contribute financially to the well-being of their dependents. Thus, the RAF acknowledges the economic vacuum left behind and offers a monetary lifeline to those who have lost a spouse, parent, or guardian—their provider.

In the intricate framework of the RAF’s claims, Loss of Support occupies a unique niche. Although the RAF attends to a broad spectrum of claims, from personal injury to medical expenses, Loss of Support claims specifically address the ongoing financial needs that arise from the loss of a family’s breadwinner.

It’s a stark reminder that the aftermath of road accidents resonates far beyond the immediate physical injuries, rippling into the very sustenance of households.

When one examines the fiscal breakdown of the RAF’s budget, the proportion allocated to Loss of Support claims is relatively modest. Accounting for only about 5% of the entire RAF claims budget, these claims might seem a minor fraction, However, this percentage represents a substantial financial commitment in absolute terms.

With annual payouts for Loss of Support hovering between R2.5 billion to R3.0 billion, the RAF’s role in mitigating the financial aftermath for affected families is significant.

Delving into the data, the RAF processes roughly 4,500 to 6,500 Loss of Support claims each year, with the average claim ranging from R450,000 to R650,000.

These figures are not mere numbers. They are a financial reflection of the value placed on the lost support, an attempt to quantify the economic impact on families left behind. This average claim value is not just a statistic but a representation of the RAF’s effort to approximate the contribution of the deceased to their family’s future—a future that has been irreparably altered.

In understanding Loss of Support claims, one must recognize them as the RAF’s acknowledgment of the long-term economic impact of road fatalities.

These claims serve as a testament to the RAF’s recognition that the repercussions of a road accident can span decades, altering the trajectory of entire families, and as such, they command a significant and poignant place within the RAF’s claims structure.

Case Studies Illustrating the Claim Process

In the realm of loss of support claims, the individual stories of claimants bring to life the statistics that often overshadow the personal struggles and victories that define the Road Accident Fund’s (RAF) mission. Two such cases, emblematic of hope and the search for justice, illustrate the intricate dance between the bereaved and the behemoth of bureaucracy.

Case Study One: A Test of Perseverance

The first narrative unfolds with a woman’s unwavering quest for compensation after the untimely demise of her partner, the father of her child, in a harrowing road mishap. As the wheels of justice began to turn, she found herself entangled in a legal battle against the RAF, which contested both the liability for the accident and the quantum of the claim.

The case hinged on the testimony of a lone eyewitness whose account painted a vivid picture of the incident. The court was told how the deceased’s vehicle met its fate in a sideswipe collision, countering the RAF’s initial defense.

The evidence was bolstered by a police report sketching out the accident scene, which corroborated the eyewitness’s narrative. The judgment swung in favor of the claimant, establishing the RAF’s full liability—a vindication for the plaintiff and a beacon of hope for similar future claims.

The full court order for this case study is available for download .

Case Study Two: A Young Mother’s Legal Odyssey

The second case revolves around a young mother, left to weave her child’s future with threads of resilience following the collision that claimed her partner’s life. She too faced the RAF in court, challenging the fund’s reluctance to acknowledge the full measure of her loss.

The essence of her struggle lay not just in proving the RAF’s liability but in contesting the quantum deemed adequate for her child’s upbringing.

The legal foray saw expert testimonies and actuarial reports dissected, with the court ultimately rendering a decision that upheld the RAF’s liability. However, it was the quantum that dominated the proceedings, as the court grappled with the actuarial subtleties of future financial needs.

The outcome was bittersweet. While liability was not in question, the compensation awarded was a compromise, factoring in the complexities of life’s unpredictable nature.

The full court order for this case study is available for download .

The Implications for Future Claimants

These case studies serve as microcosms of the RAF’s broader narrative, illustrating the complex interplay between the loss of loved ones and the quest for financial solace. The outcomes highlight a legal system’s capacity to empathize with the bereaved while also adhering to the rigors of the law.

For future claimants, these stories underscore the importance of credible evidence and the weight of expert testimony in swaying the scales of justice. They reveal that while the RAF’s mandate is to compensate, the road to recompense is often long and winding, with each case contributing to the evolving legal tapestry that shapes Loss of Support claims.

The precedents set by these cases will inform future legal strategies, encourage meticulous preparation by claimants and their legal teams, and perhaps most importantly, instill a sense of cautious optimism for those seeking redress from the RAF.

For in the details of these individual stories lies the collective hope of all who turn to the RAF in their hour of need, searching for a semblance of stability in a world upended by sudden loss.

The Legal Landscape of Loss of Support Claims

Critical changes were introduced to the RAF Act, particularly impactful being the cap on earnings for loss of earnings and support claims.

The Cap on Earnings: A Paradigm Shift

Prior to the implementation date, the calculation of loss of support claims was largely unbounded. It was determined by the actual earnings and potential future income of the deceased. However, the introduction of the cap marked a significant shift.

Now, the claimable amount is limited to a maximum value, pegged and adjusted quarterly based on the consumer price index (CPI).

This ceiling is not just a number. It represents a critical inflection point in the RAF’s approach to handling loss of support claims.

Implications for Claimants

For claimants, this legislative change has had far-reaching consequences. The cap effectively standardizes compensation, ostensibly to streamline claims processing and ensure equitable distribution of the RAF’s resources.

However, for families of high-earning deceased individuals, this change has often resulted in a notable reduction in the financial support they receive.

This disparity has introduced a new dimension to the claimants’ financial planning. These are claimants who previously might have expected larger settlements based on their loved one’s substantial earnings.

It compels families to recalibrate their financial expectations. In some cases private insurance may be relevant as an alternative means to bridge the gap left by their diminished compensation.

Evolving Legal Strategies

In response to this capped regime, legal strategies have had to adapt. Lawyers representing claimants now place increased emphasis on meticulous documentation and comprehensive actuarial assessments to maximize the claim within the set limits.

The focus has shifted to optimizing each claim component, such as proving the extent of dependency and exploring all avenues for lawful entitlements.

Another critical strategy has been the pursuit of challenging and potentially reshaping this cap through legal channels. Advocates for the bereaved argue that while the cap may streamline the Road Accident Fund’s financial obligations, it does not necessarily equate to fair compensation reflective of individual circumstances.

Legal challenges aim to strike a balance between the RAF’s sustainability and the claimants’ right to adequate compensation, potentially setting precedents for future amendments to the RAF Act.

As the legal landscape continues to evolve, so too will the strategies of those navigating its terrain. All in pursuit of a system that equitably supports those who have lost their loved ones on South Africa’s roads.

Challenges in the Claim Journey

The journey to secure a Loss of Support claim is fraught with challenges, each a potential hurdle in the path of claimants seeking redress. These challenges, ranging from procedural delays to complex actuarial assessments, paint a picture of a journey that is anything but straightforward.

Protracted Delays: A Test of Patience

One of the most daunting challenges faced by claimants is the prolonged time it takes to finalize claims. It’s not uncommon for a Loss of Support claim to stretch over four years before reaching resolution.

But the waiting doesn’t necessarily end there.

Even after a claim is adjudicated, the RAF may take an additional 6 to 12 months to disburse the funds. These delays can be agonizing for families who depend on this compensation for their livelihood, often exacerbating their financial and emotional distress.

Disputes over Liability and Compensation

Disputes form another significant hurdle in the claim process. Claimants often find themselves embroiled in disagreements over liability, where proving the fault of the other party can be contentious and complex.

Furthermore, disputes over the quantum of compensation are commonplace. The RAF may contest the amount claimed. This leads to protracted legal battles that require exhaustive evidence and expert testimony to resolve.

The Complexity of Actuarial Calculations

Determining the exact financial loss due to the death of a breadwinner involves intricate actuarial calculations. These calculations must consider numerous factors, such as the deceased’s earnings at the time of death, their projected income growth, and the dependents’ financial needs.

The actuary’s role is pivotal in substantiating the claim amount. But the complexity and cost of these assessments can pose a significant challenge, especially for claimants without the resources to hire expert actuaries.

Stringent Time Limits

Another critical challenge is the strict time limits for filing claims. The RAF mandates a three-year deadline for claims submission if the identity of the driver responsible for the accident is known.

In cases of hit-and-run accidents where the driver remains unidentified, this window narrows to two years.

For children who lose a parent in a road accident, the clock starts ticking when they turn 18 years old.

Missing these deadlines can have dire consequences. Claims submitted even a day late may be dismissed outright, leaving the claimants without any recourse for compensation.

This rigid time frame underscores the importance of prompt action following an accident and places an additional burden on claimants to navigate the legal process swiftly.

Navigating the Maze

For many, navigating the claim process with the RAF is akin to traversing a maze filled with legal intricacies and administrative hurdles.

The journey demands not only emotional fortitude but also a keen understanding of the legal landscape.

It’s a path lined with challenges that test the resilience of claimants at every turn, underscoring the need for comprehensive support and guidance for those who embark on this daunting journey.

RAF’s Financial Footing and Claimant Impact

Understanding the financial health of South Africa’s Road Accident Fund (RAF) is crucial in grasping how it impacts the processing and payout of Loss of Support claims. The RAF’s financial standing, characterized by its claim liability, revenue generation, and annual payouts, paints a vivid picture of the challenges and constraints within which it operates.

RAF’s Financial Overview

The RAF registers a staggering near 100,000 new claims each year, indicative of the extensive need for its services.

This volume of claims translates into a hefty financial commitment. The total claim liability for the RAF exceeds R30 billion, a figure that starkly highlights the extent of compensation required to meet the demands of claimants.

On the revenue front, the RAF’s annual income approaches R50 billion. This substantial revenue is crucial in enabling the RAF to meet its obligations.

However, the challenge arises in the form of annual payouts, which often surpass R35 billion. This disparity between revenue and payouts underscores the RAF’s ongoing struggle to balance its books while fulfilling its mandate.

Impact on Loss of Support Claims

The RAF’s financial strain has direct repercussions on the processing and payout of Loss of Support claims. With such a significant portion of its budget dedicated to payouts, the fund often grapples with liquidity issues, which in turn can lead to delays in compensation distribution to claimants.

These delays are not merely administrative but have real-life implications for families relying on these funds for their daily sustenance and long-term financial security.

Furthermore, the RAF’s financial pressures have catalyzed changes in policy and legislative amendments, such as the introduction of caps on earnings for loss of earnings and support claims.

While such measures aim to ensure the fund’s sustainability, they often result in reduced compensation for claimants, particularly affecting those who might have expected larger settlements based on their deceased family member’s earnings.

Navigating Financial Constraints

The RAF’s endeavor to strike a balance between its financial constraints and its obligation to provide fair compensation is a delicate act.

It necessitates not only prudent financial management but also constant adaptation to changing circumstances, be it through policy reforms or operational efficiencies.

For claimants, understanding the RAF’s financial health is crucial. It sets realistic expectations regarding the timing and amount of compensation and underscores the importance of seeking legal advice to navigate this complex landscape.

The RAF’s financial footing, while challenging, is pivotal to its ability to continue serving as a lifeline for thousands of families affected by road accidents across South Africa.

Support and Advocacy for Claimants

In the intricate and often overwhelming world of Loss of Support claims with the Road Accident Fund (RAF), claimants can find solace and guidance in dedicated support services and legal advocacy.

Navigating the RAF’s complexities requires not just an understanding of the law but also strategic know-how in dealing with procedural nuances.

The Role of RAF Knowledge

Knowledge of the RAF process serves as a critical resource for those embarking on the claim process with the RAF. Education provides claimants with vital information, demystifying the RAF’s procedures, and offering clarity on various aspects of the claim process.

From understanding the eligibility criteria for a Loss of Support claim to navigating the filing process, knowledge plays a pivotal role in empowering claimants.

Moreover, this can assist in breaking down complex legal jargon into understandable terms, making the claim process more accessible to individuals who may not have a legal background. It can also offer updates on policy changes within the RAF, ensuring claimants are always informed about the latest developments that could impact their claims.

Consulting Attorneys or the RAF Directly

While resources like RAF Cash are invaluable, there are instances where the guidance of a qualified attorney becomes crucial. Legal professionals specializing in RAF claims can offer tailored advice, taking into account the specifics of each case. They can help in accurately calculating the quantum of the claim, preparing the necessary documentation, and representing the claimant in disputes or court proceedings.

Attorneys become particularly essential in scenarios where claims are complex, involve substantial sums, or when there are disputes regarding liability or quantum. Their expertise can significantly enhance the chances of a successful claim, ensuring that claimants receive the full compensation they are entitled to.

On the other hand, there are situations where claimants might choose to engage directly with the RAF. This approach may be suitable for more straightforward cases or when claimants feel confident in managing their claims. Direct interaction with the RAF can offer a more direct line of communication and might expedite simpler claim processes.

The journey through a Loss of Support claim with the RAF can be daunting. Claimants must carefully assess their situation to decide whether to seek legal assistance or interact directly with the RAF. In either case, being well-informed and strategically prepared are key to navigating this challenging journey.

International Perspective and Best Practices

The approach to Loss of Support claims by South Africa’s Road Accident Fund (RAF) can be better understood (and potentially improved)by examining similar systems in other countries. This comparative analysis can reveal best practices and innovative models that the RAF might adopt to enhance its services.

Comparative Analysis: International Schemes

Globally, numerous countries have established frameworks to compensate victims of road accidents. For instance, the United Kingdom operates under a system where claims are usually made directly against the insurance company of the party at fault.

This model emphasizes the role of private insurance in providing compensation and reduces the burden on public funds. The UK system also tends to be more expedient in processing claims, partly due to the direct involvement of insurance companies.

In contrast, New Zealand’s Accident Compensation Corporation (ACC) offers a no-fault scheme, providing personal injury cover for all New Zealand citizens, residents, and temporary visitors.

Under this system, individuals do not need to prove fault to receive compensation, which can streamline the process and reduce legal battles over liability.

Best Practices and Potential Models for RAF

Drawing from these international models, several best practices could be adopted or adapted to improve the RAF’s services:

- Private Insurance Participation: Introducing or expanding the role of private insurance in the South African context could alleviate some of the financial burdens from the RAF. This approach could also lead to more efficient claim processing.

- No-Fault Compensation Scheme: Implementing a no-fault system, similar to New Zealand’s ACC, might reduce the time and resources spent on determining liability, allowing for quicker resolution of claims.

- Digital Transformation: Digitalizing the claim submission and processing system, inspired by tech-forward approaches in countries like Canada and Australia, could significantly reduce administrative delays.

- Public-Private Partnerships: Collaborations with private entities could bring in additional resources and expertise, enhancing the RAF’s capacity to manage claims and payouts effectively.

- Streamlined Actuarial Processes: Simplifying and standardizing actuarial calculations, as seen in some European models, could make the determination of compensation amounts more efficient and transparent.

- Proactive Claimant Support: Adopting a more claimant-centric approach, where claimants receive regular updates and support throughout their claim process, could improve claimant satisfaction and trust in the system.

- Continuous Policy Review: Regularly reviewing and updating policies and caps on claims, informed by current economic conditions and claimant needs, as practiced in the UK, could ensure that the RAF’s compensation remains fair and relevant.

Incorporating international best practices and adapting successful models from other countries could significantly enhance the effectiveness and efficiency of the RAF.

Direct replication of another country’s system may not be feasible due to differing legal, social, and economic contexts. However, elements of these systems can offer valuable insights for reform and improvement of the RAF’s approach to Loss of Support claims.

Conclusion

In this exploration of Loss of Support claims within South Africa’s Road Accident Fund (RAF) framework, we have traversed a landscape marked by complexity, compassion, and the continual pursuit of justice.

The RAF, tasked with the monumental responsibility of providing financial succor to those bereaved by road accidents, operates within a system that balances legal precision with human empathy.

We commenced our journey by understanding the nature of Loss of Support claims and their critical role in the RAF’s operations.

Despite constituting only a small percentage of the RAF’s total claims budget, these claims carry immense weight in terms of their impact on the lives of the affected families.

The average claim, ranging between R450,000 to R650,000, underscores the RAF’s endeavor to quantify and compensate for the irreplaceable loss of a family’s breadwinner.

The narrative deepened as we delved into case studies, revealing the intricate legal battles and emotional toll experienced by claimants.

These stories, while unique, collectively reflect the common challenges faced by many – protracted delays, complex actuarial calculations, and frequent disputes over liability and quantum. The legal landscape of Loss of Support claims, shaped by recent legislative amendments like the cap on earnings, further illustrates the evolving nature of the RAF’s operations.

A comparative international analysis illuminated potential pathways for reform, drawing from global best practices in handling similar claims. The insights gleaned from systems like the UK’s insurance-based model and New Zealand’s no-fault scheme offer valuable perspectives for enhancing the RAF’s efficiency and claimant experience.

As we conclude, it’s imperative to reflect on the profound significance of Loss of Support claims. They are more than financial transactions. They are lifelines that offer stability in the turbulent aftermath of a road accident. They represent the RAF’s commitment to cushioning families from the economic shockwave that follows the loss of a loved one.

For potential claimants navigating this challenging journey, vigilance is key.

Being aware of the stringent time limits for filing claims and understanding the importance of meticulous documentation and evidence cannot be overstated. In this complex landscape, seeking legal advice is not just advisable. It is a critical step in ensuring rightful compensation.

Legal professionals not only provide guidance through the procedural maze but also advocate passionately on behalf of claimants, ensuring their voices are heard and their losses acknowledged.

In the grand tapestry of the RAF’s operations, each Loss of Support claim is a thread woven with resilience and hope. For those embarking on this journey, know that while the path may be fraught with challenges, it leads to a destination where justice and support await.

Navigate the complexities of the RAF with confidence and clarity.

Don’t let the intricacies of Loss of Support claims be a roadblock in your quest for justice and support.

Stay informed and educated – subscribe to our newsletter. Empower yourself with knowledge, and join a community committed to unraveling the RAF ecosystem. Your journey to understanding and assistance starts here.

Frequently Asked Questions

How do I know if I'm eligible for a Loss of Support claim with the RAF?

Eligibility hinges on whether you’re a dependent of someone who died in a road accident, such as a spouse, child, or financially reliant family member.

What is the time limit for filing a Loss of Support claim with the RAF?

You have three years from the date of the accident to file your claim, or two years in the case of a hit-and-run, unless you’re a minor.

What kind of compensation can I expect from a Loss of Support claim?

Compensation typically covers the financial support the deceased would have provided, like living expenses and education costs, but it’s capped based on the RAF’s regulations.

How long does it usually take for a Loss of Support claim to be resolved?

Claims can take several years to resolve, often around four years, and additional time for the payout after a claim is approved.

Can I file a Loss of Support claim if the deceased was unemployed?

Yes, if you can show that the deceased had the potential to financially support you in the future, such as a stay-at-home parent or a student.

Do I need a lawyer to file a Loss of Support claim with the RAF?

While not mandatory, a lawyer can help navigate the complexities and maximize your claim, especially in cases of large sums or disputes.

What happens if I miss the deadline for filing a claim?

Unfortunately, if you miss the deadline, your claim will likely be dismissed, emphasizing the importance of timely action.

How are the amounts for Loss of Support claims calculated?

Amounts are calculated using factors like the deceased’s earnings, potential future income, and the dependents’ needs, often involving actuarial assessments.

Can the RAF dispute my claim, and what can I do if they do?

Yes, the RAF can dispute claims. In such cases, providing solid evidence and possibly seeking legal assistance are crucial for challenging their decision.

Are there any recent changes in the RAF policies that affect Loss of Support claims?

Key changes include caps on claimable amounts, introduced to ensure equitable distribution and financial sustainability of the RAF, affecting the size of potential payouts.

Glossary

- Loss of Support Claims: Claims made to receive financial compensation for dependents of someone who died in a motor vehicle accident.

- Indemnity: Protection or compensation for loss or damage.

- Quantum: The amount or extent of financial compensation in a claim.

- Liability: Legal responsibility for one’s actions or omissions.

- Dependents: Individuals who rely financially on someone else, typically family members like spouse or children.

- Earnings Cap: A maximum limit set on the amount that can be claimed for loss of earnings.

- Actuarial Assessments: Calculations and evaluations done by actuaries to determine financial implications and compensation amounts.

- Consumer Price Index (CPI): A measure that examines the weighted average of prices of consumer goods and services, such as transportation, food, and medical care.

- Procedural Delays: Delays in the process of handling and resolving a claim.

- Liability Disputes: Conflicts regarding who is legally responsible for the accident.

- Time Limits: The deadline by which a claim must be filed.

- No-Fault Scheme: A system where compensation is provided regardless of who caused the accident.

- Private Insurance Participation: Involvement of private insurance companies in providing compensation for accidents.

- Public-Private Partnerships: Collaborations between government entities and private companies.

- Claimant Satisfaction: The degree to which the needs and expectations of the person making a claim are met.

2 Responses

Thanks a lot for eye opening information

Thanks a lot for information