In this article we give a comprehensive overview of the Road Accident Fund, what it covers, what it does not cover, and how to claim.

The RAF ecosystem is large with many role-players and intricate processes.

However, this article will give you a good overview and enough to make heads or tales of this complex thing we call the Road Accident Fund.

A Road Accident Fund Primer

Road Accident Fund 101

The Road Accident Fund (also known simply as the “RAF”) is a South African state insurer that provides liability insurance coverage against injuries sustained or death arising from accidents involving motor vehicles within the borders of SA.

Let’s break that down more simply.

- As a state insurer, the RAF is run and managed by the government to administer insurance claims.

- The coverage is specifically for liability claims. This means damage caused to another person as the result of a motor vehicle accident.

- The sorts of damages covered by the Road Accident Fund relate to loss of life (death) or injury.

- The RAF compensates victims of negligent driving by way of financial compensation (cash payment) and/or rehabilitation services.

The Road Accident Fund is South Africa’s state insurer / social benefit scheme that provides liability insurance coverage against injuries sustained or death arising from accidents involving motor vehicles within the borders of SA.

Historical Context of the Road Accident Fund (RAF)

Did you know that an insurance-based system of compensation, and a predecessor to the Road Accident Fund, was first established in South Africa since its inception in 1946?

This system was first established all those years ago in order to provide compensation for victims of road accidents, ensuring financial support for medical expenses, loss of income, and other damages.

Initially, the RAF’s primary goal was to offer a reliable source of compensation for accident victims without the need for lengthy legal battles.

Over time, the RAF has undergone significant legislative changes, most notably with the Road Accident Fund Act 56 of 1996, which redefined its operations and benefits to better serve the public.

Evolution and Reforms

Since its inception, the RAF has evolved to address emerging challenges and improve service delivery.

Major reforms have included changes in funding mechanisms, the introduction of a fuel levy to ensure sustainable funding, and updates to claim procedures to enhance efficiency and fairness.

Despite these efforts, the RAF continues to face issues such as financial sustainability and processing delays, prompting ongoing reviews and potential future reforms to better meet the needs of South African road accident victims.

Comparative Analysis: Road Accident Compensation Systems

The Road Accident Fund (RAF) in South Africa can be better understood by comparing it to similar institutions in other countries. Here we compare

- South Africa’s Road Accident Fund (RAF)

- United Kingdom’s Motor Insurers’ Bureau (MIB)

- Botswana’s Motor Vehicle Accident Fund (MVA)

- Namibia’s Motor Vehicle Insurance Fund (MVA)

- Netherland’s Dutch Motor Traffic Guarantee Fund.

This table highlights key strengths and areas for improvement:

| Country | Institution | Strengths | Areas for Improvement |

|---|---|---|---|

| South Africa | Road Accident Fund (RAF) | Comprehensive coverage; Funded by a fuel levy | Financial instability; Lengthy claims process |

| United Kingdom | Motor Insurers’ Bureau (MIB) | Funded by insurance companies; Efficient claims process | Limited to uninsured and hit-and-run accidents |

| Botswana | Motor Vehicle Accident (MVA) Fund | Government-funded; Focus on rehabilitation | Limited coverage |

| Namibia | Motor Vehicle Accident (MVA) Fund | Sustainable funding; Victim support focus | Smaller scale and scope |

| Netherlands | Dutch Motor Traffic Guarantee Fund | Comprehensive cover; Efficient claims process | Limited to uninsured and underinsured cases |

The RAF provides extensive coverage compared to its international counterparts, but it can benefit from adopting more efficient claims processing systems and ensuring financial stability.

By learning from these international examples, the RAF can improve its services for South African road accident victims.

What is the Purpose of the Road Accident Fund

To understand the purpose of RAF, it may be easier to first image the country without a national road insurer.

Example

Adam accidentally drives his car into Bob, resulting in Bob either dying or becoming disabled. In this case Bob and his family would have a legal claim against Adam for compensation due to the loss of earnings as well as Bob’s large medical bills.

However, Adam may not actually have enough money to pay, putting Bob and his family at financial risk. Alternatively, the large payment could actually bankrupt Adam causing his financial ruin.

That’s where the Road Accident Fund comes in. The RAF provides two types of cover, namely personal insurance cover to accident victims or their families (Bob), and indemnity cover to wrongdoers (Adam).

This is a very necessary organization in a country with one of the highest road accident rates globally. The RAF helps create a stable situation for drivers, passengers and pedestrians on South African roads.

Who runs the Road Accident Fund?

The RAF was established by the Road Accident Fund Act, 1996. It existed in different shapes and forms before that, but really kicked off in its current state on 1 May 1997.

Oversight for RAF falls under the South African government, specifically:

- The National Assembly, through the relevant Portfolio Committee and the Standing Committee on Public Accounts (“SCOPA”)

- The Executive Authority

- The Minister of Transport

- The Board of the RAF.

The day-to-day operations of the Road Accident Fund falls on the RAF’s CEO, executive team, managers and employees.

Very simplistically, they are responsible for:

- Collecting fund

- Assessing claims

- Paying out valid claims

There is obviously a lot more involved in this process, and the RAF run several offices and service centers spread across all provinces of the country.

Road Accident Fund Contact Details

Need to contact the Road Accident Fund?

Contact center: 087 820 1111

Head Office: 2 Eco Glades Office Park, 420 Witch Hazel Avenue, Centurion

Where does RAF money come from?

As with all insurers, the Road Accident Fund requires money (premiums) to be paid in, in order for it to pay out claims.

But where does this money come from?

The RAF is funded primarily by the RAF Fuel Levy, a component of the National Fuel Levy.

So, for each liter of fuel pumped at the service station a percentage of the cost goes to the Road Accident Fund.

According to the latest published results, the RAF collect approximately R45 billion per annum in fuel levies.

In theory this is a smart and fair way of funding the RAF as the users of the roads pay for their own insurance, without having to rely on state taxes.

There are however drawbacks to the current RAF system which are continually debated in government and the media.

Financial Impact of the Road Accident Fund (RAF)

The Road Accident Fund (RAF) plays a critical role in providing financial support to road accident victims in South Africa.

Here’s a detailed look at its financial implications:

Individual Impact

Medical Expenses: One of the primary benefits of the RAF is covering medical expenses for accident victims. This includes hospital bills, rehabilitation costs, and ongoing medical care, which can be financially overwhelming without support.

Loss of Earnings: The RAF compensates for the loss of income if a victim is unable to work due to their injuries. This is crucial for maintaining the financial stability of affected individuals and their families.

General Damages: Victims can also receive compensation for non-monetary losses such as pain and suffering, which acknowledges the broader impact of their injuries on their quality of life.

Dependents’ Support: In cases where a breadwinner is killed in a road accident, the RAF provides financial support to the dependents, ensuring they are not left destitute.

Economic Impact

Funding Mechanism: The RAF is primarily funded through a levy on fuel sales, which means every motorist contributes to the fund. This RAF fuel levy ensures a continuous inflow of funds to support the RAF’s operations.

Economic Stability: By compensating victims and supporting their recovery, the RAF helps to maintain economic stability. Victims are more likely to return to work and contribute to the economy if their medical and financial needs are addressed.

Job Creation: The RAF’s operations involve numerous professionals, including medical experts, legal advisors, and administrative staff, thereby contributing to job creation in these sectors.

Challenges and Sustainability: Despite its significant role, the RAF faces financial challenges, including large backlogs and delayed payouts. Ensuring the sustainability of the fund is crucial for its continued support of road accident victims.

Public Health and Safety: The existence of the RAF indirectly promotes road safety awareness and encourages responsible driving, as the consequences of road accidents are widely publicized through compensation claims.

The RAF’s financial impact is far-reaching, providing essential support to individuals and contributing to the broader economy.

However, addressing its financial and administrative challenges is crucial for ensuring that it can continue to fulfill its mandate effectively.

What is covered by the RAF

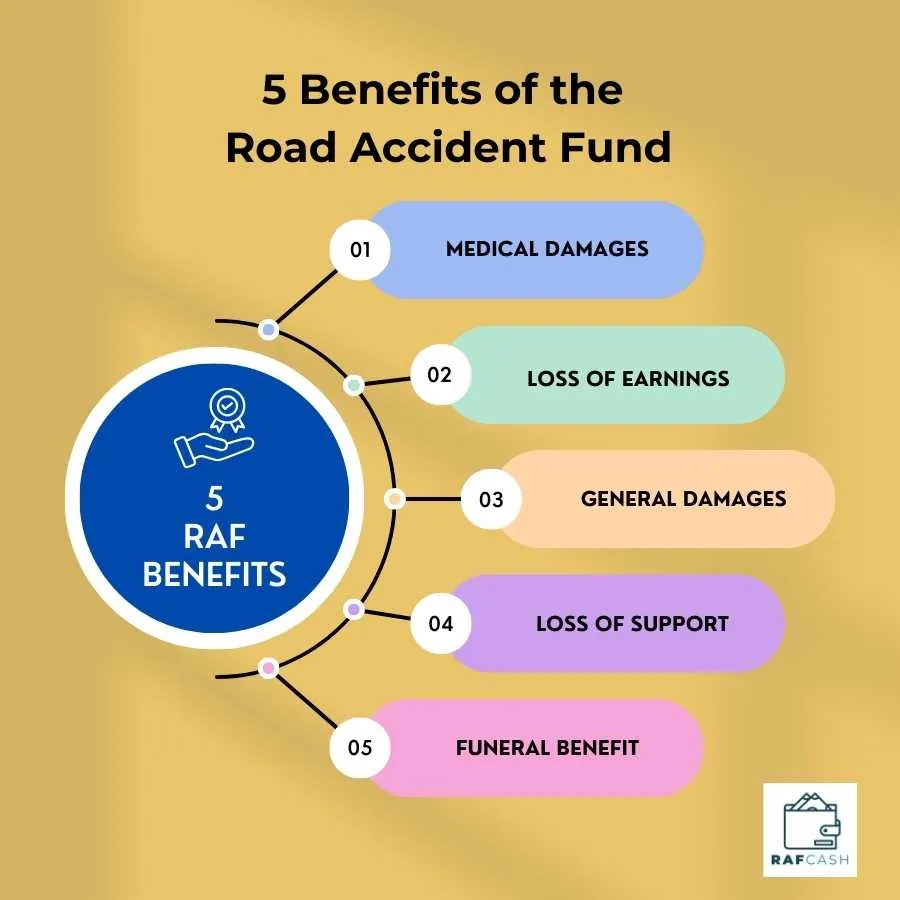

There are five separate benefits covered by the Road Accident Fund.

- Medical damages

- Loss of earnings

- General damages

- Loss of support

- Funeral costs

1 Medical Damages

This covers medical, hospital and related expenses which are the result of road accidents..

It includes both past and future medical damages. Past medical damages refers to medical expenses immediately following an accident, but prior to the RAF paying compensation. Future medical damages relate to those which may occur in the future.

Example

Bertha was run over by a motorbike while crossing the road. She was immediately rushed to hospital resulting in extensive surgery to her right thigh and leg. Due to the nature of her injuries she is likely to have to undergo further surgeries in the decades to come.

The hospital and surgeon bills are covered under ‘Past Medical Damages’. The unknown future bills are covered under ‘Future Medical Damages’.

Past medical expenses are compensated by way of a lump sum cash payment. Future medical expenses are covered by way of an RAF undertaking.

Claiming for medical damages requires extensive documentary evidence which is usually in the form of medical expert reports.

The average claim for medical damages is approximately R350 000.

2 Loss of Earnings

Road accident victims are entitled to receive compensation for any unpaid salary or overtime lost as a result of being unable to work due to injury.

This includes both past and future loss of earnings. Past loss of earnings refers to lost compensation immediately following an accident, such as unpaid leave.

Future medical damages relate to estimated income lost into the future. This could include not being able to work at all going forward, losing opportunities for promotion, having to work fewer hours, or having to take early retirement.

Example

Prior to his accident, Themba worked as a doctor based in the Cape Town CBD. After sustaining injury to his lower back, he was no longer able to perform his duties full-time and transitioned to a part-time role.

His claim for future loss of earnings would take into account the value of income lost due to his lower earning capacity.

The calculation to determine the claim size is relatively complex, requiring expert judgment as to the life expectancy, salary inflation and expected morbidity of the patient and their specific circumstances. These calculations are performed by an actuary who specializes in these considerations.

Any claim for loss of earnings is subject to a statutory maximum.

The average claim for loss of earnings claims is approximately R1 000 000.

3 General Damages

Also known as a ‘pain and suffering’ claim, general damages relates to an accident victim’s pain, suffering, shock, disability, disfigurement, and loss of amenities of life resulting from injuries sustained in a crash.

The injuries must be assessed as serious to qualify for compensation.

The average claim for general damages is approximately R500 000.

4 Loss of Support

RAF Death Benefits

Unfortunately, there is no shortage of tragic stories occurring on South Africa’s roads.

The drivers and passengers of buses, taxis, cars, bikes as well as pedestrians die every day.

Besides for the tragedy of a loved-one passing, there are often significant financial consequences for the families of deceased breadwinners.

The Road Accident Fund pays two benefits to the dependents of a deceased breadwinner. Namely, the loss of support and RAF funeral benefits.

The time to finalize loss of support and funeral benefits are often much shorter than the previous damages claims we’ve discussed.

The main reason being that the nature of injuries and damages do not need to be assessed.

RAF Loss of Support Benefit

The victims of motor vehicle accidents are often the breadwinner in their households. i.e. a person who earns money to support their spouse, children or other close relatives. But what happens if this person dies?

A loss of support claim is paid by RAF to the dependents of a deceased person to cover the lost income to support the family.

If there is no direct duty to support then interested parties will need to show that they are indigent if not for the support.

Children’s interests are represented by parents or legal guardians.

The average claim for loss of support claims is approximately R650 000.

5 Road Accident Fund Funeral Benefits

In the event of an accident resulting in death,dependents are entitled to claim for the funeral costs. This benefit covers:

- Transportation of the body

- Provision of the coffin or burial shroud

- Preparation of the body (including embalming)

- Storage of the body

- Arranging for issuing of a death certificate

- Burial or cremation of the body

- Hiring of equipment to lower the coffin into the grave

- Grave fees

The RAF does not cover additional costs for catering, flowers, transport for attendees, funeral programmes or tombstones.

The average claim for RAF funeral claims is approximately R20 000.

What is not covered by RAF

The Road Accident Fund pays out over R35 billion in claims each year. This includes bus, taxi, car, bicycle and motorcycle accidents involving drivers, passengers and pedestrians. Both South Africans and foreigners are insured.

While the RAF coverage is relatively wide and comprehensive it is important to note that the Road Accident Fund does not cover every accident victim and every claim type. Below are some of the common exclusions worth noting.

- The RAF is limited to liability claims and does not cover property damage such as damage to vehicles, buildings, and the contents of a vehicle.

- RAF claims are also known as ‘third-party’ liability claims. This means that the motor accident must involve two parties. Single party accidents (where only one vehicle was involved) are excluded.

- The requirements for a RAF claim are that the deceased was not 100% to blame for the road accident and there was at least 1% negligence on the part of the other driver. Therefore, death or injury of a drunk driver would not be covered by RAF. Passenger claims would typically be valid.

- You cannot claim if you did not suffer any injuries in the accident, or if the injuries suffered were not ‘serious’.

- ‘Prescription’ is a legal term that refers to the expiry of a right or claim due to the passage of time. In the context . In the context of RAF you generally have three years from the date of the accident to lodge a claim with the RAF.

In the event of doubt the Road Accident Fund or a competent personal injury attorney should be contacted.

How much can you get from the Road Accident Fund

We have discussed what coverage is provided by the RAF, but the more interesting question is how much can you get paid?

Determining the quantum, or value, of a RAF payout is a complicated calculation and beyond the scope of this article.

Nevertheless we will cover the important concepts of ‘apportionment of damages’ and ‘caps’ as well as looking at some of the most common claim examples.

Understanding Apportionment of Damages

The Road Accident Fund provides for a fault-based system of compensation. What this means is that compensation is provided to victims of road accidents based on who was at fault for the accident.

A party who is 100% responsible for causing the accident (eg a drunk driver) has no right to a claim. On the other hand, a party who is completely blameless for the accident (eg taxi passengers) have a right to full compensation.

However, many accidents fall somewhere between 0% and 100% negligence. Establishing who was at fault involves a legal processes or investigations to establish responsibility.

The RAF are not liable for the percentage of damage representing the claimant’s own negligence.

This reduction in the size of the claim, by assigning the claimant a percentage of responsibility for the accident, is known as apportioned compensation.

This concept ensures that compensation is fairly distributed based on each party’s contribution to the cause of the accident.

It’s a way to balance the responsibility between the parties involved in the accident.

Example

Imagine there’s a car accident involving two drivers: Tina and George. After investigation, it was found that both drivers were partially at fault for the accident.

Tina was speeding down the road. George failed to yield at a stop sign. The investigation concludes that Tina was 60% at fault for the accident, while George was 40% at fault.

In this scenario, if Tina suffers damages worth R1,000,000, the apportionment of damages comes into play. Since Tina was 60% at fault, she cannot claim the full amount from the Road Accident Fund.

Instead, she can only claim a portion of the damages that corresponds to the fault of the other party (George). So, Tina could potentially claim 40% of her damages (which is R400,000) because that’s the extent of George’s fault.

Similarly, if George also suffered damages, he would face a similar reduction in his claim amount based on Tina’s percentage of fault (60% in this case).

RAF Caps

The Road Accident Fund does apply caps (maximum limits) on loss of earnings and loss of support claims. The RAF will not pay out any more than this amount.

These caps are subject to periodic adjustments for inflation, and the most current caps are typically published in a Government Gazette.

Claim Examples

Some of the most common injuries resulting in RAF claims include:

- Above-elbow and below-elbow amputations

- Back pain & stiff neck

- Brain damage

- Cerebral concussion

- Head injury

- Hip replacements

- Leg amputations

- Leg injuries

- Lumbar spine & lacerations

- Motor sensor loss

- Paraplegia

- Partial and full paralysis

- Shoulder injuries

- Spine injuries

An actuary’s role is to calculate the financial impact of the accident, such as estimating the future loss of income or support for the victim or their dependents.

They use specialist skills and statistical models to evaluate the specifics of a claim and the impact of damages of future financial outcomes.

This helps in determining a fair compensation amount based on the claimant’s specific situation.

How to claim from RAF

There are 11 steps to a successful Road Accident Fund Claim:

Step 1 – Accident

Step 2 – Gathering Information

Step 3 – Consultation with an Attorney

Step 4 – Filing the Claim

Step 5 – Medical Examination

Step 6 – Negotiation and Settlement

Step 7 – Possible Court Proceedings

Step 8 – Waiting & Bridging

Step 9 – Payment

Step 10 – Save and Invest

Step 11 – Post-Claim Support

Step 1: Accident

The process starts with a road accident happening.

Your immediate focus following an accident should not be on the Road Accident Fund or financial compensation.

Rather focus should be on the health and safety of those involved, including seeking medical treatment for any injured parties.

Step 2: Gathering Information

You success or failure of your RAF claim will ultimately stand on the credibility of the supporting documentation presented to a court and the Road Accident Fund.

Collect all necessary information related to the accident, such as police reports, medical records, witness statements, and any other relevant documents.

Documentation should be as comprehensive and accurate as possible.

Step 3: Consultation with an Attorney

RAF claimants have the option of utilizing the services of a qualified attorney (lawyer) or alternatively lodging a claim directly with the Road Accident Fund.

Often, the Road Accident Fund will make an offer to direct claimants in the hope of an early settlement.

While taking an offered amount may seem better than waiting longer for compensation, the settlement may be only a small percentage of what you could receive through the legal process.

This is why it is advisable to obtain the services of an experienced attorney, who can guide you through the entire process, as well as advising you on whether or not an offer made to you is reasonable.

While legal representation is not free, the cost should be more than justified by the increase in claim size.

Most attorneys in South Africa work on a ‘no-win no-fee’ model (contingency fee), so you only pay if and when your claim is ultimately successful.

Step 4: Filing the Claim

Filling your claim kicks off the process with the Road Accident Fund.

Once received the RAF will open a new file for this claim and wheels of justice begin.

If you are working with a competent attorney they will handle all the paperwork on your behalf to ensure you have the best prospects of success.

Step 5: Medical Examination

When pursuing a Road Accident Fund (RAF) claim, medical examinations are a critical component.

The primary purpose of these examinations, conducted by medico-legal practitioners, is to assess and document the extent and nature of your injuries resulting from the vehicle accident.

This assessment is crucial as it directly influences the compensation amount.

Typically, a range of healthcare professionals, including general practitioners, orthopedists, neurologists, physiotherapists, and psychologists, may be involved in these examinations, depending on the nature of your injuries.

As a claimant, you can expect a thorough examination where the healthcare professional will evaluate your physical and, if necessary, mental health.

They will ask about your medical history, the specifics of the accident, and how your injuries have impacted your daily life.

During these examinations, it is important to be honest and detailed about your symptoms and challenges.

Avoid exaggerating or downplaying your condition, as accurate reporting is essential for a fair assessment.

Lying or providing false information could jeopardize your claim.

Remember to follow the healthcare professional’s instructions during the examination and feel free to ask questions if you are unsure about any part of the process.

If you live far from a metropolitan area or if you have difficulties traveling, speak to your attorney.

Many law firms can provide assistance arranging travel and accommodation if necessary.

Step 6: Negotiation and Settlement

A settlement offer in the context of a Road Accident Fund (RAF) claim is a proposal made by the RAF to compensate the claimant without proceeding to court.

This offer is made after assessing the claim and is often a quicker way to resolve the case.

However, it’s important to note that the RAF may not always make a settlement offer, and when they do, it typically comes with a time limit, requiring the claimant to make a relatively quick decision.

One of the main advantages of accepting a settlement agreement is the avoidance of lengthy and potentially costly litigation.

It provides a quicker resolution and certainty of outcome, as opposed to the unpredictability of a court case.

However, there are also disadvantages to consider.

The settlement amount might be lower than what could potentially be awarded in court, and it might not fully cover all future needs, especially in cases of severe or long-term injuries.

As the claimant, the decision to accept or reject a settlement offer ultimately rests with you.

While your attorney can provide valuable guidance and assistance, weighing the pros and cons of the offer based on your specific circumstances, the final decision is yours to make.

If the initial settlement offer doesn’t meet your expectations or needs, it is often possible to go back and negotiate for a better deal.

This is where your attorney’s expertise becomes crucial, as they can negotiate on your behalf and advise you on whether the new offer is fair and in line with your best interests.

Remember, effective negotiation requires understanding the full extent of your damages and future needs, which a skilled attorney can help articulate and justify.

The settlement process ends with a signed settlement agreement.

Step 7: Possible Court Proceedings

If a settlement cannot be reached in a Road Accident Fund (RAF) claim, the case may proceed to court.

This stage involves formal legal proceedings where both the claimant and the RAF present their arguments and evidence before a judge.

The judge will consider factors such as the extent of the claimant’s injuries, the impact on their quality of life, and any financial losses incurred due to the accident.

Legal representation is crucial at this stage, as attorneys and advocates argue the case on behalf of the claimant, presenting evidence, expert testimonies, and legal arguments.

The judge then makes a decision based on the evidence presented, determining the amount of compensation to be awarded.

Court proceedings can be lengthier and more complex than settlement negotiations, and the outcome, while potentially more favorable, is also less predictable.

The court process ends with a signed court-order.

Step 8: Waiting & Bridging

After finalizing your case you will still need to wait 6-months or longer until payment.

This can be frustrating, especially if you have already waited years since the accident date.

However, there is a solution known as Bridging Finance or RAF Loans.

Bridging finance allows RAF claimants with an attorney and a finalized case to access a portion of their payout early.

RAF CASH is a market leader allowing:

- Quick and easy access to funds

- Trustworthy and ethical

- No credit checks

- No compound interest

- Repayment linked to when the RAF pay you.

Step 9: Payment

Payment day has finally arrived. Well done for making it this far.

You should get communication from both the Road Accident Fund and your attorney informing you that payment has been made.

Payment is made directly into your attorney’s trust bank account.

From there they will subtract their fees as well as any other deductions.

The balance of proceeds will then be paid over to you.

Step 10: Save and Invest

Most people think that the process ends once the RAF makes payment.

But that just isn’t true.

Remember, the funds are meant to replace lost income and to pay for medical expenses.

It is advisable to consult an expert financial advisor who can assist you to preserve and grow your money for the long-term benefit of your family.

RAF SAVE is the solution.

Expert financial advisors are able to assess your situation and provide authorized financial advice to meet your specific needs and financial goals.

Step 11: Post-Claim Support

Depending on the nature of injuries, ongoing medical treatment or support services may be necessary.

The RAF often gives an undertaking to cover future medical treatments resulting from injuries caused by the initial accident.

For more information speak with your attorney or consult the wording in your court-order or settlement- agreement.

Common Myths about the Road Accident Fund (RAF)

The Road Accident Fund (RAF) is a crucial institution in South Africa, designed to provide compensation to victims of road accidents.

Despite its significance, several myths and misconceptions about the RAF and the claims process persist. These misunderstandings can lead to confusion and may deter individuals from pursuing legitimate claims.

Below we address and debunk common myths to provide a clearer understanding of the RAF and its operations.

Myth 1: The RAF covers only medical expenses.

Reality: The RAF covers a wide range of expenses, including medical costs, loss of income, general damages for pain and suffering, and loss of support for dependents.

Myth 2: Only drivers can claim from the RAF.

Reality: Passengers, pedestrians, and cyclists injured in road accidents can also file claims with the RAF.

Myth 3: Filing a claim is a quick process.

Reality: The claims process can be lengthy due to detailed investigations and assessments.

Myth 4: You don’t need any documentation to file a claim.

Reality: Comprehensive documentation is essential for a successful claim, including police reports, medical records, and proof of income loss.

For more myths and realities about RAF claims, refer to the article RAF Claims: Myths vs. Reality.

By addressing these misconceptions, you can better understand the scope and process of filing a claim with the RAF, ensuring you are well-prepared and informed.

Did you know...

- Road Accident Fund Act 56 of 1996: All the rules of the RAF, including how it collects fuel levies, and pays claims is covered by government legislation.

- Comprehensive Coverage: The RAF covers medical expenses, loss of earnings, and general damages for pain and suffering.

- Broad Eligibility: Passengers, pedestrians, and cyclists injured in road accidents can also claim compensation.

- Fuel Levy Funding: The RAF is funded by a levy on fuel sales, ensuring a consistent revenue stream.

- Established in 1946: The RAF has been providing compensation for road accident victims for over 75 years.

- Legislative Framework: The RAF operates under the Road Accident Fund Act 56 of 1996, which outlines its mandate and operations.

- No-Fault System: The RAF operates on a no-fault basis, meaning compensation is provided regardless of who caused the accident.

- Claim Time Limits: Claims must be submitted within three years of the accident or within two years if the identity of the wrongdoer is unknown.

- Medical Assessments: Detailed medical reports are crucial for determining the extent of injuries and appropriate compensation.

- Compensation Limitations: There are caps on certain types of compensation, such as general damages, which are only awarded for serious injuries.

Who’s who in a RAF Claim

There are several different people involved in a Road Accident Fund claim.

Below is a summary of the main players and their respective roles:

Actuary

A financial expert who calculates the long-term financial impact of the accident on the claimant, especially in terms of future loss of income and support needs, to help determine appropriate compensation.

Advocate

A legal professional, typically specializing in court representations, who may be engaged to argue the claimant’s case in court if the claim proceeds to litigation.

Attorney

A legal professional who represents the claimant in a RAF claim, providing legal advice, preparing necessary documentation, and negotiating with the RAF for a fair settlement.

Claimant

An individual (or their dependents) who has suffered injuries or loss due to a road accident and is seeking compensation from the Road Accident Fund. The claimant initiates and pursues the claim process.

Legal Practice Council

A regulatory body for legal practitioners (attorneys and advocates) in South Africa, ensuring they adhere to ethical and professional standards. They do not directly participate in RAF claims but oversee the conduct of legal professionals involved.

Medical Experts

Healthcare professionals who assess the claimant’s injuries, provide treatment, and give expert testimony on the medical implications of the injuries, which is crucial for determining the claim amount.

Police or Accident Investigators

Officials who investigate the accident scene and prepare a report, which is vital for establishing the facts and determining liability in the claim.

Road Accident Fund (RAF)

A South African public entity that provides compulsory cover to all users of South African roads against injuries sustained or death arising from motor vehicle accidents within South Africa. Its role is to compensate victims of road accidents fairly and in a timely manner.

Witnesses

Individuals who witnessed the accident and can provide testimonies or statements to support the claimant’s version of events.

Conclusion

The Road Accident Fund is an incredible institution providing meaningful benefits to those who need it most.

However, this does not mean there are no difficulties or problems.

Nevertheless, this is an insurance we all pay for (directly or indirectly) as users of the public road system. So it is important to make sure that if you have been injured as the result of a motor vehicle accident that you take the claim process seriously. Our advice would be.

- Get educated

- Get a great attorney

- Bridge some of the waiting to speed up the cash

- Consider options to make the money last

We have solutions to help you with all of these.

Frequently Asked Questions

What is the Road Accident Fund (RAF) in South Africa?

The RAF is a state insurer providing coverage against injuries or death from vehicle accidents within South Africa.

How does the RAF work?

It compensates victims of negligent driving through financial payments and rehabilitation services.

Who funds the RAF and how?

The RAF is primarily funded by the RAF Fuel Levy, part of the National Fuel Levy on fuel purchases.

What types of damages does the RAF cover?

It covers medical damages, loss of earnings, general damages, loss of support, and funeral costs.

Can anyone claim from the RAF?

Yes, both South Africans and foreigners affected by vehicle accidents in SA can claim, subject to certain conditions.

How does one make a claim with the RAF?

Collect accident information, consult an attorney, file a claim, undergo medical exams, and negotiate or proceed to court. An attorney is recommended to help you through the process.

Are there limits to RAF compensation?

Yes, the RAF applies caps on loss of earnings and support claims, and doesn’t cover property damage or single-party accidents.

What if the RAF offer doesn't cover all my needs?

You can negotiate for a better deal or proceed to court for a potentially higher compensation.

How long does a RAF claim take to settle?

The time varies, but expect a waiting period even after a settlement or court decision, typically around 6 months or more.

What should I do with my RAF compensation?

It’s advisable to consult a financial advisor to help manage and invest your compensation for long-term needs.

Does the Road Accident Fund pay the driver?

Yes, the RAF can pay the driver if they are not entirely at fault for the accident and have suffered injuries or losses.

Can a drunk driver claim from the Road Accident Fund?

No, a drunk driver is typically considered fully at fault and cannot claim compensation from the RAF.

Can I claim from the RAF after 5 years?

No, claims must be lodged within three years from the date of the accident, except for minors where different rules apply.

What happens if the person at fault in an accident has no insurance in South Africa?

The RAF can provide compensation for victims, regardless of the at-fault party’s insurance status.

Who is liable in a car accident, owner or driver, in South Africa?

Generally, the driver is liable for accidents they cause. However, specific circumstances could implicate the owner, especially if the driver was unfit or unauthorized.

What is the highest Road Accident Fund payout in South Africa?

The exact highest payout is not commonly disclosed, but RAF claims, especially for severe injuries or loss of support, can amount to millions of Rand.

Glossary

Road Accident Fund (RAF): A public entity that provides compensation for bodily injuries or death resulting from road accidents in South Africa.

Claimant: A person who makes a claim for compensation from the RAF.

General Damages: Compensation for non-monetary losses such as pain and suffering.

Loss of Earnings: Compensation for the income a person loses due to being unable to work because of their injuries.

Loss of Support: Compensation provided to dependents of a deceased victim who was financially supporting them.

Medical Expenses: Costs associated with medical treatment and rehabilitation following a road accident.

Fuel Levy: A tax included in the price of fuel, which funds the RAF.

2 Responses

Very useful information

Thank you Meshack!