In the wake of a road accident, navigating the financial aftermath can be as daunting as the recovery itself. Our comprehensive guide on RAF Loans offers a beacon of hope, illuminating a path to financial stability and peace of mind. Dive in to discover how these loans can be your financial ally in troubled times.

Introduction

Imagine this: You’ve been involved in a road accident.

The shock and trauma are overwhelming enough, but soon, a new worry emerges – the financial aftermath. Medical bills pile up, daily expenses don’t pause, and if you’re unable to work, the financial strain can feel insurmountable.

This is where Road Accident Fund (RAF) Loans come into play, a beacon of hope for many.

Road accidents in South Africa are not just a matter of physical and emotional trauma. They bring a significant financial burden too.

Recent statistics indicate that road accidents cost the South African economy billions annually, with victims bearing a substantial portion of this burden. The Road Accident Fund alone costs South Africans approximately R45 billion each year in fuel levies. That number excludes road maintenance, vehicle asset damage, and non-recovered medical bills. Not to mention the emotional damage and intangible losses on individuals and families.

RAF Loans offer a vital financial lifeline, providing immediate financial relief when it’s most needed. They bridge the gap between accident and settlement, ensuring that life’s essential needs are not put on hold while you await your due compensation.

In this comprehensive guide, we’ll delve deep into what RAF Loans are, how these upfront cash advances can help you, and how to navigate the application process.

This isn’t just about understanding a financial product. It’s about finding a way to regain stability in a time of chaos and uncertainty.

RAF Loans Explained

RAF Loans, an abbreviation for Road Accident Fund Loans, are specialized financial aids provided to victims of road accidents in South Africa.

These loans or cession arrangements are essentially a form of bridging finance, designed to offer immediate financial relief to those awaiting settlements from the Road Accident Fund.

The concept of RAF Loans emerged as a response to the prolonged process typically involved in settling claims with the Road Accident Fund. More specifically, the RAF together with the South African courts instituted a staggered payment processes whereby finalized claims take a minimum of 180 days (6 months) to get paid.

This delay often left accident victims in a precarious financial state, struggling with medical expenses and daily living costs.

Recognizing this gap, financial institutions began offering RAF Loans as a solution, allowing claimants to access part of their expected settlement in advance.

These loans are known by various names – RAF Bridging Finance, RAF Cash Advances, RAF Discounting, and RAF Funding, to mention a few.

Irrespective of the name, RAF discounting arrangements serve the same purpose: providing advance funds against the eventual settlement from the Road Accident Fund.

However, bridging loans may vary slightly in terms of repayment conditions, interest rates, and the amount of money that can be advanced.

Over the years, RAF Loans have evolved to become more streamlined and accessible, with a focus on ethical lending practices and transparent terms.

They stand as a critical support system for accident victims, helping them navigate a challenging period without the added stress of financial instability.

RAF Loans vs. Traditional Loans

When comparing RAF Loans to traditional bank loans, the differences are quite distinct.

Traditional loans, like personal loans, overdraft facilities or credit cards, usually require a thorough credit check, a demonstrated ability to repay, and often, collateral. The repayment for these loans is through structured, periodic payments over a set term.

In contrast, RAF Loans are specifically designed for road accident fund claimants awaiting their settlement. They are typically unsecured and do not rely on the claimant’s credit history or income.

Instead, the focus is on the validity and value of the RAF claim. This means that Road Accident Fund loans do not require a credit check, and blacklisted clients can still be approved.

Furthermore, the repayment of an RAF Loan is unique. It occurs in a lump sum and is directly tied to the receipt of the claimant’s RAF settlement. This means repayment is only due once the claimant receives their payout from the Road Accident Fund.

To illustrate, consider the case of John, a road accident victim. After his accident, John faced immediate medical expenses and lost income.

A traditional loan wasn’t feasible due to his inability to work. Since he no longer earned a regular salary, his debit-orders had failed resulting in an adverse credit score.

He opted instead for an RAF Loan from RAF Cash. This provided him with the necessary funds upfront, repaid from his eventual RAF settlement without the need for monthly repayments. Since RAF Cash understand the RAF and its processes we were able to make a same-day payment.

This flexibility and alignment with the RAF claim process is a hallmark of RAF Loans, making them a tailored solution for accident victims in financial distress.

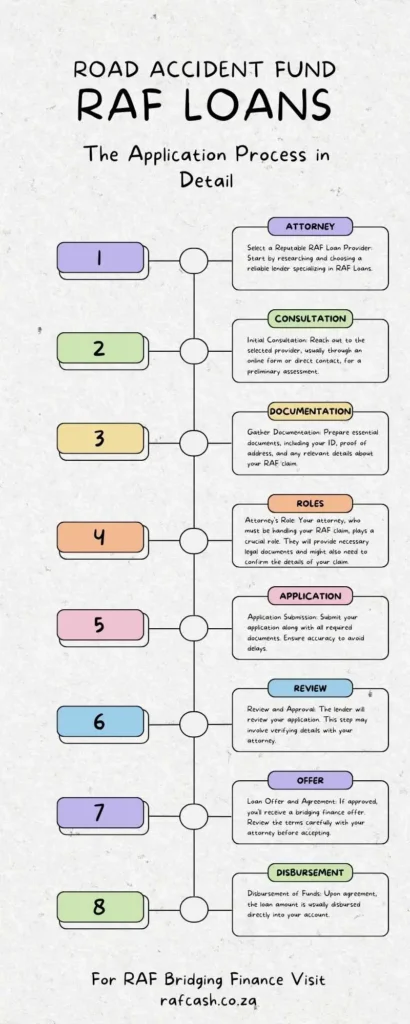

The Application Process in Detail

Applying for an RAF Loan involves a few critical steps, and understanding each one is key to a smooth experience.

- Select a Reputable RAF Loan Provider: Start by researching and choosing a reliable lender specializing in RAF Loans.

- Initial Consultation: Reach out to the selected provider, usually through an online form or direct contact, for a preliminary assessment.

- Gather Documentation: Prepare essential documents, including your ID, proof of address, and any relevant details about your RAF claim.

- Attorney’s Role: Your attorney, who must be handling your RAF claim, plays a crucial role. They will provide necessary legal documents and might also need to confirm the details of your claim.

- Application Submission: Submit your application along with all required documents. Ensure accuracy to avoid delays.

- Review and Approval: The lender will review your application. This step may involve verifying details with your attorney.

- Loan Offer and Agreement: If approved, you’ll receive a bridging finance offer. Review the terms carefully with your attorney before accepting.

- Disbursement of Funds: Upon agreement, the loan amount is usually disbursed directly into your account.

Common mistakes to avoid include choosing an unvetted loan provider, incomplete documentation, and not involving your attorney at every stage. Ensuring these steps are correctly followed can significantly ease the process.

Eligibility and Qualifying Criteria

To be eligible for an RAF Loan, there are specific criteria that applicants must meet. The most crucial is having a finalized case with the Road Accident Fund.

This means that your claim should be either settled or awarded by a court decision. The existence of a confirmed settlement amount is vital, as the loan amount is typically a percentage of this figure.

Applicants who have not yet reached a settlement or judgment in their RAF claim generally do not qualify.

Additionally, the involvement of a registered attorney handling the RAF claim is mandatory. This ensures the legitimacy of the claim and facilitates the loan process.

Unfortunately, claimants with direct claims do not qualify.

It’s also important to note that each RAF finance provider might have additional specific criteria. These could include the minimum and maximum amounts they are willing to advance, the expected time frame for the RAF to pay out, and other case-specific details.

Understanding and meeting these criteria is key to a successful application.

Overcoming Common Challenges

Navigating the world of RAF Loans can present a few hurdles, the most common being payout delays from the RAF and issues with attorney cooperation.

Payout Delays: Delays in receiving payouts from the RAF can extend the loan repayment period, potentially increasing the cost. To mitigate this, it’s crucial to have a clear understanding of the terms and conditions of your RAF Cash Advance, especially regarding how extended payout times affect repayment.

Attorney Cooperation: Sometimes, attorneys may be hesitant to engage in the RAF Loan process. It’s vital to have open and honest communication with your attorney about why you need the loan and how it can help alleviate your financial burdens.

Success Story

Consider the case of Maria, who faced significant delays in her RAF payout. Initially overwhelmed, she worked closely with RAF Cash (her finance provider) to understand the flexible repayment terms.

We offered her a plan that accounted for potential delays, providing peace of mind. When her payout was delayed by three months, Maria was prepared, and the impact on her financial obligations was minimal.

This example underscores the importance of being informed, prepared, and having open communication channels. By being transparent both with your RAF Loan provider and your attorney, you will be successful in navigating any challenges which arise.

The Financial Lifeline

RAF Loans can significantly alleviate the financial strain on accident victims. These loans often become a crucial lifeline, covering immediate expenses like medical bills and daily living costs.

For many, this support is not just about financial relief but also about maintaining dignity and normalcy in a challenging time.

For instance, consider the story of Thabo, a father and the sole breadwinner for his family, who was involved in a car accident. Unable to work and with mounting medical expenses, he faced the risk of falling into debt.

An RAF Loan provided him the necessary funds to cover his medical bills and support his family during recovery. This not only relieved him of financial stress but also allowed him to focus on his health and family without the constant worry of unpaid bills.

Stories like Thabo’s highlight the transformative impact RAF Loans can have, offering more than just financial aid – they offer a chance to rebuild lives disrupted by unforeseen circumstances.

Emotional and Psychological Aspects

The emotional and psychological journey of accident victims is often a complex one.

Coping with the aftermath of an accident can lead to stress, anxiety, and even depression, especially when financial worries are added to the mix. RAF Loans can play a crucial role in easing this burden.

The assurance of financial support helps reduce stress and provides mental space for victims to focus on recovery and rehabilitation.

A poignant example is Linda, who experienced severe anxiety after her accident due to financial pressures. Receiving an RAF Loan lifted a weight off her shoulders, allowing her to focus on her psychological healing. This financial respite gave Linda the peace of mind she needed to engage fully with her therapy sessions, greatly aiding her emotional recovery.

This story underscores the profound impact financial stability can have on the overall well-being of accident victims, illustrating that RAF Loans offer more than just monetary relief. They are a key component in the holistic recovery process.

The Future of RAF Loans

The landscape of RAF Loans is likely to evolve with potential regulatory changes.

The Road Accident Fund Amendment Bill proposes significant changes to the current system of compensation for road accident victims in South Africa. If enacted, it would shift from a comprehensive compensation approach to providing more limited social benefits.

This change could significantly impact the rights of drivers, passengers, and pedestrians to claim compensation for injuries suffered in motor vehicle accidents.

The amendment aims to reduce extensive liabilities of the RAF, but it might also limit the extent of financial relief available to accident victims. The bill’s potential impact on the public, especially the economically disadvantaged who rely on public transport, could be substantial, as they might have to depend more on the public health system and face limited compensation for loss of earnings.

For a detailed understanding of the bill and its implications, it’s recommended to consult legal or financial experts familiar with the South African Road Accident Fund.

With regards to operational changes at the RAF, the experts are divided. Some anticipate that changes being enacted by the Road Accident Fund management and board of directors could streamline the claim process, affecting the demand and structure of RAF Loans. There’s speculation that enhanced efficiency in the RAF payout process might reduce the need for such loans. Conversely, others speculate that if payout delays persist or increase, the reliance on RAF Loans could in fact grow.

Future trends may include more digitalization in the loan application process, making it quicker and more user-friendly. Also, there might be a shift towards more transparent and flexible loan terms to meet the diverse needs of claimants.

Experts also foresee greater regulatory oversight to protect claimants from unfair lending practices, ensuring that RAF Loans continue to serve as a supportive financial tool rather than a burden.

These developments are expected to make RAF Loans more accessible and tailored to the specific needs of road accident victims.

Top 10 things to know about RAF Loans:

- Specifically for Road Accident Victims: RAF Loans are designed for individuals awaiting Road Accident Fund settlements.

- Not Based on Credit Score: Eligibility isn’t determined by your credit history.

- Dependent on a Settled Case: You must have a finalized RAF claim.

- Attorney Involvement Is Crucial: Your attorney plays a key role in the application process.

- Flexible Usage: Funds can be used for various expenses, such as medical bills and living costs.

- Lump Sum Repayment: Repayment is made in a single sum once the RAF pays out.

- Quick Access to Funds: Once approved, disbursement is usually swift.

- Interest and Fees: Understand the costs involved, which vary between providers.

- Provider Selection Is Key: Choose a reputable and transparent loan provider.

- A Lifeline in Difficult Times: They offer financial relief during the challenging post-accident period.

Navigating Legal Complexities

The legal framework of RAF Loans is intertwined with the broader regulations governing the Road Accident Fund and personal injury claims in South Africa. Navigating these complexities often requires the guidance of a skilled attorney.

Legal experts emphasize the importance of understanding the terms and conditions of RAF Loans, particularly how they align with the legal process of RAF claims.

While not financial advisors, attorneys often play a critical role in ensuring that loan agreements respect the claimant’s rights and the legal boundaries of the RAF system. They can offer valuable advice on how to approach RAF Loans in a way that is legally sound and financially prudent.

This might include insights into the expected timelines, potential legal hurdles, and the best strategies for managing the loan in the context of an ongoing RAF claim.

In essence, expert legal guidance is not just a recommendation but a necessity in navigating the complexities of RAF Loans, ensuring that claimants make informed decisions that align with their legal and financial interests.

Tips for Choosing the Right RAF Loan Provider

Selecting the right RAF Loan provider is crucial. Here are key criteria to consider:

- Reputation and Credibility: Look for providers with a strong track record. Check reviews and seek feedback from previous clients.

- Transparency: Providers should be upfront about their fees, interest rates, and repayment terms. Avoid those with hidden charges.

- Ethical Practices: Choose a provider that adheres to ethical lending practices. They should prioritize your financial well-being.

- Fair Pricing: Compare different providers to ensure you get competitive rates.

- Customer Service: Good providers offer excellent customer support, guiding you through the process.

- Legal Compliance: Ensure they comply with relevant financial and legal regulations.

Research thoroughly and consult with your attorney before making a decision.

Case Studies of the Benefits of RAF Loans

Let’s explore the real-life impact of RAF Loans through detailed case studies:

Sarah’s Story: Overcoming Medical Debt

Sarah, a mother of two, was involved in a serious car accident. Faced with escalating medical bills and unable to work, she was on the brink of financial ruin. An RAF Loan provided her with the necessary funds to cover her medical expenses and basic needs until her settlement was processed. This timely financial support not only helped her manage her debts but also gave her the peace of mind needed for recovery.

Michael’s Journey: Restoring a Business

Michael, a small business owner, suffered injuries in a road accident that left him unable to manage his business effectively. His RAF Loan allowed him to hire temporary help to keep his business afloat during his recovery period. This story highlights how RAF Loans can be vital in sustaining livelihoods impacted by accidents.

Linda’s Experience: Aid in Psychological Recovery

Linda, battling severe anxiety and depression post-accident, found her RAF Loan to be more than financial relief. It enabled her to afford quality psychological care and focus on healing without the added stress of unpaid bills. Her case demonstrates the broader impact of RAF Loans on overall well-being.

These stories illustrate the diverse and significant benefits RAF Loans can offer, underscoring their role not just in financial relief, but in aiding recovery and preserving normalcy in the lives of accident victims.

Conclusion

In conclusion, this article has delved into the nuances of RAF Loans, offering insights into their application, benefits, and the vital role they play in the lives of road accident victims.

We’ve explored the unique features of RAF Loans, how they compare with traditional loans, and the importance of selecting the right loan provider. Through personal stories, we’ve seen the profound impact these loans can have, not just financially but emotionally and psychologically.

As we navigate the complexities of post-accident recovery, RAF Loans emerge as a crucial tool for stability and hope. Remember, staying informed and seeking the right financial support can make a significant difference in your journey to recovery.

Now that you’ve gained insights into the RAF ecosystem, take the next step in your journey to financial literacy.

Subscribe to our newsletter at RAF Cash for regular updates and expert advice.

Stay informed and stay ahead in understanding the complexities of the Road Accident Fund.

Your financial well-being starts here.

Frequently Asked Questions

How Do RAF Loans Work?

RAF Loans provide financial aid to road accident victims awaiting their RAF settlement. The loan amount is repaid in a lump sum when the settlement is received.

Can I Apply for an RAF Loan Before My Case is Settled?

No, your case must be settled or have a court judgment to qualify for an RAF Loan.

What Documents Do I Need for an RAF Loan?

You’ll need a valid ID, proof of address, banking details, and documentation related to your RAF claim.

How Long Does It Take to Receive an RAF Loan?

Once approved, you can typically receive an RAF Loan within a few hours to a few days.

Are There Any Risks with RAF Loans?

The main risk is if the RAF payout is delayed, which might increase the cost of the loan.

Do I Need an Attorney for an RAF Loan?

Yes, having an attorney who handles your RAF claim is essential for the loan process.

How is an RAF Loan Repaid?

The loan is repaid in a single lump sum from your RAF settlement.

Can RAF Loans Cover Medical Expenses?

Yes, RAF Loans can be used to cover medical bills and other related expenses.

What If My RAF Claim Is Delayed?

If your claim is delayed, communicate with your loan provider about possible implications.

How Do I Choose the Right RAF Loan Provider?

Look for providers with a good reputation, transparent terms, and ethical lending practices.

Glossary

- RAF Loans: Short-term loans given to claimants of the Road Accident Fund.

- Bridging Finance: A type of loan designed to provide temporary financial relief.

- Settlement Claim: The amount awarded to an individual after a legal case resolution.

- Repayment Terms: Conditions outlining how and when a loan must be repaid.

- Financial Relief: Assistance provided to alleviate financial burdens.

- Claimant: A person making a claim, in this context, for RAF compensation.

- Ethical Lending: Fair and responsible loan practices.

- Legal Framework: The system of rules and regulations governing a process.

- Financial Stress: Anxiety or pressure resulting from financial difficulties.

- Psychological Recovery: The process of regaining mental health and well-being.

- Lump Sum: A single payment made at a particular time, as opposed to several smaller payments.

- Credit History: A record of a person’s ability to repay debts and managed credits.

- Settlement: An agreement reached between parties in a legal case.

- Judgment: A decision made by a court regarding a legal matter.

- Attorney Involvement: Participation or representation by a legal professional in a process.

11 Responses

Hi request RAFCash Loan assistance/clarity. My case is finalized on 31 January 2024. Court Order in place and only awaiting for settlement letter from my attorneys. Thanks

I need bridging finance. I do have an Attorney

I need a loan

Hi Nompi, thank you for reaching out. Someone from our office will contact you in the morning.

Hi my name is andries magwane can you please contact me on 0738578218

I need a bridging loan I have an offer

Hi Nompi, thank you for reaching out. Someone from our office will contact you in the morning.

I would love to secure a loan on my RAF offer

I need a loan

I nead loan and i do have attorney

Hello a bridging loan please.I have an offer