Uncover the lifeblood of South Africa’s roads – the RAF Fuel Levy. Dive into its intriguing evolution, challenges, and impact on society. How does this vital component shape the rhythm of everyday life? Join us on a journey through the veins of South Africa’s road safety system.

Introduction

Have you ever wondered how South Africa manages to financially support victims of road accidents?

In a country where the hum of traffic is a constant backdrop to daily life, the Road Accident Fund (RAF) plays a pivotal role.

At the heart of this system is the RAF Fuel Levy – a crucial yet often overlooked component of our nation’s approach to road safety and social security.

What is the RAF Fuel Levy?

Picture this: every time you fill up your car, a portion of what you pay goes towards a fund designed to offer a financial safety net for those affected by road accidents.

This is the RAF Fuel Levy in action. It’s more than just a line item on your fuel receipt; it’s a lifeline for thousands.

Why Does It Matter?

But why should this matter to you, the everyday South African?

The RAF Fuel Levy isn’t just a financial mechanism; it’s a testament to our collective responsibility towards each other on the roads. Whether you’re a daily commuter, a weekend traveler, or an occasional road user, this levy impacts all of us.

It represents a critical blend of social welfare and road safety management, a unique approach that warrants our understanding and attention.

In this article, we’ll embark on a journey through the intricate world of the RAF Fuel Levy.

We’ll uncover its history, dissect its workings, and explore its far-reaching impact.

So buckle up, and let’s dive into understanding this essential aspect of our national road safety system.

Historical Background

The RAF’s journey began in the shadows of World War II, under the 1942 Motor Vehicle Assurance Act. Initially, South Africans relied on compulsory motor vehicle insurance, ensuring victims of road accidents could claim compensation.

This system, primarily managed by selected insurance companies, was the backbone of road accident compensation for decades.

However, as the wheels of time turned, so did the need for a more robust and sustainable system.

The Shift from Insurance to Levy

In 1986, a significant transformation occurred. The Motor Vehicle Act of 1986 marked a departure from the traditional insurance model, introducing a groundbreaking approach – the fuel levy system.

This pivotal shift was not just a change in funding mechanism but a paradigm shift in how road safety and compensation were viewed in the public policy sphere.

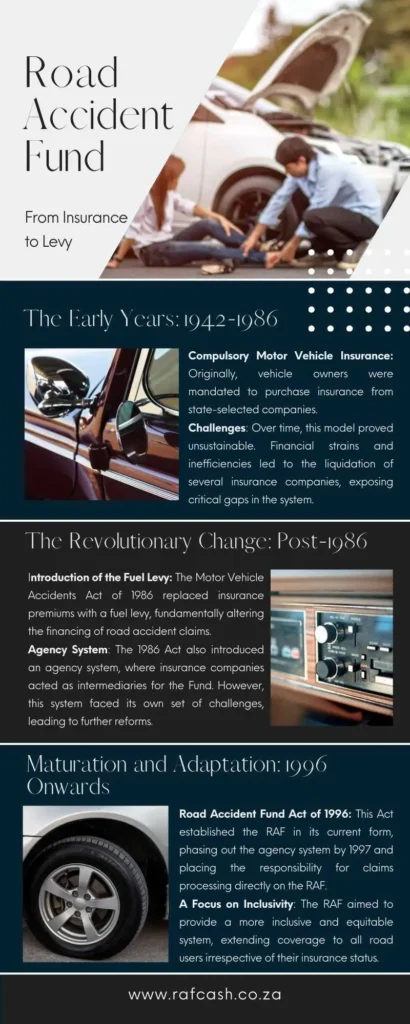

The Early Years: 1942-1986

- Compulsory Motor Vehicle Insurance: Originally, vehicle owners were mandated to purchase insurance from state-selected companies.

- Challenges: Over time, this model proved unsustainable. Financial strains and inefficiencies led to the liquidation of several insurance companies, exposing critical gaps in the system.

The Revolutionary Change: Post-1986

- Introduction of the Fuel Levy: The Motor Vehicle Accidents Act of 1986 replaced insurance premiums with a fuel levy, fundamentally altering the financing of road accident claims.

- Agency System: The 1986 Act also introduced an agency system, where insurance companies acted as intermediaries for the Fund. However, this system faced its own set of challenges, leading to further reforms.

Maturation and Adaptation: 1996 Onwards

- Road Accident Fund Act of 1996: This Act established the RAF in its current form, phasing out the agency system by 1997 and placing the responsibility for claims processing directly on the RAF.

- A Focus on Inclusivity: The RAF aimed to provide a more inclusive and equitable system, extending coverage to all road users irrespective of their insurance status.

The RAF’s evolution reflects South Africa’s dynamic response to changing needs and circumstances. From its roots in compulsory insurance to the innovative fuel levy system, the RAF’s history is a testament to adaptability and commitment to serving the nation’s road users.

This journey, marked by legislative reforms and paradigm shifts, has not only shaped the RAF’s identity but also underscored its significance in South Africa’s socio-economic fabric.

In the next section, we’ll delve deeper into the mechanics of the RAF Fuel Levy – how it’s calculated, collected, and utilized – to paint a clearer picture of its role in modern South Africa.

The RAF Fuel Levy Mechanism

As we venture deeper into the intricacies of the Road Accident Fund (RAF) Fuel Levy, it becomes evident that this financial tool is more than just a number on a balance sheet.

It’s a dynamic entity, influenced by governmental decisions and economic trends, playing a pivotal role in the lives of those traversing South Africa’s roads.

Setting the Levy: A Governmental Affair

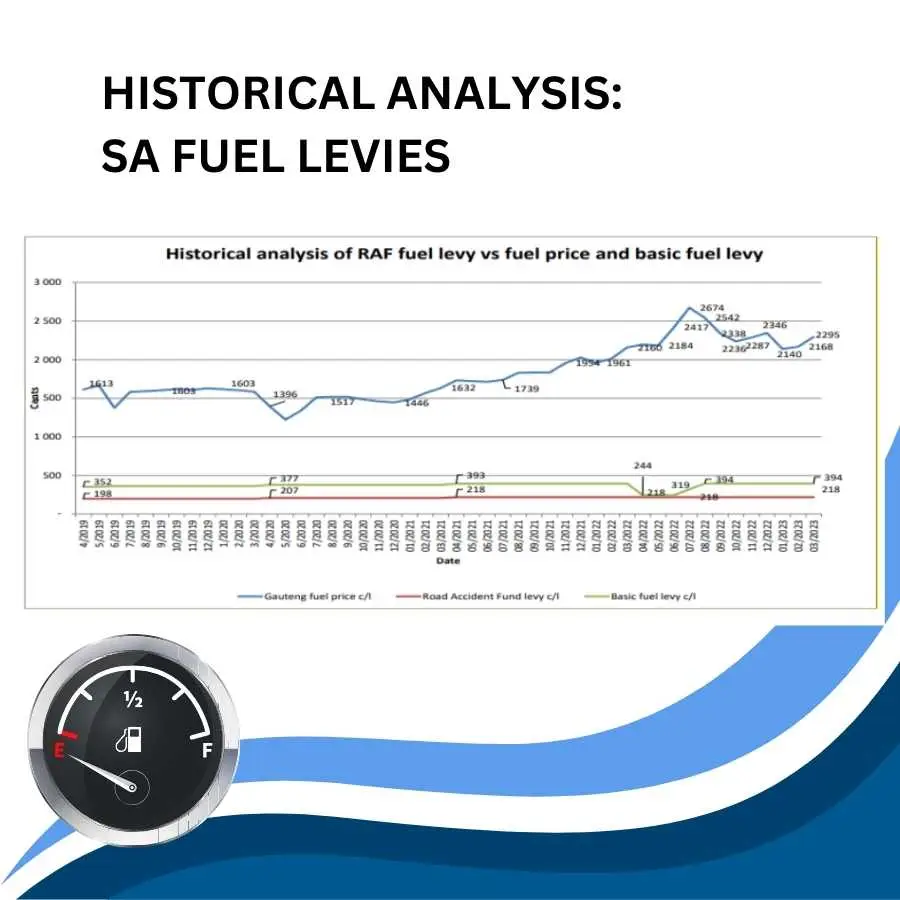

The heart of the RAF Fuel Levy lies in its annual determination. Who decides how much should be levied per litre of fuel? This critical decision rests with the National Treasury (NT).

Each year, based on a comprehensive financial model and a projection of the upcoming year’s expenses, the RAF makes a formal request to the NT for a levy adjustment.

A Balancing Act

- Request vs. Reality: Historically, the RAF’s requested levy amount is a balancing act, seldom fully granted. The NT, adhering to a ‘pay-as-you-go’ principle, often sets the levy with immediate needs in mind rather than fully funding the RAF.

- Example from the Recent Past: In the 2022/23 financial year, the levy remained unchanged at 218 cents per litre, showcasing the NT’s cautious approach in levy determination.

Collection: SARS Takes the Reins

Once set, the actual collection of the RAF Fuel Levy falls under the purview of the South African Revenue Service (SARS).

A significant player in this process, SARS is responsible for the effective and efficient gathering of these funds.

How It Works

- Direct Collection: The levy is directly recovered from oil refineries by SARS.

- Payment into the National Revenue Fund: After certain deductions, as prescribed by the Customs and Excise Act of 1964 and the RAF Act, SARS deposits the funds into the National Revenue Fund.

- Payment to RAF: From there, the NT disburses the levies to the RAF.

The Role of Oil Refineries

- Payment Schedule: Refineries are required to pay approximately 50% of the levies at the end of the month following the month of fuel removal, with the remaining 50% paid at the end of the subsequent month.

- Adjustment for Bad Debts: The final amount paid by refineries is adjusted for any bad debts needing refunds by the RAF.

The Interplay Between RAF, NT, and SARS

The relationship between these three entities is crucial for the smooth functioning of the levy system. The NT’s role in setting the levy underscores its responsibility in balancing fiscal policy with social welfare.

SARS’ efficiency in collection ensures that the RAF has the necessary funds to fulfill its mandate. This triad forms the backbone of a system designed to provide financial support to road accident victims.

In the next segment, we’ll explore the financial landscape of the RAF Fuel Levy – where does the money come from, where does it go, and how does this financial flow impact the larger picture of road safety and compensation in South Africa?

Financial Aspects of the RAF Fuel Levy

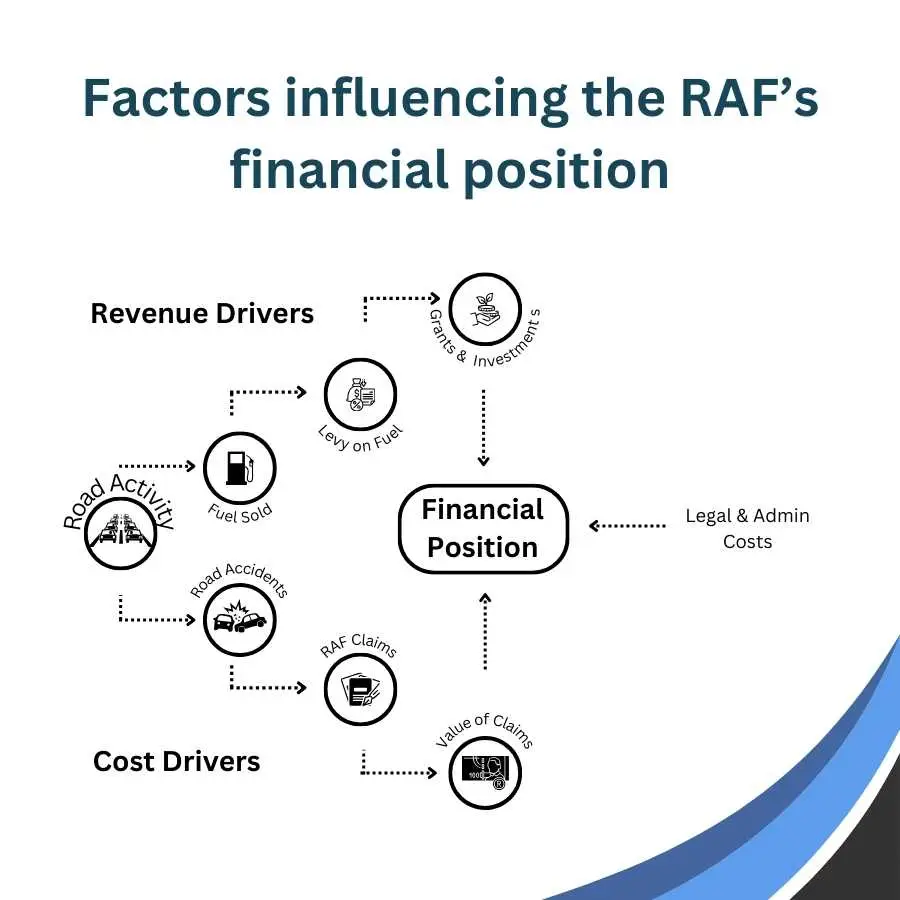

The financial model of the Road Accident Fund (RAF) is a complex mosaic, where various elements intertwine to influence its income and expenditure.

Understanding this financial landscape is key to appreciating the RAF’s role in South African society.

Income Sources and Determinants

The Central Pillar: Fuel Levy Income

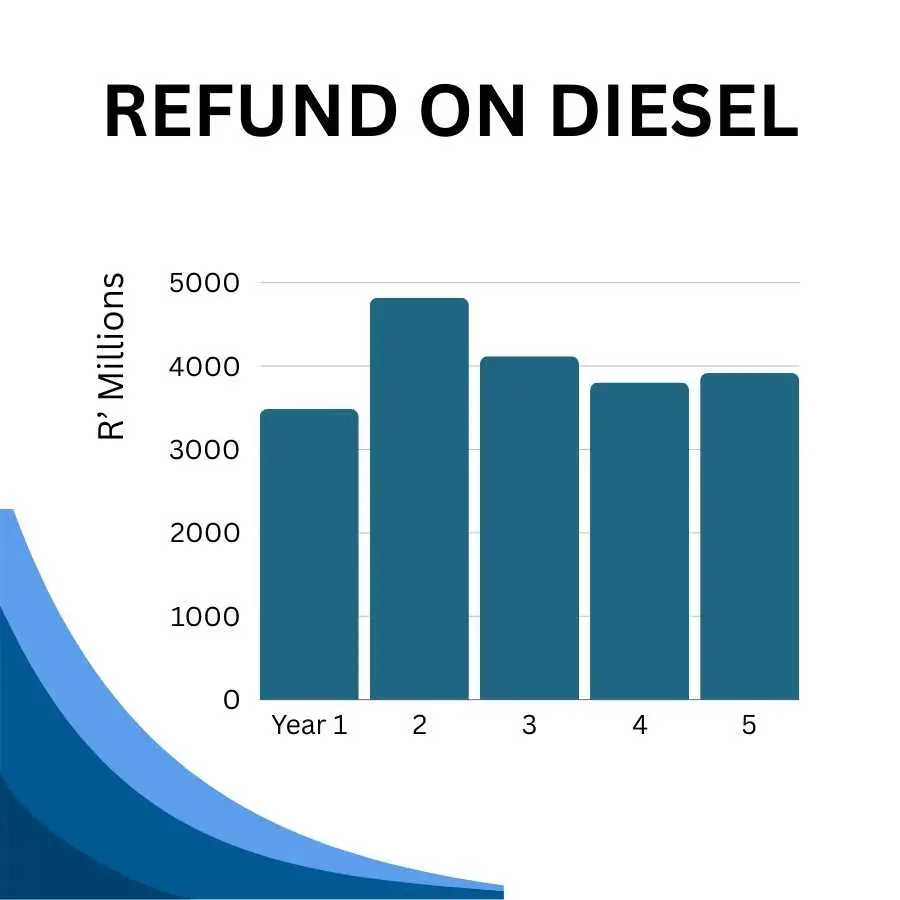

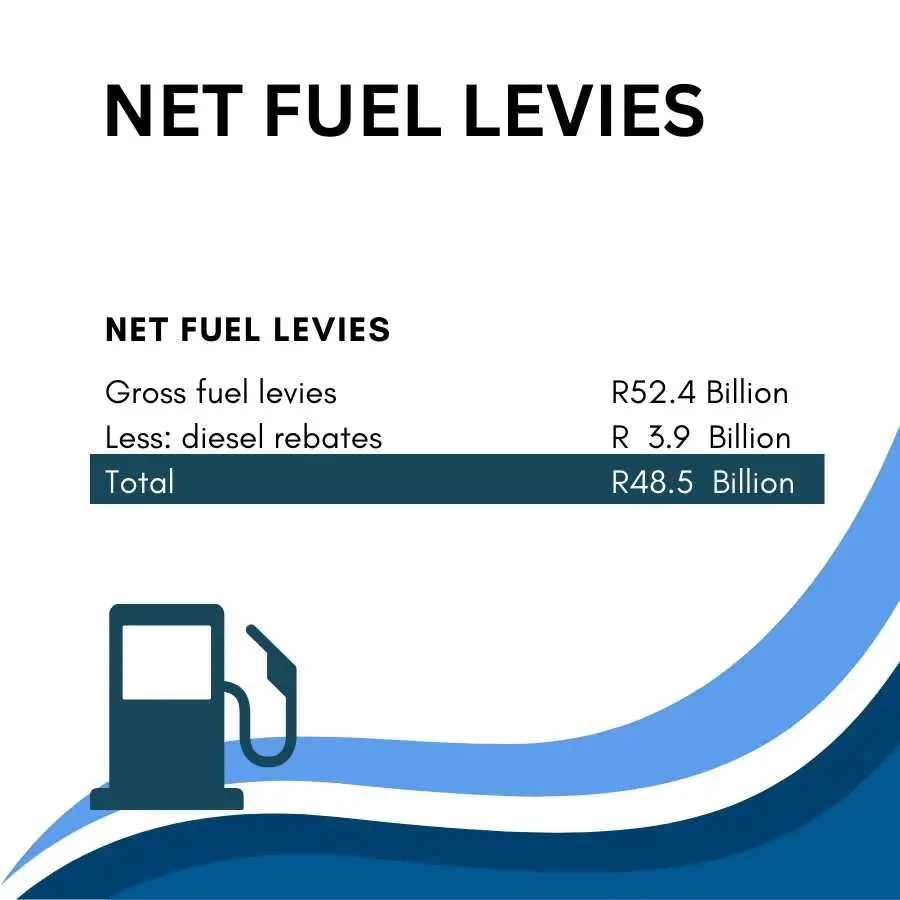

- Primary Source: The RAF’s main source of income is the fuel levy, which is a specific charge per litre on petrol and diesel.

- Factors Impacting Income:

- Fuel Sales Volume: The total volume of petrol and diesel sold annually is a significant determinant. More fuel sales translate into higher income.

- Levy Rate: The set rate per litre, determined by the National Treasury, directly impacts the total levy income.

Recent Financial Data

Stagnation Amidst Inflation: For two consecutive years, including the 2022/23 financial year, the levy remained static at 218 cents per litre. Despite no increase, the RAF faced the challenge of rising inflation, which averaged 6.9%.

Expenditure Dynamics

RAF’s Major Expenses

- Claims Expenditure: The largest expense for the RAF is claims expenditure, comprising payments to road accident victims.

- Administrative Costs: This includes operational costs like staffing, office management, and third-party services such as legal and medical expertise.

Influence of Road Accidents

- Volume and Severity: The number and severity of road accidents directly impact the volume and average value of claims. A higher incidence of accidents means increased claims, adding financial strain to the RAF.

Investment Income

A Silver Lining: Despite the levy’s stagnation, the RAF’s investment income increased by 27%, attributed to effective investment strategies and improved liquidity from the rule 45A court order. This order extended the time for paying court orders from 14 days to 180 days, easing short-term cash flow pressures.

The Ripple Effect of a Static Levy

Economic Implications

- Real-Term Decrease in Income: With the levy rate unchanged and inflation rising, the RAF effectively experienced a decrease in income in real terms.

- Operational Challenges: A static levy, combined with increasing claims and operational costs, poses significant challenges in maintaining financial stability and meeting the RAF’s obligations.

Looking Ahead

- Adapting to Change: The RAF’s financial model may need to adapt to changing economic conditions, balancing between sufficient income generation and sustainable expenditure.

In our next section, we will explore how the RAF Fuel Levy compares to similar systems in other countries, offering a global perspective on managing road accident compensation.

Comparative Analysis: The RAF Fuel Levy in a Global Context

When we turn our gaze beyond the borders of South Africa, we find an intriguing array of systems designed to compensate victims of road accidents.

Each system, from the United Kingdom to the United States, Botswana, and Namibia, offers unique insights into the varied approaches nations take to address this universal challenge.

The United Kingdom: Insurance-Backed Compensation

In the United Kingdom, the Motor Insurers’ Bureau (MIB) serves a role somewhat parallel to South Africa’s RAF, but with a key difference – it’s funded by insurance companies, not a fuel levy.

This organization compensates victims of uninsured and hit-and-run drivers, ensuring that even in cases where traditional insurance fails, victims are not left without recourse.

The UK model underscores a collaborative approach between the government and private insurance sector, offering comprehensive protection but relying heavily on the efficiency and solvency of private insurers.

The United States: A Decentralized Approach

Across the Atlantic, the United States presents a highly decentralized model. There is no national equivalent to the RAF; instead, car insurance is mandatory in most states, with each state setting its own minimum liability coverage requirements.

This system places the onus of compensation primarily on individual insurance providers, promoting a direct link between vehicle ownership and insurance responsibilities.

While this model offers the benefit of tailored insurance policies, it also risks leaving gaps in coverage, particularly for victims of uninsured or underinsured drivers.

Botswana and Namibia: Mandatory Third-Party Insurance

Closer to home, Botswana and Namibia follow a more traditional path, requiring third-party insurance for all vehicles. Similar to the RAF, these systems aim to ensure that anyone injured in a road accident has access to compensation.

However, unlike the RAF’s fuel levy model, these nations rely on mandatory insurance policies that vehicle owners must purchase.

This approach aligns the cost of the insurance more directly with vehicle ownership but may also exclude or disadvantage those who cannot afford insurance premiums.

Pros and Cons of Different Systems

Each of these models has its strengths and weaknesses. The RAF Fuel Levy stands out for its broad coverage, encompassing all road users irrespective of their insurance status, a significant benefit in a country with a high rate of uninsured drivers.

However, this inclusivity comes at the cost of financial sustainability, as evidenced by the RAF’s ongoing financial challenges.

In contrast, the insurance-based models of the UK, US, Botswana, and Namibia potentially offer more financial stability, as they spread the risk and cost among insurance policyholders.

Yet, these systems can exclude or inadequately cover certain segments of the population, particularly those who cannot afford insurance or fall victim to uninsured drivers.

As we consider these various models, it becomes clear that there is no one-size-fits-all solution. Each system reflects the unique socio-economic realities of its country, balancing between inclusivity, financial sustainability, and administrative efficiency.

In our next segment, we will delve into how the South African public perceives the RAF Fuel Levy, shedding light on the diverse opinions and experiences that shape the debate around this critical policy.

Public Perception of the RAF Fuel Levy

The RAF Fuel Levy, while a singular entity in the realm of public policy, elicits a spectrum of perceptions among the South African populace.

Its impact is as diverse as the people it affects, from taxi drivers navigating the bustling streets of Johannesburg to single mothers commuting to work and small business owners managing their enterprises.

Each story paints a unique picture of how the RAF Fuel Levy is woven into the fabric of daily life.

The Taxi Driver: A Necessary Burden

Thabo, a taxi driver in Johannesburg, represents a segment of the population for whom the RAF Fuel Levy is a double-edged sword.

“It’s a necessary part of my day-to-day expenses,” he explains, “but it also cuts into my earnings.” As someone who relies heavily on fuel for his livelihood, Thabo feels the weight of the levy with each trip he makes.

“It’s for a good cause, I know, but for us drivers, it’s a significant overhead.” His story reflects the reality of many in the transport sector, balancing the necessity of the levy against the immediate impact on their income.

The Single Mother: Striving for Balance

For Lerato, a single mother commuting to her job in Sandton, the RAF Fuel Levy is a tangible reminder of the tightrope she walks financially.

“Every cent counts for me,” she says. The additional cost imposed by the levy, while understood and appreciated for its purpose, strains her already stretched budget.

“I see its importance in case of accidents, but at the end of the month, it’s another expense that makes things harder.”

Lerato’s perspective is shared by many working-class South Africans, who acknowledge the levy’s significance but feel the burden of its financial implications.

The Small Business Owner: Seeking Sustainability

Sipho, who owns a small trucking business in Durban, faces the levy from a business perspective.

“The RAF Fuel Levy is a significant operational cost,” he notes. Understanding its role in providing for accident victims, he nonetheless finds the high rates challenging, especially for small businesses like his.

“There should be a balance,” Sipho suggests, advocating for a tiered system that could ease the financial pressure on smaller enterprises.

His viewpoint echoes the concerns of many small business owners, who support the fund’s objectives but grapple with its impact on their operations.

A Tapestry of Views

These stories illustrate the complex relationship South Africans have with the RAF Fuel Levy. While there is a general recognition of its importance for social security, this acknowledgment is often tempered by the real-world implications it has on individuals and businesses.

The levy is seen through various lenses – as a necessary contribution to societal welfare, a significant financial burden, and an economic challenge.

As we navigate through these diverse perspectives, it becomes clear that public perception of the RAF Fuel Levy is multifaceted, shaped by personal experiences and economic realities.

In the following section, we will delve into the challenges and criticisms the RAF Fuel Levy faces, exploring the hurdles and debates that surround this key component of South Africa’s road safety net.

Challenges and Criticisms of the RAF Fuel Levy

While the RAF Fuel Levy serves as a crucial safety net for road accident victims, it is not without its challenges and criticisms.

From operational hurdles to financial constraints and governance issues, the RAF faces a multifaceted array of difficulties.

Operational and Financial Challenges

- Financial Shortfalls: Despite its significant income from the fuel levy, the RAF has consistently faced financial shortfalls, such as an R8.6 billion deficit. This gap raises questions about the fund’s financial management and sustainability.

- High Volume of Claims: The RAF processes a large volume of claims, especially towards the financial year’s end. This can strain both its financial resources and administrative capacity.

- Static Levy Rate in an Inflationary Environment: The lack of increase in the levy rate for consecutive years, against the backdrop of rising inflation, further exacerbates financial pressures.

Criticisms of Efficiency and Compliance

- Delays in Payment to Claimants: A major point of criticism is the slow processing and payment of claims, which can cause significant distress to accident victims awaiting compensation.

- Legal and Compliance Issues: The RAF has faced challenges over its compliance with statutory requirements, raising concerns about potential legal and financial complications, such as class-action lawsuits.

- Data and Systems Management: There have been concerns regarding the RAF’s data management and IT systems, which are crucial for efficient and accurate processing of claims.

Executive Remuneration

- Public Scrutiny: The high remuneration packages of RAF executives have come under public scrutiny. Critics argue that these packages are excessive, especially in light of the fund’s financial difficulties.

- Balancing Fair Compensation and Fiscal Responsibility: The debate around executive pay highlights the challenge of attracting skilled leadership while being mindful of the RAF’s financial constraints and public expectations.

The RAF’s Response

- Emphasis on Achievements: In response to these criticisms, the RAF often highlights its performance improvements and achievements under current leadership.

- Potential Reforms: Discussions about revising the funding model and operational strategies are ongoing. This includes considering aspects of personal insurance models to enhance sustainability.

Reflecting on the Road Ahead

These challenges and criticisms are integral to understanding the complexities of the RAF Fuel Levy. They reflect the delicate balance between providing comprehensive coverage to road accident victims and ensuring the fund’s long-term viability.

In our next section, we’ll explore personal stories that bring to life the impact of the RAF Fuel Levy on everyday South Africans, offering a closer look at the human dimension of this policy.

Environmental and Economic Implications: The RAF Fuel Levy in a Changing World

The RAF Fuel Levy, integral to South Africa’s road accident compensation system, now faces new challenges in an era increasingly defined by environmental consciousness and the rise of electric vehicles (EVs).

This shift towards green transportation has significant implications for the levy, which is fundamentally linked to the sale of petrol and diesel fuels.

The Impact of Electric Vehicles (EVs)

As EVs gain popularity, a decline in traditional fuel sales is anticipated, which could directly affect the RAF’s primary source of income.

This presents a conundrum: while the shift towards EVs aligns with global environmental goals, it simultaneously threatens the financial foundation of the RAF.

- Decreasing Fuel Sales: As more people adopt EVs, the consumption of petrol and diesel is expected to decrease, potentially leading to a reduction in fuel levy revenues.

- Need for Adaptive Strategies: This situation necessitates the exploration of alternative funding models to sustain the RAF’s operations and services.

Potential Future Adjustments

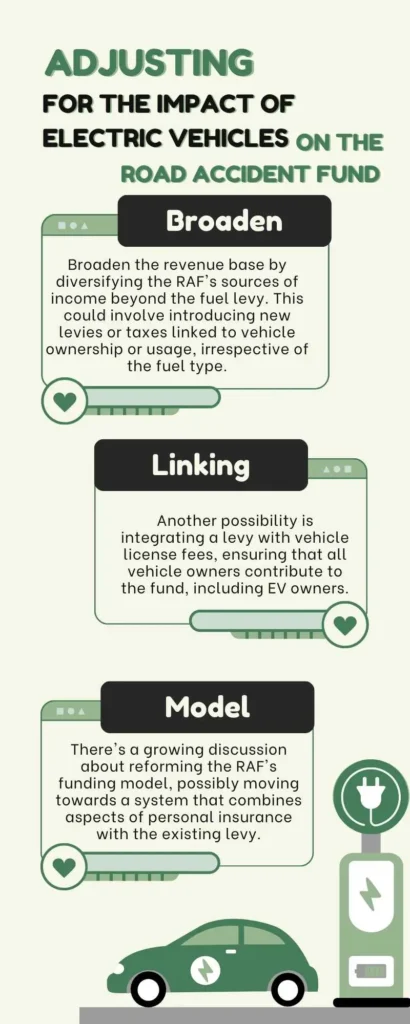

The advent of EVs and the global push towards sustainability call for innovative thinking regarding the RAF’s funding mechanisms. Several potential adjustments and strategies are being considered:

- Broadening the Revenue Base: One approach could be diversifying the RAF’s sources of income beyond the fuel levy. This could involve introducing new levies or taxes linked to vehicle ownership or usage, irrespective of the fuel type.

- Linking to Vehicle License Fees: Another possibility is integrating a levy with vehicle license fees, ensuring that all vehicle owners contribute to the fund, including EV owners.

- Re-evaluating the Current Model: There’s a growing discussion about reforming the RAF’s funding model, possibly moving towards a system that combines aspects of personal insurance with the existing levy.

Economic Considerations

- Balancing Environmental Goals with Economic Needs: The transition to EVs aligns with South Africa’s environmental commitments but must be balanced with the economic necessity of funding road accident compensation.

- Innovative Funding for Sustainable Transportation: The country is exploring ways to encourage EV adoption, such as tax incentives and the establishment of Special Economic Zones (SEZs) for EV production. These initiatives could foster a more sustainable transportation sector while also considering new revenue streams for the RAF.

The Way Forward

The RAF’s response to these environmental and economic shifts will be crucial. It requires a delicate balancing act: embracing sustainable transportation trends while ensuring the continuity of a vital social security system.

As we navigate these changes, the RAF’s ability to adapt and innovate will be key to its future effectiveness and sustainability.

We will synthesize the insights and perspectives gathered throughout this exploration, offering a comprehensive view of the RAF Fuel Levy’s role in South Africa’s socio-economic landscape and its path forward in an evolving world.

Conclusion: Charting the Future of the RAF Fuel Levy

As we conclude our journey through the intricate landscape of the Road Accident Fund (RAF) Fuel Levy, it’s clear that this mechanism is more than a financial instrument.

It’s a reflection of South Africa’s commitment to safeguarding its citizens on the roads.

The RAF Fuel Levy has evolved over time, adapting to changing socio-economic conditions and continuing to serve as a vital safety net for those affected by road accidents.

Key Points Recapitulation

- Historical Evolution: The shift from compulsory motor vehicle insurance to a fuel levy-based system marked a significant transition in how South Africa handles road accident compensation.

- Mechanism and Challenges: While the levy is a primary income source for the RAF, it faces challenges in terms of operational efficiency, financial sustainability, and public perception.

- Global Perspectives: Comparative analysis with systems in the UK, US, Botswana, and Namibia reveals a diversity of approaches, each with its own merits and drawbacks.

- Public Perception: The varied views of different segments of the population, including taxi drivers, single mothers, and small business owners, highlight the levy’s widespread impact.

- Emerging Challenges: The rise of electric vehicles and a global shift towards sustainable transportation present new challenges, requiring innovative funding strategies for the RAF.

Insights and Recommendations

Looking towards the future, the RAF Fuel Levy must navigate a landscape marked by technological advancement and environmental consciousness. Here are some insights and recommendations:

- Embrace Innovation in Funding: As EVs become more prevalent, the RAF should explore innovative funding mechanisms. This might include integrating levies with vehicle license fees or considering a hybrid model that combines elements of personal insurance and public funding.

- Enhance Operational Efficiency: Improving the speed and efficiency of claim processing will not only bolster public trust but also ensure timely support to accident victims.

- Adapt to Economic Realities: The RAF must remain agile in responding to economic fluctuations, such as inflation, ensuring that the levy rate is periodically reviewed and adjusted as necessary.

- Public Engagement and Transparency: Engaging with the public and stakeholders can provide valuable insights into how the RAF can better serve its intended beneficiaries. Transparency in operations and financial management will enhance public trust and support.

- Policy Alignment with Environmental Goals: As South Africa moves towards a greener future, policies governing the RAF should align with these environmental goals, balancing sustainability with the fund’s financial health.

The RAF Fuel Levy is at a crossroads, facing both challenges and opportunities. Its future success will depend on a careful balance of adapting to changing times while staying true to its core mission of providing for road accident victims.

As South Africa continues to evolve, so too must the RAF Fuel Levy, ensuring it remains a relevant and effective pillar in the nation’s social and economic infrastructure.

Want to stay in the loop with the ever-evolving RAF ecosystem? For insights beyond the pavement, subscribe to our newsletter. Keep your finger on the pulse of changes, challenges, and developments in this crucial sector. Get informed, get educated, and drive change!

Frequently Asked Questions

How is the RAF Fuel Levy determined annually?

The National Treasury sets the RAF Fuel Levy rate each year, considering the RAF’s financial needs and broader economic factors.

Why has the RAF Fuel Levy not increased in recent years?

Despite the RAF’s requests, the National Treasury has kept the levy rate static, prioritizing a pay-as-you-go approach and considering economic constraints.

What challenges does the RAF face with a static levy rate?

A non-increasing levy rate, especially in an inflationary environment, strains the RAF’s financial resources and ability to fulfill its compensation obligations.

How does the RAF Fuel Levy impact different segments of the population?

The levy affects various groups differently – taxi drivers see it as a significant expense, while small business owners struggle with its operational cost impact.

What are some criticisms of the RAF's operational efficiency?

Criticisms include slow claims processing and payment, which delay financial support to road accident victims.

How might the rise of electric vehicles affect the RAF Fuel Levy?

Increased use of electric vehicles could decrease fuel sales, potentially reducing the RAF’s primary income source from the fuel levy.

Are there any alternative funding strategies for the RAF being considered?

Alternatives include diversifying income sources, integrating levies with vehicle license fees, or adopting elements of personal insurance models.

What role does the South African Revenue Service (SARS) play in the RAF Fuel Levy?

SARS is responsible for collecting the fuel levy from oil refineries and ensuring its transfer to the National Revenue Fund for the RAF.

How does the RAF Fuel Levy compare to similar systems in other countries?

Unlike the RAF, countries like the UK and US rely more on insurance-based models for road accident compensation, offering different advantages and challenges.

What steps can the RAF take to improve public trust in the levy system?

Improving claim processing efficiency, ensuring transparency in operations, and engaging with the public can enhance trust and support for the RAF Fuel Levy.

Glossary

- Fuel Levy: A charge added per litre of petrol or diesel, used to fund the RAF.

- National Treasury (NT): The government department responsible for managing South Africa’s economic policy and public finances.

- South African Revenue Service (SARS): The tax authority in South Africa, responsible for collecting taxes and duties, including the RAF Fuel Levy.

- Claims Expenditure: Money spent by the RAF to compensate victims of road accidents.

- Executive Remuneration: Payment or salary given to high-level administrators or executives within an organization.

- Electric Vehicles (EVs): Cars or other vehicles powered by electricity instead of traditional petrol or diesel engines.

- Green Transportation: Environmentally-friendly transportation methods, typically those that minimize emissions, such as electric vehicles.

- Motor Insurers’ Bureau (MIB): An organization in the UK that compensates victims of uninsured or untraceable drivers.

- Third-Party Insurance: Insurance that covers the policyholder against damages or injuries they cause to another person or property.

- Operational Efficiency: The effectiveness and productivity with which an organization, like the RAF, conducts its operations.

- Inflation: The rate at which the general level of prices for goods and services rises, eroding purchasing power.

- Fiscal Responsibility: The practice of managing an organization’s or government’s budget, ensuring prudent spending and financial health.

- Revenue Streams: Different sources of income for an organization or business.

- Claim Settlements: The process of resolving a claim, usually involving the payment of compensation to the claimant.

- Policy Alignment: Ensuring that different policies or practices are consistent and support each other’s objectives.

One Response

Great eye opening information