The Road Accident Fund (RAF) serves as a pivotal institution in South Africa, providing compulsory insurance coverage to all users of its roads.

This coverage ensures that victims of road accidents are compensated for injuries or death, regardless of the at-fault party.

The importance of the RAF extends beyond immediate financial assistance, as it embodies a critical component of the national strategy to manage and mitigate the consequences of road accidents.

This article delves into the historical evolution of the RAF, its funding mechanisms, the challenges it faces, and the significant role of claims statistics in assessing its financial health and operational effectiveness.

The numbers and statistics discussed are primarily sourced from the RAF Annual Reports, unless stated otherwise.

By exploring these elements, we aim to provide a comprehensive understanding of the RAF’s impact on individuals and the broader societal implications, highlighting why such information is crucial for continuous policy improvement and public awareness.

Background and Purpose of the RAF

Historical Context

The Road Accident Fund (RAF) in South Africa was established with a critical mission: to provide insurance cover to all drivers of motor vehicles in the country, ensuring that victims of road accidents are compensated, irrespective of who was at fault. This initiative emerged from a dire need to address the consequences of road accidents which, due to the high prevalence in South Africa, had become a significant social and economic issue.

The origins of the RAF date back to the 1940s, with the introduction of the Motor Vehicle Insurance Act of 1942. This Act was replaced by the more comprehensive Motor Vehicle Accidents Act in 1972, which laid the foundation for a more robust system of compensation.

However, it was the Road Accident Fund Act of 1996 that officially established the RAF in its current form, marking a pivotal moment in the country’s approach to road accident claims.

Primary Purpose

The primary purpose of the RAF is to provide compulsory cover to all users of South African roads against injuries sustained or death arising from accidents involving motor vehicles within the borders of South Africa. This includes not only drivers and passengers but also pedestrians and cyclists.

The Fund is mandated to ensure that victims of road accidents are adequately compensated, regardless of the financial status of the person responsible for the accident.

Evolution of Role

Over time, the role and functioning of the RAF have evolved significantly. Initially, the focus was primarily on providing financial assistance for medical costs, loss of earnings, and, in the case of fatalities, funeral expenses.

However, as the volume of traffic and the rate of accidents increased, the RAF’s role expanded to address a broader range of needs. This includes providing support for rehabilitation and long-term care, especially in cases of severe and disabling injuries.

Additionally, the RAF has been involved in proactive measures aimed at road safety and accident prevention.

These initiatives include public education campaigns, research into road safety, and partnerships with other stakeholders committed to reducing the incidence and severity of road accidents in South Africa.

Challenges and Adaptations

Despite its noble objectives, the RAF has faced various challenges, including financial constraints, a backlog of claims, and administrative issues. These challenges have prompted the need for reforms and strategic adaptations.

The Fund has undertaken measures to streamline its processes, enhance its financial management, and improve overall efficiency. Moreover, there have been ongoing discussions and proposals for legislative changes to ensure the RAF’s sustainability and better serve the needs of accident victims.

The RAF’s evolution reflects South Africa’s ongoing commitment to addressing the impacts of road accidents.

While challenges persist, the Fund’s adaptation over time demonstrates its critical role in the social fabric of the country, continually striving to balance the needs of victims with sustainable operational practices.

RAF Funding Model: SA RAF Fuel Levies

Funding Mechanisms

The Road Accident Fund (RAF) in South Africa is primarily funded through a specific levy imposed on the fuel sold within the country. This RAF levy is included in the price of both petrol and diesel, making it a direct charge to the consumer.

This funding model aligns with the Fund’s broad-based benefit scheme, ensuring that all road users contribute to the system which in turn provides cover for all road users.

The fuel levy is periodically adjusted, often in line with national budget announcements, and reflects the government’s approach to balance the RAF’s financial needs with the economic impact on consumers.

Impact of the Fuel Levy

The dependence on fuel levies for funding has several implications.

Firstly, it makes the RAF’s revenue stream highly sensitive to fluctuations in fuel prices and consumption patterns. Economic factors such as inflation, global oil prices, and changes in consumer behavior (like reduced fuel usage due to economic downturns or shifts towards more fuel-efficient vehicles) can significantly impact the Fund’s financial position.

Financial Challenges

Historically, the RAF has faced substantial financial challenges, primarily due to the increasing number and value of claims. These challenges include:

- Funding Shortfalls: The growth rate of claim payouts has often outpaced the revenue generated through fuel levies, leading to funding shortfalls.

- Claims Backlog: A high volume of claims and limited financial resources have contributed to a significant backlog in claim processing, affecting the RAF’s operational efficiency and service delivery.

- Financial Sustainability: Balancing the need to provide adequate compensation to accident victims with maintaining financial sustainability has been a persistent challenge, leading to debates over the adequacy of the fuel levy and the need for additional funding mechanisms.

- Legal and Administrative Costs: The RAF has also grappled with high legal and administrative costs, partly due to the litigation-heavy process of claim settlements.

Impact on Operations

These financial challenges have had a profound impact on the RAF’s operations:

- Delayed Claim Settlements: Financial constraints have often led to delays in settling claims, impacting the lives of accident victims awaiting compensation.

- Operational Efficiency: Budgetary pressures have necessitated operational changes, including efforts to streamline claim processing and reduce administrative expenses.

- Policy and Legislative Reforms: The financial struggles of the RAF have prompted discussions on policy and legislative reforms aimed at ensuring the long-term sustainability of the Fund. These discussions often focus on finding a balance between providing adequate compensation to accident victims and maintaining a financially viable system.

While the RAF’s funding through fuel levies ensures a broad-based and consistent revenue stream, the Fund has historically faced significant financial challenges.

These challenges have influenced both the strategic direction and the day-to-day operations of the RAF, highlighting the ongoing need for innovative solutions to ensure its sustainability and effectiveness in serving the needs of road accident victims in South Africa.

Road Accident Statistics

Overview of Annual Payouts

The Road Accident Fund (RAF) in South Africa has a critical role in providing compensation to victims of road accidents.

Understanding the total annual payouts made by the RAF is key to assessing its financial health and operational effectiveness. While I do not have access to the most current data, I can provide an illustrative overview based on historical trends.

Trends in Annual Payouts

- Recent Years: In the last few years, the RAF has seen a significant amount in annual payouts. The total annual compensation has generally been on an upward trend, reflecting an increase in both the number of claims and the average payout per claim. This is partly due to rising medical costs and increased legal fees associated with claim settlements.

- Year-on-Year Changes: The year-on-year changes in total payouts can be attributed to several factors, including the aforementioned rise in the cost of claims, legislative changes impacting compensation formulas, and the efficiency of the RAF in processing claims. Economic factors like inflation also play a role.

Key Observations

- Increasing Financial Burden: The increasing total annual payouts indicate a growing financial burden on the RAF, which, coupled with the funding challenges, presents a significant operational hurdle.

- Impact of Policy Changes: Various policy and legislative reforms, when implemented, have often had a direct impact on the RAF’s financial commitments. Changes in how claims are calculated or caps on certain types of compensation can lead to fluctuations in annual payouts.

- Correlation with Road Safety Trends: Interestingly, the annual payout figures can indirectly reflect the state of road safety in South Africa. An increase in payouts might suggest either a rise in the number of accidents or more severe accidents leading to higher claims.

- Economic and Social Implications: The rising trend in annual payouts not only impacts the RAF’s financial sustainability but also has broader economic and social implications. It underscores the ongoing challenge of road safety and the importance of effective compensation systems for accident victims.

While exact figures for recent years would require access to RAF’s latest financial reports or statistical releases, the trend of increasing annual payouts over time reflects the ongoing challenges faced by the RAF.

This increasing financial burden underlines the need for continuous assessment and adaptation of both the funding mechanisms and operational strategies of the RAF to ensure its viability and effectiveness in serving the victims of road accidents in South Africa.

Claims Process

Claims process: From accident to payment

The RAF claim process begins immediately after an accident. Victims should compile a thorough record, including personal details of everyone involved, descriptions of the accident, and insurance information.

Gathering detailed medical documentation and expense receipts is critical. This is followed by filing a claim with the RAF, where the Fund reviews the documentation and may conduct additional investigations.

Upon assessment and determination of compensation, the RAF processes the payout. It’s important for claimants to retain detailed notes throughout the recovery and claims process.

For a detailed checklist and more information, it’s recommended to review resources provided by experts like those at RAF Cash.

Claim Categories

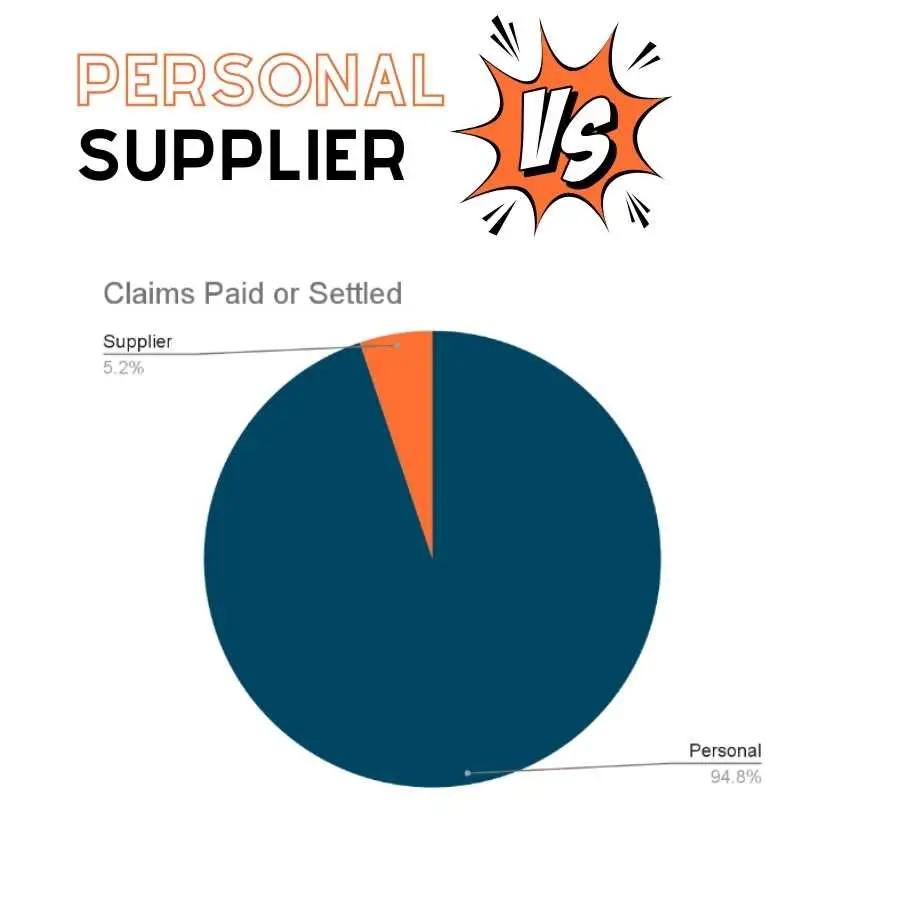

Personal claims vs Supplier claims

In the RAF framework, personal claims are made by individuals who have sustained injuries or by those claiming on behalf of a deceased or injured party. These claims cover losses incurred directly by the claimant.

On the other hand, supplier claims are lodged by service providers, such as healthcare institutions, who have extended medical services or accommodations to the accident victim.

These claims are made for reimbursement of costs incurred during the treatment of the victim. Both claim types follow specific procedural guidelines as outlined by the RAF.

A personal claim is a claim submitted by any person, “the third party”, for any loss or damage which that person has suffered as a result of any bodily injury to him/her, or the death of, or any bodily injury to any other person.

A supplier claim is a claim submitted directly to the RAF by a person/institution that provided medical treatment and accommodation to the victim of an accident.

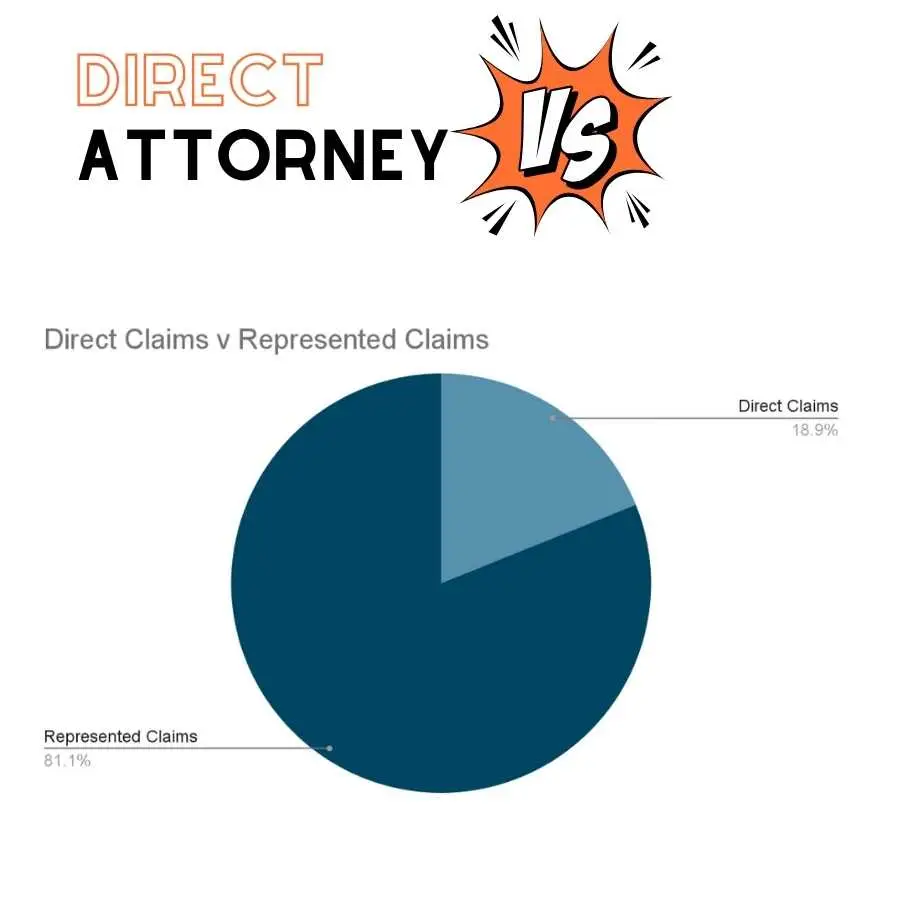

Direct Claims vs Represented Claims

Direct claims with the RAF involve claimants managing their own case without legal representation. It’s a more direct, personal approach and can save on legal fees.

Represented claims, however, are handled by legal professionals, which can offer the advantage of expert guidance through complex procedures and negotiations, potentially increasing the chances of a successful outcome.

Each option carries implications regarding cost, time, and effort for the claimant.

A direct claim is one which is lodged and claimed directly with the Road Accident Fund without the use of an intermediary legal representative.

A represented claim involves legal assistance and representation. While there are a number of advantages to having legal representation, this is not a requirement and a certain percentage of claimants do elect to proceed without third-party assistance.

Claims Registered and Finalized

Claims are categorized, tracked and managed based on their status in the Road Accident Fund process. This categorization aids in tracking the progress and efficiency of the claims handling process.

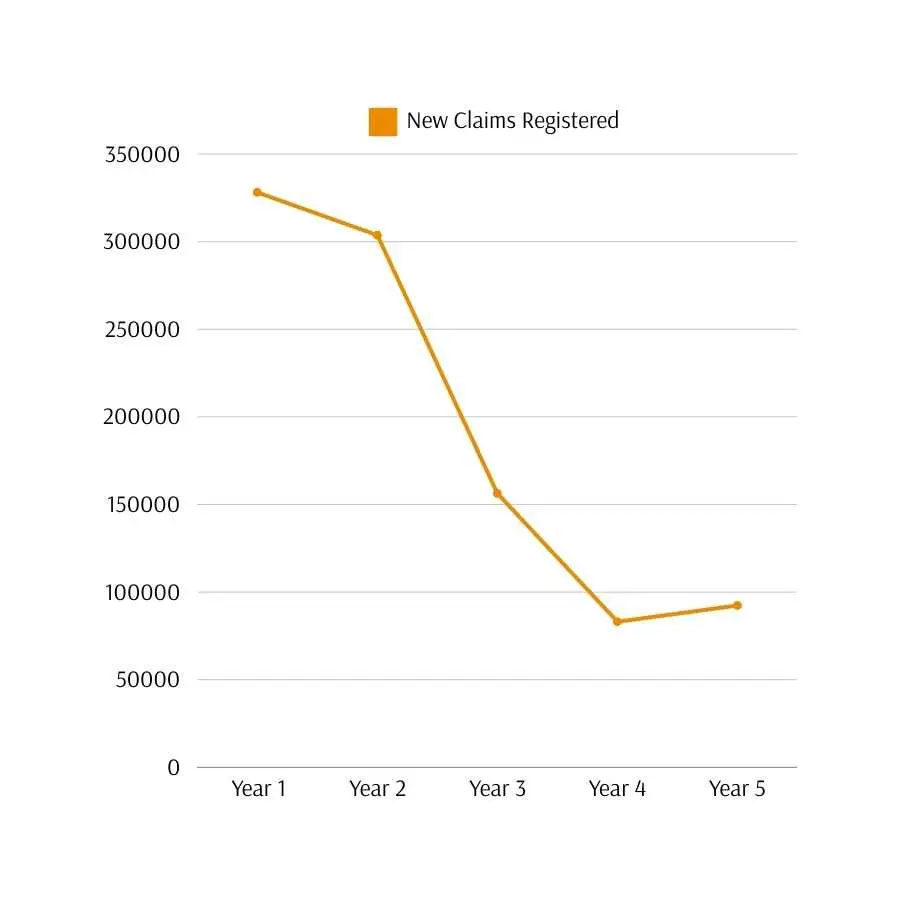

Registered

In the RAF claims process, ‘Registered’ status indicates newly submitted claims within a fiscal year, which the RAF acknowledges and enters into its system.

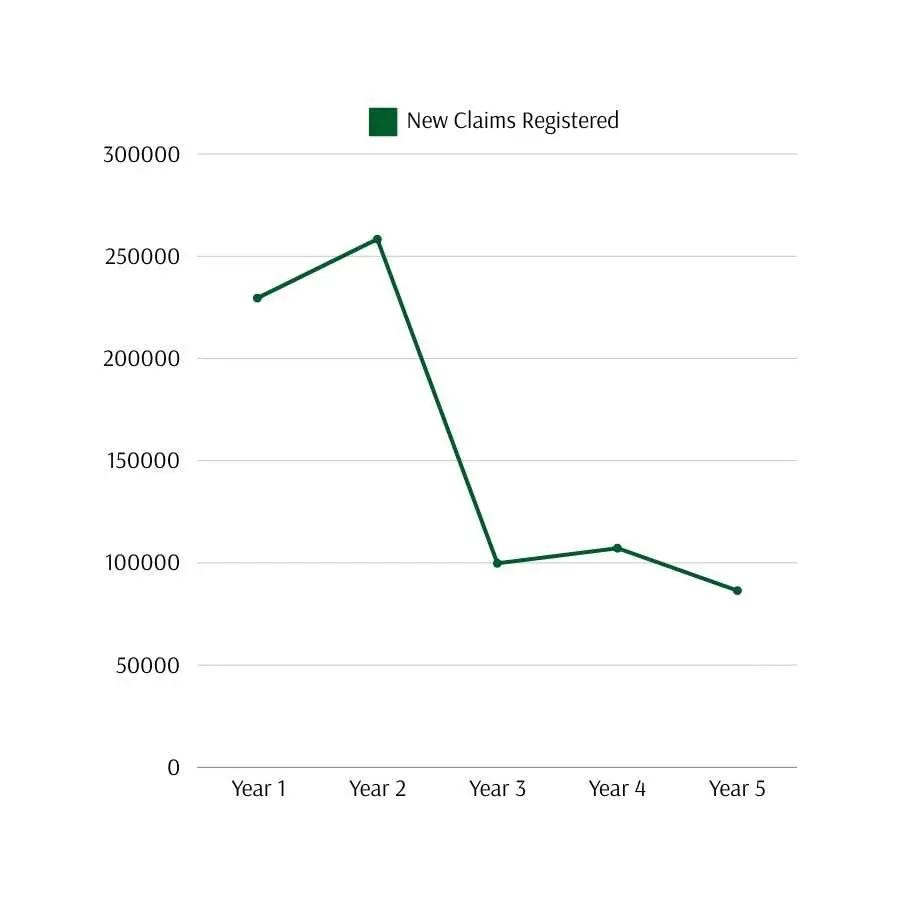

There appears to be a dramatic decline in claims registrations. For example, most recent claim statistics show approximately between 80 000 to 90 0000 claims registered per annum, compared to over 300 000 five years ago.

Finalized

Claims ‘Finalized’ reflects claims, both personal and supplier, that have been fully processed and settled.

Approximately 85 000 claims are processed and settled during each year. This has reduced significantly over the past few years having dropped from over 250 000 claims in 2020.

Claims Outstanding and Backlog

Claims outstanding’ refer to those pending payment or awaiting legal costs resolution, highlighting cases where the RAF’s role is complete but external factors delay closure.

Despite a persistent backlog, there is an observed improvement in the processing rate of claims.

A review of older open claims revealed widespread missing documentation, impeding further progress on these cases.

Claim Statistics

Claims Analysis

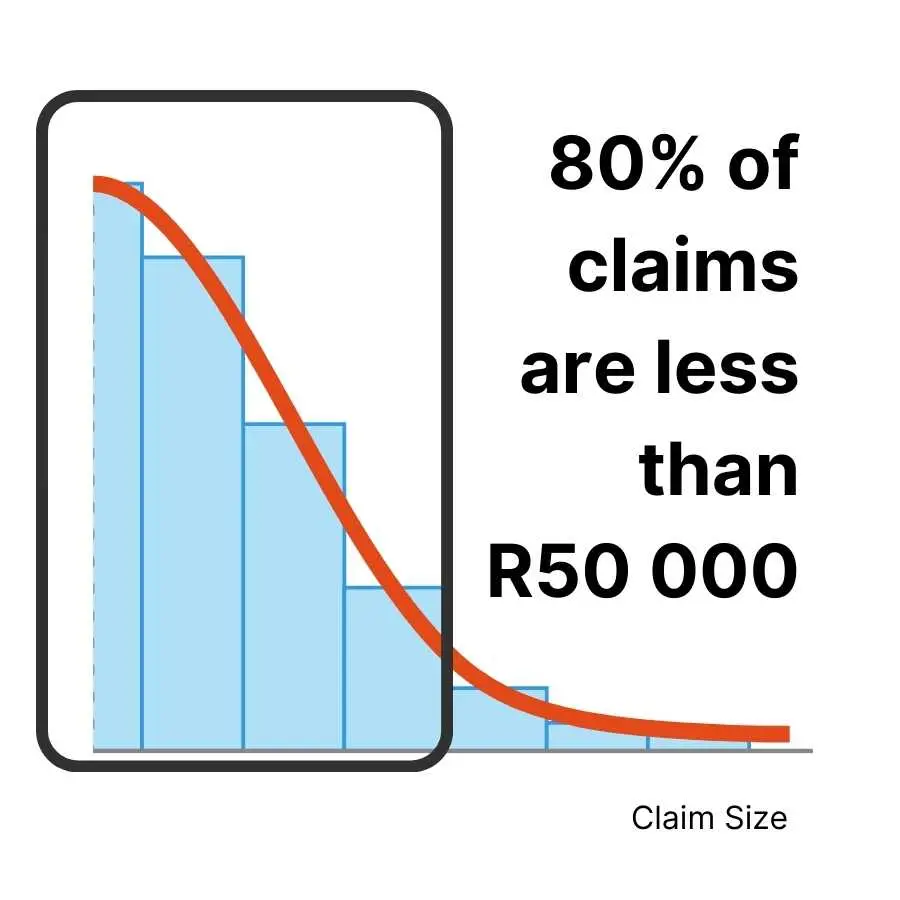

Of the total claims finalized in the financial year, a large number of claim payments were at values less than R10 000. This is because of the accelerated approach to supplier claims, which allowed for hospitals and other service providers to be paid directly by the RAF.

Thus, the RAF managed to reduce outstanding supplier claims more effectively than those of personal claims.

During the financial year, the RAF continued to receive and settle high volumes of small claims, with an average of 80% being for settlement values below R50,000 respectively.

High Value Claims

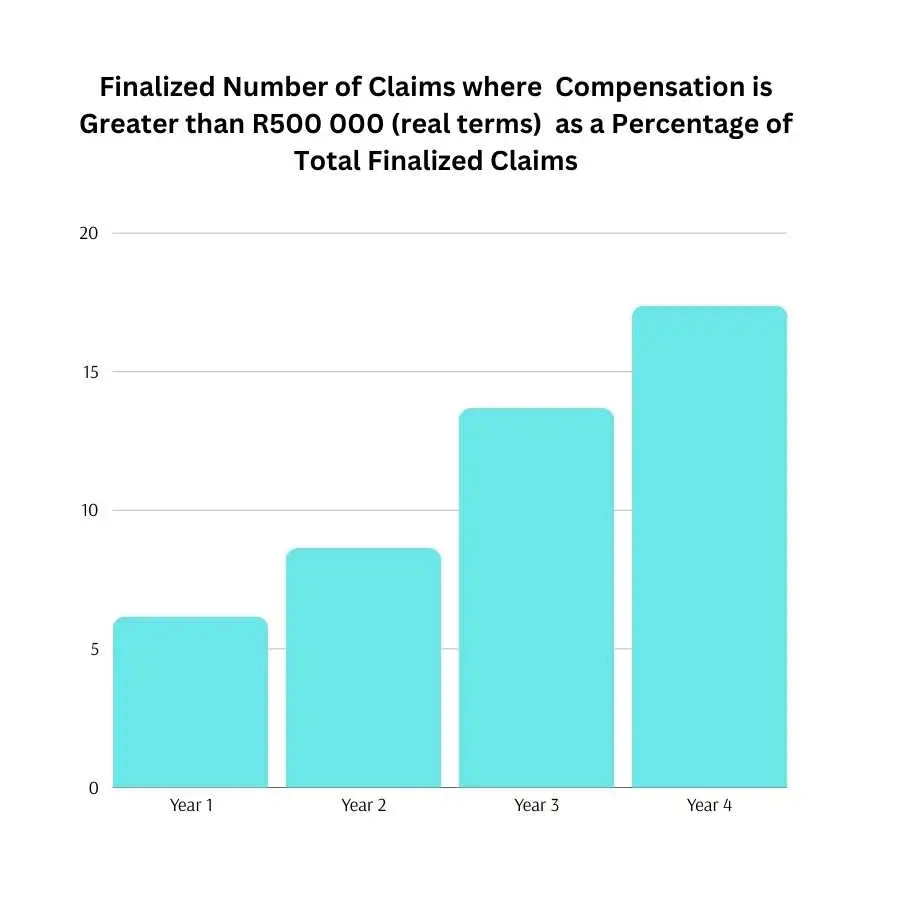

Although the number of high-value claims (claims where compensation paid is greater than R500 000), increased during the year, these claims still represent a relatively small proportion of total claims finalized.

Composition of Claims Payments

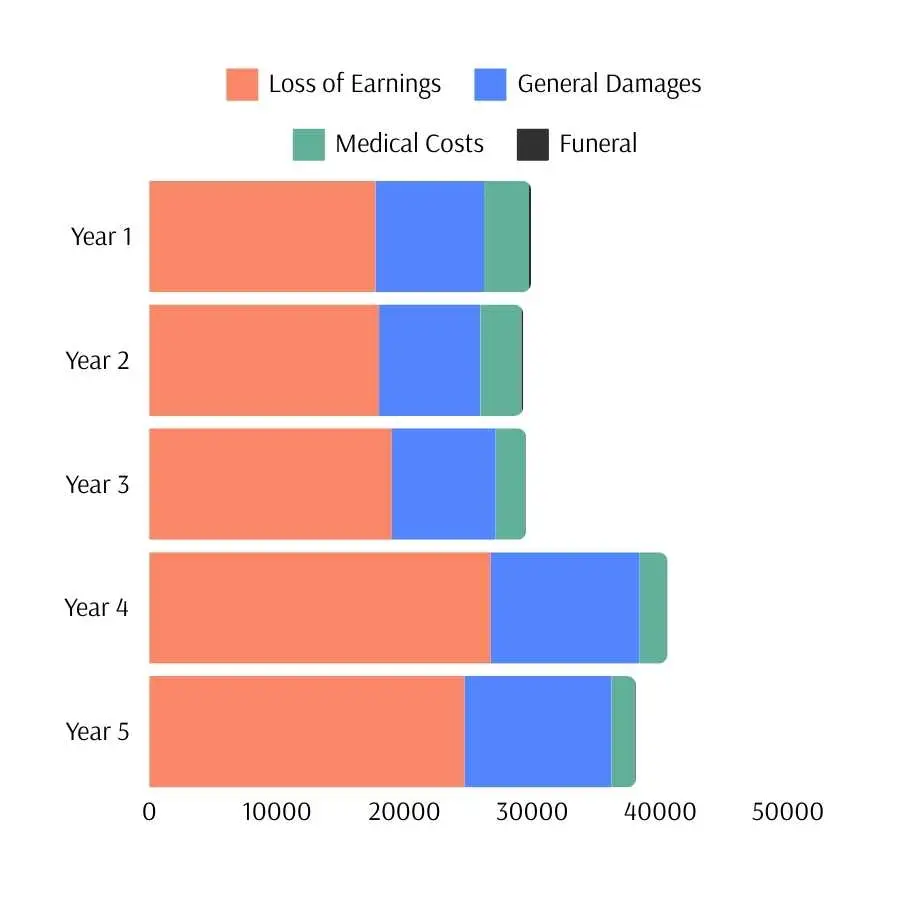

The composition of claims payments illustrates the effectiveness of the strategy through the focus on claims administration and abandoning the litigious operating model.

RAF legal and other costs in 2019 and 2020 were averaging at around R9.5 billion, meaning that 25% of total claims payments went to legal and other costs and only 75% was paid to claimants.

Since the inception of the current Strategy, the RAF has paid an average of less than 16.5% on legal and other costs compared to the 25% in 2019.

There has been an increase in the amount paid out to claimants from an average of R29.9 billion in 2019 to over R40 billion in more recent years.

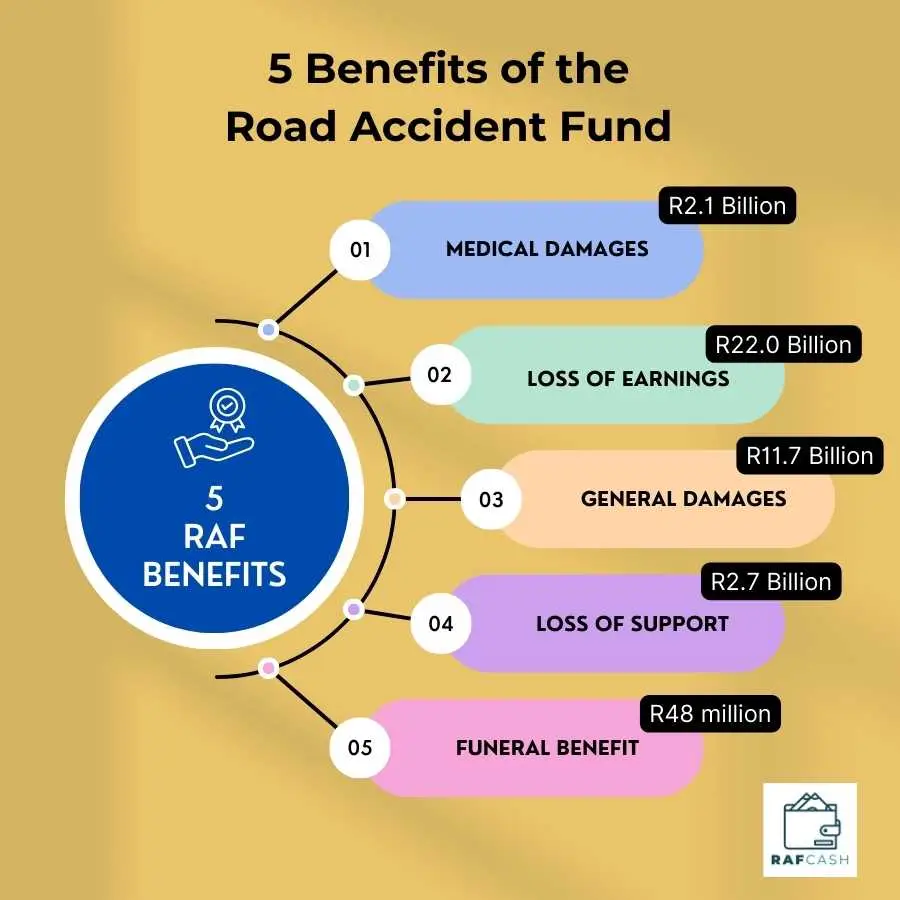

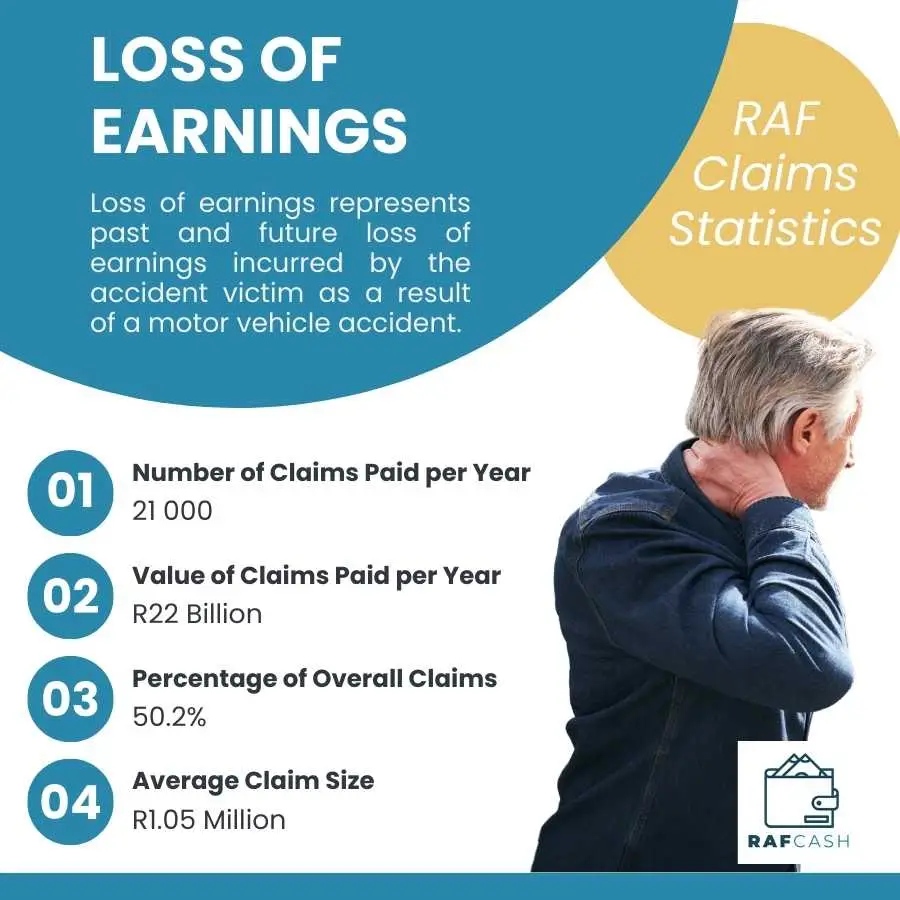

Loss of earnings

Loss of earnings represents past and future loss of earnings incurred by the accident victim as a result of a motor vehicle accident.

Loss of earnings claim statistics

Number: 21 000

Value: R22 Billion

Percentage of overall RAF claims: 50.2%

Average: R1.05 million

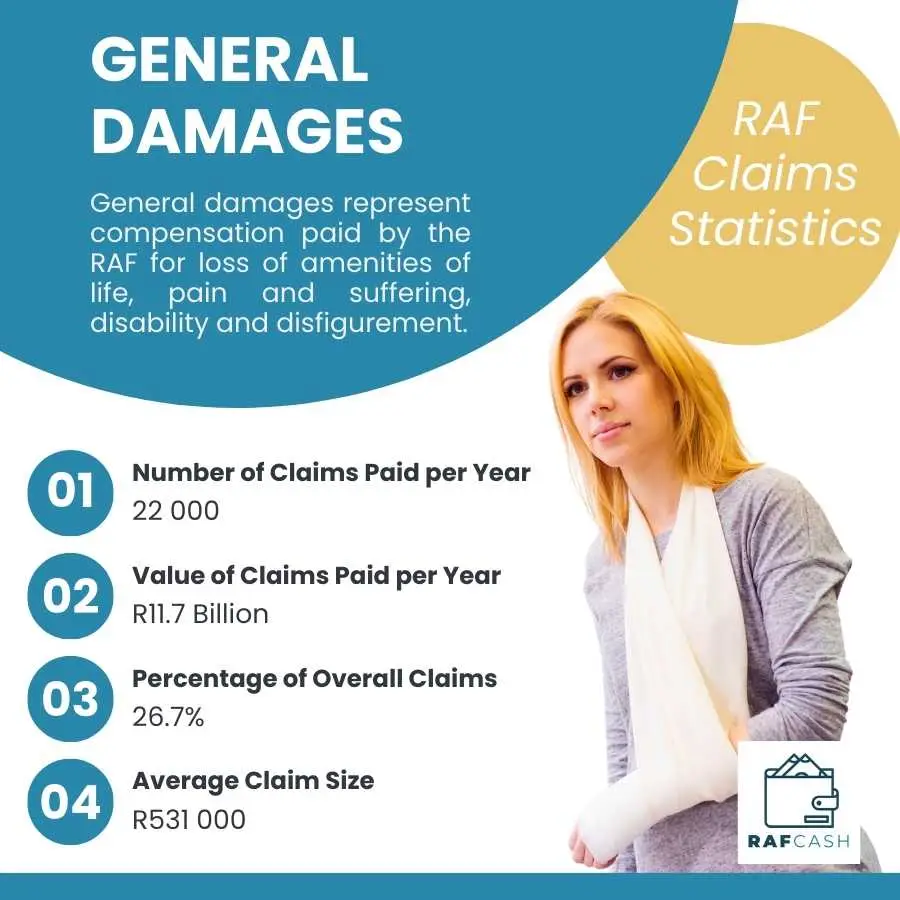

General Damages

General damages represent compensation paid by the RAF for loss of amenities of life, pain and suffering, disability and disfigurement.

General damages claim statistics

Number: 22 000

Value: R11.7 Billion

Percentage of overall RAF claims: 26.7%

Average: R531 000

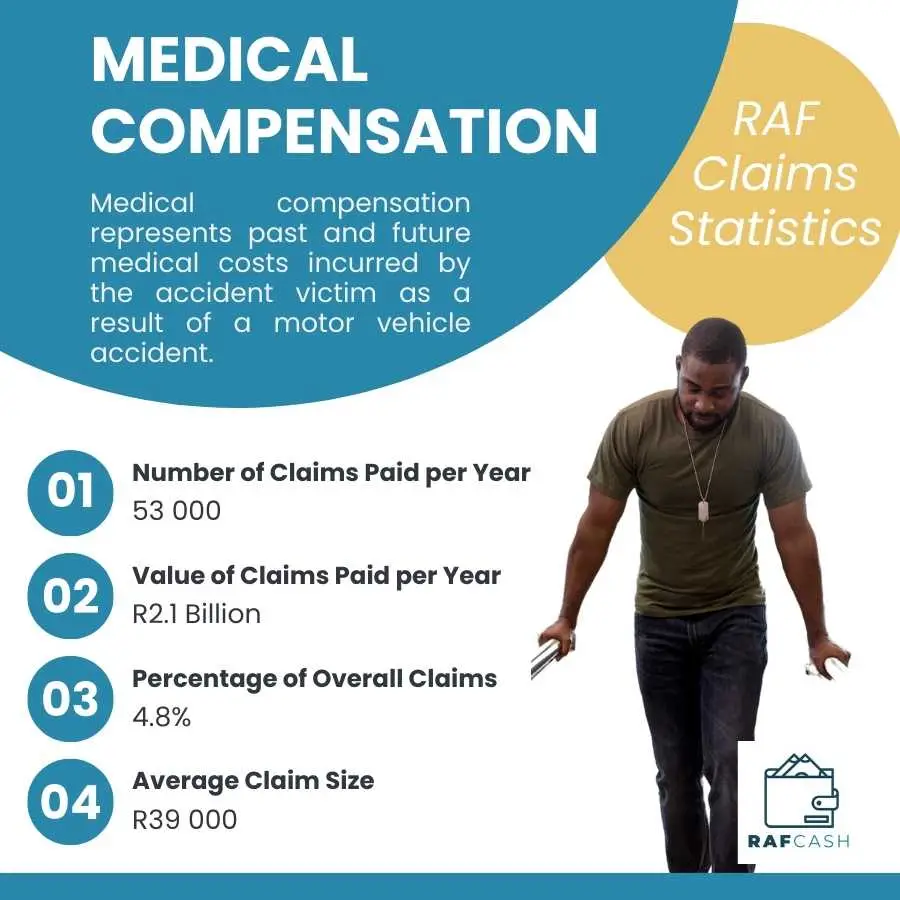

Medical Compensation

Medical compensation represents past and future medical costs incurred by the accident victim as a result of a motor vehicle accident.

Medical compensation claim statistics

Number: 53 000

Value: R2.1 Billion

Percentage of overall RAF claims: 4.8%

Average: R39 000

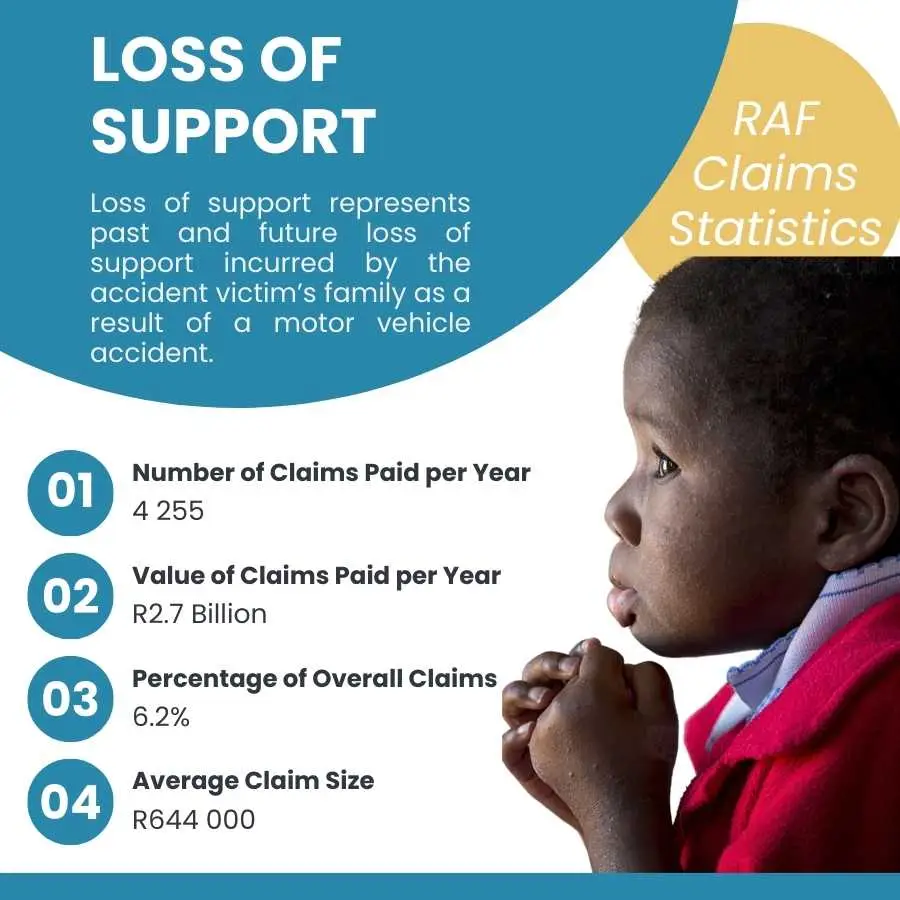

Loss of Support

Loss of support represents past and future loss of support incurred by the accident victim’s family as a result of a motor vehicle accident.

Loss of support claim statistics

Number: 4 255

Value: R2.7 Billion

Percentage of overall RAF claims: 6.2%

Average: R644 000

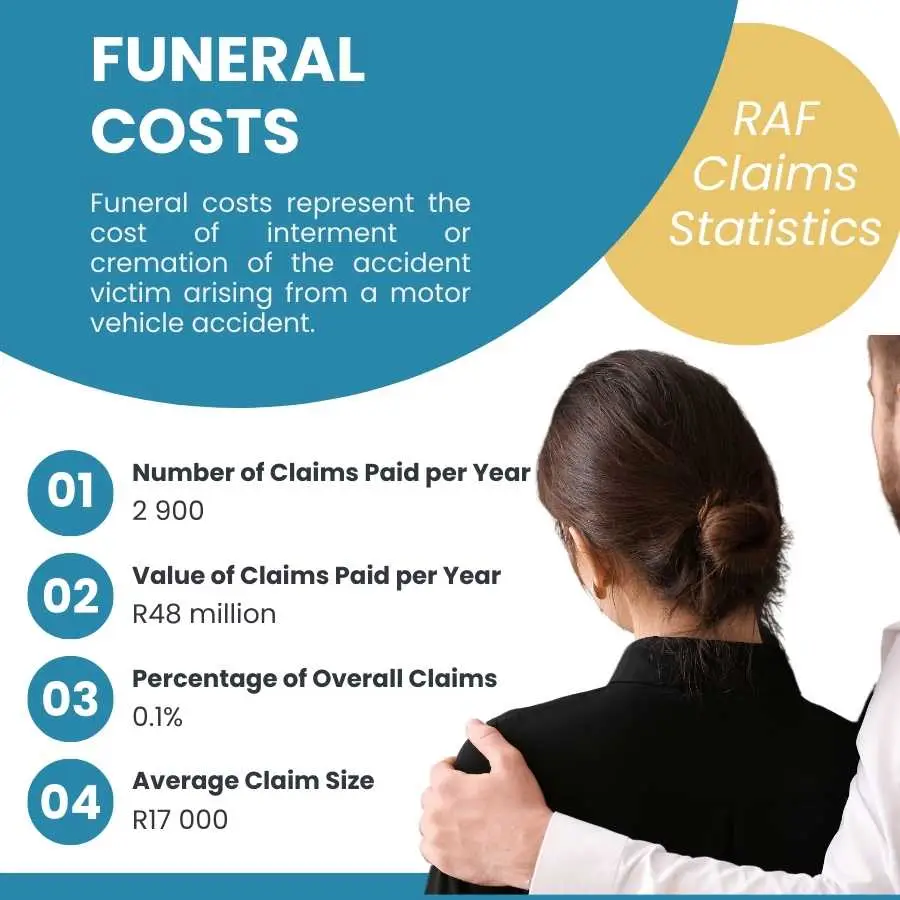

Funeral

Funeral costs represent the cost of interment or cremation of the accident victim arising from a motor vehicle accident.

Funeral claim statistics

Number: 2 900

Value: R48 million

Percentage of overall RAF claims: 0.1%

Average: R17 000

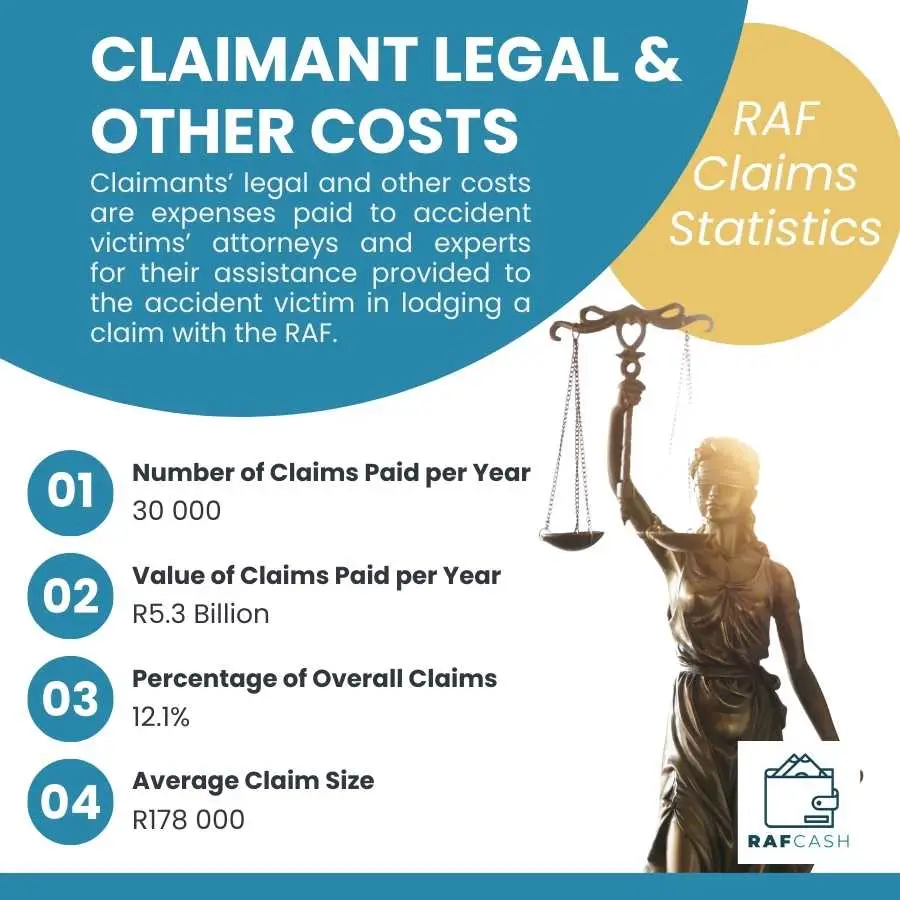

Claimant Legal and Other Costs (Cost Orders)

Claimants’ legal and other costs are expenses paid to accident victims’ attorneys and experts for their assistance provided to the accident victim in lodging a claim with the RAF.

Legal cost claim statistics

Number: 30 000

Value:R5.3 Billion

Percentage of overall RAF claims: 12.1%

Average: R178 000

Undertakings

The Road Accident Fund (RAF) operates under the guidelines of the RAF Act 1996, specifically referencing Section 17 (4) (a).

This section allows the RAF, or an agent, to issue undertakings to cover future medical costs associated with hospital stays, nursing care, treatments, services, or goods after these costs are incurred and proven by the claimant.

This includes certificates for future medical treatments and monthly compensations for caregiving services. An undertaking remains active if there’s a claim made against it within the year. Over three fiscal years, active claims on these undertakings average 5.7%, a figure consistent with the nature of most road accident injuries, which are non-chronic.

The total financial commitment for active undertakings in the previous year was R673 million, demonstrating the RAF’s commitment to supporting road crash victims through their recovery process.

Year | 2019 | 2020 | 2021 | 2022 | 2023 |

Total Number of Undertaking Certificates issued | 199 313 | 206 463 | 213 012 | 220 554 | 232 806 |

Number of Active Undertakings | 9 013 | 10 729 | 11 395 | 12 272 | 13 192 |

Amount Paid | R829 million | R935 million | R734 million | R643 million | R673 million |

Processing and Efficiency in RAF Claims Handling

The Road Accident Fund (RAF) processes claims through a defined approach that begins with the submission of a claim and includes verification, assessment, and the determination of liability and compensation.

The process is designed to ensure accuracy and fairness, although it can be complex given the nature of the claims.

The average time taken to settle claims can vary significantly, depending on the complexity of the case and the efficiency of the documentation provided by claimants.

Historically, claim settlement periods have been a point of criticism due to delays which can stretch for several years in many cases.

Efficiencies in the RAF’s process include the use of digital tools and platforms to manage claims more effectively. However, inefficiencies often arise from the heavy reliance on paper-based systems, bureaucratic delays, and the legal complexities associated with personal injury claims.

These inefficiencies can lead to prolonged waiting times for claimants and increased operational costs for the RAF.

Impact of Legislation and Policy Changes:

Recent legislative and policy changes have significantly impacted the operations and claim statistics of the Road Accident Fund (RAF). These changes have aimed to streamline the claims process, reduce fraud, and manage the financial sustainability of the Fund.

For instance, amendments to the RAF Act have introduced more defined parameters for claim eligibility and compensation limits, which have helped in reducing fraudulent claims and managing payouts more effectively.

Looking forward, there are anticipated legislative changes that could further affect the RAF. These include proposals to adjust the compensation structure to balance the fund’s liabilities with its income, primarily through fuel levies.

Such changes are expected to ensure that the RAF can continue to operate effectively without the risk of insolvency, addressing the ongoing challenge of balancing claimant needs with financial sustainability.

Largest claim in history

The largest RAF claim on record occurred when Joachim Werner Schoss, a Swiss national, claimed R1.6 billion following a severe accident in 2002 near Stellenbosch.

The final settlement reached in the case was considerably lower than the initial claim, but still significant at approximately R500 million, underscoring the substantial liabilities the RAF faces with high-impact claims.

This accident resulted in Schoss losing an arm and a leg, along with other significant injuries. The claim highlights critical discussions around the sustainability of the RAF given its financial challenges.

The claim’s magnitude, calculated based on Schoss’s high pre-accident income and costs in a foreign currency (Euros), underscores the existing policy where compensation is unlimited except for certain passenger claims.

This policy has put a strain on the RAF’s finances, emphasizing the need for reforms. This case, among others, led the government to address these challenges by capping loss of earnings claims, which has relieved some financial pressure on the fund. It has also made the system more sustainable in the long-term.

Schoss’s case also draws attention to broader issues such as South Africa’s road safety and the need for systemic improvements to prevent such accidents.

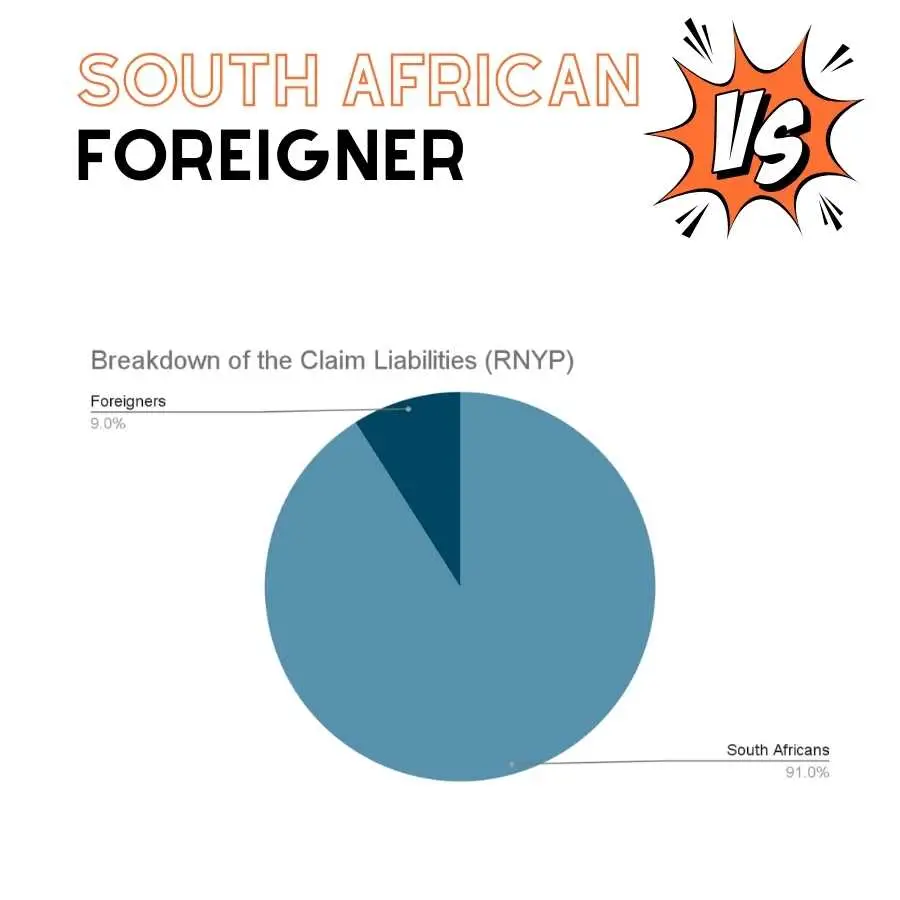

Foreign Claims

Foreign visitors’ claims have historically represented a significant portion of high-value claims within the Road Accident Fund (RAF) due to their ability to claim in their currency of origin and expectations of unlimited loss-of-earnings benefits, as is common in many of their home countries.

However, with the implementation of the RAF Amendment Act, these claims have been substantially mitigated.

As of August 2008, loss-of-earnings and loss-of-support payments to foreign nationals are now capped at R160,000 annually, adjusted quarterly for inflation reaching almost R350 000 today.

During the previous financial year, the RAF made 3 465 foreign claim payments totaling R1.62 billion.

The net RNYP balance for foreign-related claims also saw an increase, indicating a growing financial commitment by the RAF towards these claims.

Despite the cap, 9% of the RAF’s estimated liability for claims over R5 million still comprised foreign nationals’ claims, underscoring their significant impact on the fund’s financial health.

RAF Amendment Bill 2023

The Road Accident Fund Amendment Bill, 2023, in South Africa introduces significant revisions to the existing framework, fundamentally altering the compensation and support structure for road accident victims. The proposed changes are poised to reshape the provision of benefits and the overall objective of the fund.

Key elements of the amendment include a shift from comprehensive compensation provided by the fund to a more restricted provision of “social benefits.” Notably, the bill restricts eligibility to only those accidents occurring on public roads, excluding incidents in areas like parking lots or private roads. Additionally, it eliminates compensation for pain and suffering, loss of amenities, disability, disfigurement, or shock, even in cases of catastrophic injuries. Future loss of earnings and support will not be provided as lump sums but rather as annuities, which may be reassessed and discontinued by the fund over time (LSSA).

The amendments have sparked significant concern among legal professionals and advocacy groups, who argue that these changes disproportionately affect the financially disadvantaged and marginalised populations. Critics highlight that the proposed framework would leave many without adequate recourse for injuries sustained, forcing them into the public health system with limited support. This could exacerbate existing inequalities and reduce the fund’s role in mitigating the impacts of road accidents on vulnerable populations (SABC News).

Overall, the Road Accident Fund Amendment Bill, 2023, represents a critical pivot in how South Africa manages and supports road accident victims. If enacted, it could lead to a reduction in benefits and a narrowing of coverage, which would have profound implications for future claims and the accessibility of adequate compensation for road accident victims across the country.

Comparative Analysis

Motor Vehicle Accident (MVA) Fund of Namibia

In the landscape of African road safety, the Road Accident Fund (RAF) of South Africa and the Motor Vehicle Accident (MVA) Fund of Namibia stand out as pivotal institutions. Both established to address the aftermath of road accidents, they offer a cushion against the financial shock to victims and their families. Yet, they differ in operational frameworks and service delivery, reflecting their distinct national contexts.

South Africa’s RAF, funded through fuel levies, is a safety net for citizens against the devastating financial impact of road mishaps. With a compensation system that’s been subject to legal disputes, the RAF has struggled with backlogs and financial constraints. Its compensation is variable, determined by individual circumstances and court judgments.

In contrast, Namibia’s MVA Fund offers a structured package of benefits, with caps on medical benefits, injury grants, and funeral grants. This streamlined approach aligns with the country’s development plans, emphasizing efficiency and customer-centric services. Funded similarly by a fuel levy, the MVA Fund underlines transparency and quick service, boasting an expansive geographical footprint with service centers strategically placed to minimize travel for claimants.

Both funds strive for service excellence, but their strategies diverge. The MVA Fund’s clear-cut limits on claims aim for predictability and swift processing, whereas the RAF’s broader, more individualized approach reflects South Africa’s complex socio-economic tapestry. As they evolve, both funds must navigate economic pressures, legislative changes, and the shifting dynamics of road usage to fulfill their mandates effectively.

Motor Vehicle Accident (MVA) Fund of Botswana

Comparing the Motor Vehicle Accident Fund (MVA Fund) in Botswana and the Road Accident Fund (RAF) in South Africa reveals both similarities and differences in their operations, mandates, and compensation systems.

MVA Fund, Botswana

- Hybrid Compensation System: Initially a fault-based system, it transitioned to a hybrid model of fault and no-fault with the Motor Vehicle Accident Fund Act No. 15 of 2007. This change significantly expanded its compensation system.

- Expanded Mandate: Besides compensation, the MVA Fund also promotes road safety, injury prevention, and rehabilitation and support for traffic accident victims.

- Medical Treatment and Rehabilitation: Provides comprehensive coverage, including for medical appointments, patient contributions for those on medical aid, and transport, accommodation, and meals for medical appointments under certain conditions.

- Loss of Income and Funeral Expenses: Covers loss of income for severely injured claimants who can’t return to employment and provides up to P7,500 for funeral costs.

- Loss of Support: Assists dependents of a deceased breadwinner with annual disbursements, subject to home visits and verification.

- Coverage Limitations: Citizens and residents of Botswana are fully covered up to P1,000,000.00. Negligent parties are limited to P300,000.00, covering only medical treatment and rehabilitation.

- Exclusions: Excludes compensation for psychological trauma from witnessing an accident, loss of business profits, and fraudulent claims.

- Visitor Coverage: Non-citizens are covered for treatment and rehabilitation costs while in Botswana, but it’s not a substitute for travel insurance.

RAF, South Africa

- Fault Compensation System: The RAF provides compulsory cover to all users of South African roads, residents and foreigners, against injuries sustained or death arising from accidents involving motor vehicles within the borders of South Africa.

- Coverage: Includes reimbursement for medical expenses, loss of earnings or income support, funeral expenses, and general damages for pain and suffering.

- Claims Process: Similar to the MVA Fund, claimants need to submit relevant documentation for claims processing, including police reports, medical records, and proof of expenses incurred.

- Limitations and Exclusions: The RAF also has limitations and does not cover damage to vehicles or other property. Claims may be reduced based on the claimant’s negligence, such as not wearing a seatbelt.

- Funding: Primarily funded through a levy on fuel, making it a user-pay system. The RAF has faced financial challenges and backlog in claim processing.

Comparative Analysis

- Both funds have evolved to more inclusive compensation systems, though with different structures (hybrid for MVA Fund and no-fault for RAF).

- MVA Fund’s approach to incorporating road safety and injury prevention is more explicit in its mandate than the RAF.

- Coverage limitations and exclusions are present in both, but MVA Fund has specific caps for negligent parties and a clear stance on visitor coverage.

- The RAF’s challenges with financial stability and claim backlogs are well-documented, whereas the MVA Fund’s operational details in these aspects aren’t as prominently discussed.

- Both systems emphasize support beyond mere compensation, considering aspects like rehabilitation and ongoing support for severe injuries or loss of breadwinners.

While both the MVA Fund and the RAF aim to provide comprehensive support to road accident victims, their operational frameworks, scope of coverage, and administrative structures present notable contrasts alongside their shared goals of offering essential aid to those affected by road accidents.

Personal Stories: The Human Impact of the Road Accident Fund

The Road Accident Fund (RAF) not only provides financial compensation but also acts as a crucial support system for individuals and families affected by road accidents across South Africa. Here are a few more personal stories that highlight the diverse ways in which the RAF has positively impacted lives:

Thabo’s Recovery Journey

Thabo, a young professional from Johannesburg, suffered multiple fractures and a spinal injury in a car crash in 2019. Through the RAF, he received compensation that covered his extensive medical treatments, including surgeries and physical therapy, which were crucial in his long recovery process. The RAF’s support helped him return to a modified work environment, significantly aiding his reintegration into professional life.

The Van der Merwe Family’s Adaptation

The Van der Merwe family faced a tragic loss when the family patriarch was killed in a motorbike accident. The RAF provided loss of support payments, which stabilized the family’s financial situation, allowing the children to continue their education and the family to adjust to their new economic reality without immediate financial distress.

Lindiwe’s Path to Independence

Lindiwe was a pedestrian struck by an over-speeding vehicle while walking home from school in Cape Town. The RAF funded her critical surgeries and provided a grant for her rehabilitation, including occupational therapy. With ongoing support, Lindiwe regained much of her mobility and continued her education, aspiring to advocate for road safety to prevent similar incidents.

Sipho’s Second Chance

Sipho, a taxi driver involved in a head-on collision, sustained severe injuries that left him unable to work for over a year. The RAF’s compensation for loss of earnings was instrumental in keeping his family afloat during his recovery. Additionally, the RAF’s support for his long-term rehabilitation meant that Sipho could eventually return to driving, his primary livelihood.

Anita’s Advocacy for Road Safety

After surviving a severe car accident that resulted in the loss of her younger brother, Anita received compensation from the RAF that helped cover both their medical expenses and her brother’s funeral costs. Motivated by her traumatic experience, Anita has since become an advocate for road safety, using her story to educate others about the importance of vigilant driving and the support systems available through the RAF.

These stories showcase the critical role the RAF plays not just in financial compensation, but in helping individuals and families navigate the aftermath of road accidents, fostering resilience and recovery in the face of adversity.

Conclusion: Shaping the Future of Road Safety and Economic Stability

As we look forward, the RAF stands at a pivotal juncture where potential reforms and advancements in technology could greatly enhance its effectiveness and efficiency.

There is growing anticipation for the integration of more sophisticated data management systems, which could streamline claim processing and improve transparency. Additionally, legislative changes aimed at refining the compensation structure may better align the RAF’s resources with its liabilities, ensuring its sustainability.

Furthermore, the ongoing advancements in road safety technology, such as the adoption of smart vehicle features and better traffic management systems, promise to reduce the frequency and severity of accidents, potentially decreasing the volume of claims and financial strain on the RAF.

As members of a shared community, each of us has a role to play in enhancing road safety. Whether you are a driver, a pedestrian, or a policy advocate, your actions contribute to the safety of our roads.

Stay informed about the latest RAF reforms and participate in road safety initiatives. Support policies that enhance road safety education, enforce stricter penalties for traffic violations, and encourage technological advancements in traffic management.

By staying engaged and informed, you can help shape a safer and more economically stable road environment for all South Africans. Follow updates on RAF reforms and engage with them through public forums and feedback opportunities to ensure the RAF continues to meet the needs of its beneficiaries efficiently and effectively.

Together, we can contribute to a legacy of safety and stability that will benefit future generations.

Frequently Asked Questions

How does the Road Accident Fund (RAF) work?

The RAF provides compensation to road accident victims or their families, regardless of who is at fault for the accident, funded primarily through a fuel levy.

What types of claims can be made with the RAF?

Claims can include compensation for medical expenses, loss of earnings, funeral expenses, and general damages for pain and suffering.

Can foreigners make claims with the RAF?

Yes, foreigners involved in road accidents within South Africa can file claims with the RAF, although their compensation may be subject to specific limits.

What is the significance of the fuel levy to the RAF?

The fuel levy is the primary source of funding for the RAF, collected from the sale of petrol and diesel, which supports the fund’s ability to compensate accident victims.

How has the RAF's role evolved over time?

Initially focused on covering basic post-accident expenses, the RAF now also supports broader needs like long-term care and rehabilitation, and participates in road safety initiatives.

What are the most common challenges faced by the RAF?

The RAF frequently encounters financial constraints, claim backlogs, and administrative issues, which can delay the processing and settlement of claims.

How long does it typically take to settle a claim with the RAF?

The time to settle a claim can vary greatly, often depending on the complexity of the claim and the efficiency of the provided documentation.

What reforms have been proposed to improve the RAF?

Reforms typically focus on enhancing financial sustainability, reducing claim backlogs, and streamlining the claim process to improve efficiency and service delivery.

How can claimants ensure a smoother RAF claim process?

Claimants should gather comprehensive accident documentation, maintain clear records of expenses, and submit their claims promptly and accurately.

What impact do policy changes have on RAF claimants?

Policy changes can adjust compensation amounts, alter claim eligibility, and streamline processes, potentially making it easier or harder for claimants to receive compensation depending on the nature of the changes.

Glossary

- Fuel Levy: A charge included in the price of fuel, used to fund the RAF and compensate accident victims.

- Claimant: An individual or entity filing a claim for compensation due to losses or injuries sustained in a road accident.

- General Damages: Compensation for non-monetary losses such as pain, suffering, and reduced quality of life resulting from an accident.

- Loss of Earnings: Compensation for the income that the victim cannot earn due to injuries sustained from the accident.

- Medical Compensation: Reimbursement for medical expenses incurred as a result of injuries from a road accident.

- Loss of Support: Compensation provided to dependents of a deceased accident victim for the financial support they have lost.

- Funeral Costs: Expenses covered for the burial or cremation of a road accident victim.

- Direct Claims: Claims processed directly by the claimant without legal representation.

- Represented Claims: Claims handled by legal professionals on behalf of the claimant.

- Backlog: The accumulation of unresolved claims awaiting processing or settlement by the RAF.

- Operational Efficiency: The effectiveness with which an organization like the RAF manages its resources and processes claims.

- Financial Sustainability: The ability of the RAF to maintain adequate funds to meet all its obligations without running into financial difficulties.

- Legislative Reforms: Changes in laws and regulations aimed at improving the functioning and fairness of the RAF.

- Claim Settlement: The final agreement between the RAF and the claimant regarding the compensation for the claim filed.

- Policy Changes: Adjustments or modifications to the rules and procedures governing how the RAF operates and compensates claimants.